2 Big Dividend Stocks With 9% Yield; Raymond James Says ‘Buy’

Inflation data dominated the market news at the end of last week, and rightly so. The May print, of 8.6% annualized gains in the consumer price index, marked a sharp reversal from the modest decline seen in April, and a new ‘highest level in 40 years’ data point. It reignited worries that the rosy projections – of a transient inflation, or of lower rates by early next year – are unlikely to reach fruition. Even though unemployment is low and wages are up, the declines in real earnings and the GDP contraction in Q1 have brought the dreaded word ‘stagflation’ to mind.

In this environment, all eyes will turn the Federal Reserve Bank. The US central bank is tasked with managing inflation, after all, and with fine-tuning their prime weapon, interest rates, to avoid a recession. As the economic horizon clouds, however, the pundits are starting to look down various possible courses. The key factor in this situation will be the future actions of the Fed. With inflation running hot, gasoline averaging $5 per gallon nationwide, and a falling stock market, all eyes are on the central bank and its Chairman, Jerome Powell.

That’s the take of Raymond James’ Chief Investment Officer Larry Adam, who foresees a series of rate hikes, but advises patience, writing: “While we expect the Fed to raise the fed funds rate 0.5% [this] week and again in July and September, our projected Fed policy path thereafter remains far more patient than what the market is expecting.”

With all of this in mind, it’s probably time to consider getting into dividend stocks. These are equities that will protect and investment portfolio by providing a valuable income stream regardless of market movements.

The stock analysts from Raymond James have tapped two high-yield payers as choices for investors to buy now. According to TipRanks’ database, these are Strong Buy stocks with dividend yields of at least 9%. Let’s take a closer look.

Crestwood Equity Partners (CEQP)

We’ll start with an energy-related firm, Crestwood Equity. This company operates as a limited master partnership in the energy industry, with its focus on three regions: the Marcellus shale, a major Appalachian natural gas formation; the Williston and Powder River shale oil basins of the upper Plains region; and along the Texas-New Mexico state line, the Delaware basin and Barnett shale. Crestwood is a midstream company, with a network of assets that act in the collection, transport, and storage of natural gas, natural gas liquids, and crude oil.

At the top line, Crestwood has benefited recently from the inflationary increase in both crude oil and natural gas prices. The company’s total revenues in 1Q22 came to $1.58 billion, up from $1.03 billion in the year-ago quarter, for an impressive 53% year-over-year gain. At the bottom line, the company recorded a quarterly net EPS loss of 4 cents per share, way better than the 86-cent per share loss in 1Q21.

CEQP shares remain up year-to-date, however, by a minimal 3%; still, a gain is a gain, especially compared to the losses on the broader market, where the S&P 500 is down ~21% this year.

This stock’s real attraction for investors is not the share gain, but the dividend. Crestwood bumped its payment up in the most recent declaration, by 5%, to 65.5 cents per common share. This was the first increase since the Feb 2020 quarter, and at an annualized rate of $2.62, the dividend now yields 9.2%. That is 4.5x the average dividend found among companies on the S&P 500 index – and more importantly, a higher yield than the 8.6% annualized inflation rate.

In his coverage of this stock for Raymond James, 5-star analyst Justin Jenkins writes: “CEQP has improved its risk profile via a series of strategic actions, most recently consolidating Bakken/Permian G&P assets and allowing renewed distribution growth. Although 1Q22 was a ‘pause,’ operating leverage pushes annual expectations higher, and M&A synergies and financial flexibility can provide further catalysts this year. While the OAS equity overhang has not dissipated, CEQP trades at sub-8x 2023E EV/EBITDA — a compelling entry point, especially over a multi-year time horizon.”

A ‘compelling entry point’ and an upbeat financial outlook going forward add up, in Jenkins’ view, to an Outperform (i.e. Buy) rating for the shares, and his price target of $35 reflects this, suggesting ~30% one-year upside potential. Based on the current dividend yield and the expected price appreciation, the stock has ~39% potential total return profile. (To watch Jenkins’ track record, click here)

Overall, the Street has given this stock 5 recent reviews and these break down 4 to 1 in favor of Buys over Holds – for a Strong Buy analyst consensus view. The stock is selling for $27 and has an average price target of $36.40, which implies a 34% gain in the year ahead. (See CEQP stock forecast on TipRanks)

KKR Real Estate Finance Trust (KREF)

Next up is a Real Estate Finance Trust, a REIT. These company’s are perennial leaders among dividend payers, as they usually use the payments to meet regulatory requirements regarding the return of profits to shareholders. KKR acquired and funds loans on a wide range of properties, including multifamily dwellings (48% of the portfolio), office space (27% of the portfolio), and life sciences facilities (10% of the total). The company’s portfolio currently includes $7.1 billion in performing loans, of which 99% are senior loans.

A hot recent real estate market has supported KKR over the last few months, and in 1Q22 the company reported 47 cents in distributable earnings per diluted share. This was based on a total $29.8 million in distributable earnings. The EPS total was down from the 55 cents reported in 1Q21 – but it was still sufficient to fund the company’s dividend, which was declared at 43 cents per common share.

The company has held the dividend steady at this level since 2019, a remarkable achievement, considering that many firms cut back on dividend payments during the worst of the COVID crisis. At its current rate, the dividend annualizes to $1.72 per common share and yields a robust 9.4%. This is a far higher yield than investors will find in Treasury bonds, or in the ‘average’ dividend-paying stock, and it beats inflation by a significant margin.

All of this has 5-star analyst Stephen Laws willing to go bat for this stock. In his note for Raymond James, Laws writes: “Given characteristics of KREF’s floating rate loan portfolio, we expect portfolio returns to benefit in 2H and 2023 from increasing short-term interest rates. Our Outperform rating is based on the attractive portfolio characteristics, solid dividend coverage, and strong external manager…. We expect increasing short-term rates to be a tailwind to portfolio returns in 2H22 and 2023. We expect KREF to maintain the quarterly common dividend of $0.43 per share.”

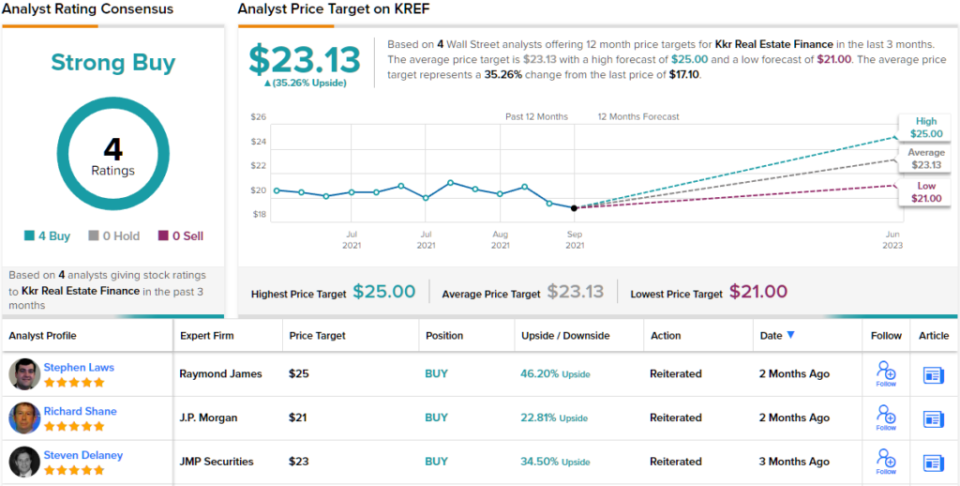

Baking his Outperform (i.e. Buy) rating, Laws gives KREF a $25 price target, which indicates potential for 46% gains in the next 12 months. (To watch Laws’ track record, click here)

The Raymond James viewpoint is hardly the only upbeat take on KKR. The company’s stock has 4 recent analyst reviews and they all agree that this is one to buy – making the Strong Buy consensus rating unanimous. Shares are selling for $17.06 and the $23.13 average price target suggests a 35% upside from that level. (See KREF stock forecast on TipRanks)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.