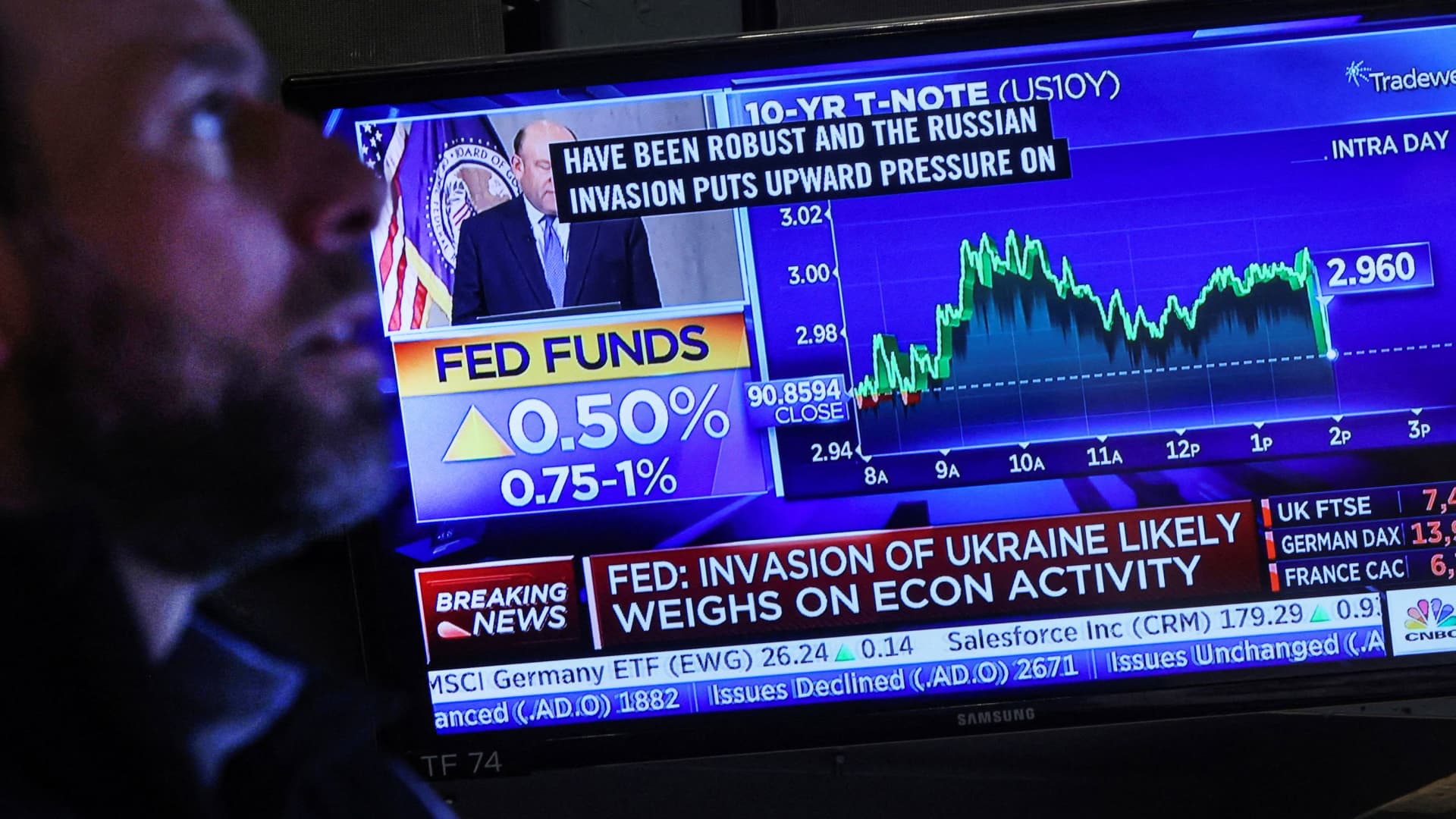

Global markets took a hammering to start the week as expectations grew that the U.S. Federal Reserve will need to hike interest rates more aggressively than planned.

May’s U.S. consumer price index reading came in at 8.6% year-on-year, the highest since 1981, and prompted the market to price in a 75 basis point hike from the Fed on Wednesday.

Markets broadly expect between nine and 10 rate hikes from now to early 2023, with at least 50 basis point increments at each of the next three Federal Open Market Committee meetings and a terminal rate of 4%.

Global recession

A more aggressive Fed is likely to have ripple effects throughout the global economy, and as such, Friday’s inflation print triggered a multi-day sell-off of stocks worldwide.

“Friday’s U.S. inflation print had an impact on markets globally, and that seems appropriate given that the Fed, to a certain extent, is the world’s central banker, and could certainly help cause a global recession,” said Kristina Hooper, a global market strategist at Invesco.

Hooper remained hopeful that the U.S. will still be able to avoid a recession and that the Fed will succeed in engineering a “soft landing” by being sufficiently hawkish but data-responsive. However, she acknowledged that the U.S. economy is clearly heading toward a significant slowdown, and the “soft landing” is becoming harder to achieve.

“Admittedly, slowing just enough to cool inflation but not cause a recession is an extremely delicate balancing act given that monetary policy is a blunt instrument, not a surgical tool. So of course recession risks have increased with last week’s CPI print and consumer inflation expectations reading,” she added.

Famed economist Kenneth Rogoff pointed out in April that a U.S. recession, especially if triggered by an interest rate hiking cycle, would curtail global import demand and wreak havoc for financial markets.

Central bank knock-on effect

The European Central Bank last week confirmed its intention to hike its main interest rate by 25 basis points at its July meeting, with a further hike slated for September.

However, the ECB called an emergency monetary policy meeting on Wednesday as bond yields surged for many governments across the euro zone.

Stephane Monier, chief investment officer at Banque Lombard Odier, told CNBC on Wednesday that the decision to hold an unscheduled meeting prior to the Fed’s announcement was significant.

“It probably means to a certain extent that they are afraid that the Fed will be doing serious rate hikes like the 75 basis points that we are expecting, and that will somehow have some impact on risky assets in the market, and it will further increase fragmentation in European sovereign bond markets,” Monier said.

Carsten Brzeski, global head of macro at Dutch bank ING, told CNBC on Tuesday that the currency implications of the anticipated hawkish shift from the Fed action could influence European policymakers.

“It clearly means that we could see a stronger dollar and therefore a weaker euro, which had already been a concern for several ECB officials. If we were ready to move towards parity, I think the weaker euro – even if this is not a target for the ECB – adds to the inflationary pressure, and therefore is a concern,” Brzeski said.

“What this could mean is that at least the hawks at the ECB would push for more rate hikes than they have currently penciled in just to offset the inflationary impact from a weaker euro.”

With tightening financial conditions and a global sell-off in risk assets underway, the traditional safe haven U.S. dollar has rallied significantly in recent trading sessions.

Geoffrey Yu, senior EMEA market strategist at BNY Mellon, told CNBC on Tuesday that the imbalances driving dollar strength would not abate any time soon.

“The U.S. economy is far less sensitive to tightening in financial conditions from the exchange rate compared to trade-heavy economies — we’re looking at the likes of Switzerland, Japan, the euro zone even, and there’s a lot of emerging markets,” Yu said.

“Global commodities are priced in dollars so from their own point of view, a stronger dollar in this environment is not good for them at all.”

Yu suggested that while the dollar is likely to stay bid, the Fed’s aggressive stance could free up scope for the likes of the ECB, the Swiss National Bank and the Bank of England to tighten further in order to support their own currencies.

“It really goes both ways and if the other central banks can be a bit bolder in pushing for appreciation, letting their own currencies strengthen through rate hikes, I think that can help redress the balance as well, and maybe cap the dollar,” he said.

“But for the time being I think most portfolio managers, most investors may want to stay overweight the U.S. dollar.”

‘Profit recession’

Along with the prospect of a global economic recession, investors should also be wary of an incoming “profit recession,” according to Guy Stear, head of emerging markets and credit research at Societe Generale.

Stear told CNBC on Tuesday that the more-than 25-year trend of profits increasing as a percentage of GDP was “more or less finished” given the ongoing themes of deglobalization, higher energy and input costs, and higher wages.

The difficulties posed to supply chains and costs as a result of the war in Ukraine and geopolitical divergences have compounded the threat to corporates from higher rates.

“I think that no matter what happens in terms of the economic outlook – and yes, the likelihood of an economic recession is mounting – the likelihood of a profit recession is mounting a lot faster.”