As Biden weighs a federal gas tax holiday, here’s what that could mean for prices at the pump

For months, drivers across the U.S. face have faced eye-popping prices when they fill up their gas tanks.

Now, President Joe Biden is weighing a new remedy — a federal gas tax holiday.

A gallon of gas now costs an average of $4.97, according to AAA. That’s a slight improvement from earlier this month, when the national average crossed the $5 threshold for the first time. But prices are up from $4.59 a month ago and $3.07 a year ago.

However, in some states — like Washington, Oregon and Nevada — average gas prices are more than $5.50 per gallon. In California, the average is currently $6.38 per gallon.

More from Personal Finance:

80% of economists see ‘stagflation’ as a long-term risk

Stimulus checks rewired how some Americans see money

Here’s what the Fed’s interest rate hike means for you

The federal gas tax amounts to 18.4 cents per gallon, while states separately impose their own levies.

In February, Democratic Sens. Maggie Hassan of New Hampshire and Mark Kelly of Arizona proposed a bill that would suspend the federal gas tax through the end of the year.

The idea is getting new attention from Biden’s administration, with Treasury Secretary Janet Yellen calling it “an idea that’s certainly worth considering” in a Sunday interview with ABC News’ “This Week.”

When asked about Yellen’s comments, Biden said on Monday he is considering it.

“I hope I have a decision based on data I’m looking for by the end of the week,” Biden said.

If Washington lawmakers do sign off on a federal gas tax holiday, they would be following the lead of some states — like Connecticut, Maryland and Georgia — that already put their own temporary measures in place to suspend their gas levies.

Moreover, some states like California are considering giving residents direct payments to help offset record high gas prices.

Gas tax savings for consumers would be minimal

The idea of temporarily doing away with the federal gas tax has drawn some criticism.

A report from the Penn Wharton Budget Model at the University of Pennsylvania released in March found that savings from such a break would not likely be very substantial for consumers.

The savings per person might be only around $50 if it were implemented in March through the end of the year, Kent Smetters, a professor at the University of Pennsylvania’s Wharton School told CNBC at the time.

Moreover, federal tax revenue would be lowered by about $20 billion if a gas tax holiday were put in place through the end of this year, according to the March report.

Gas taxes fund a lot of important road safety programs.Andrew GrossAAA spokesperson

The problem is that most of the savings from those changes — whether they happen at the federal or state level — will not be passed on to the consumer, Smetters said.

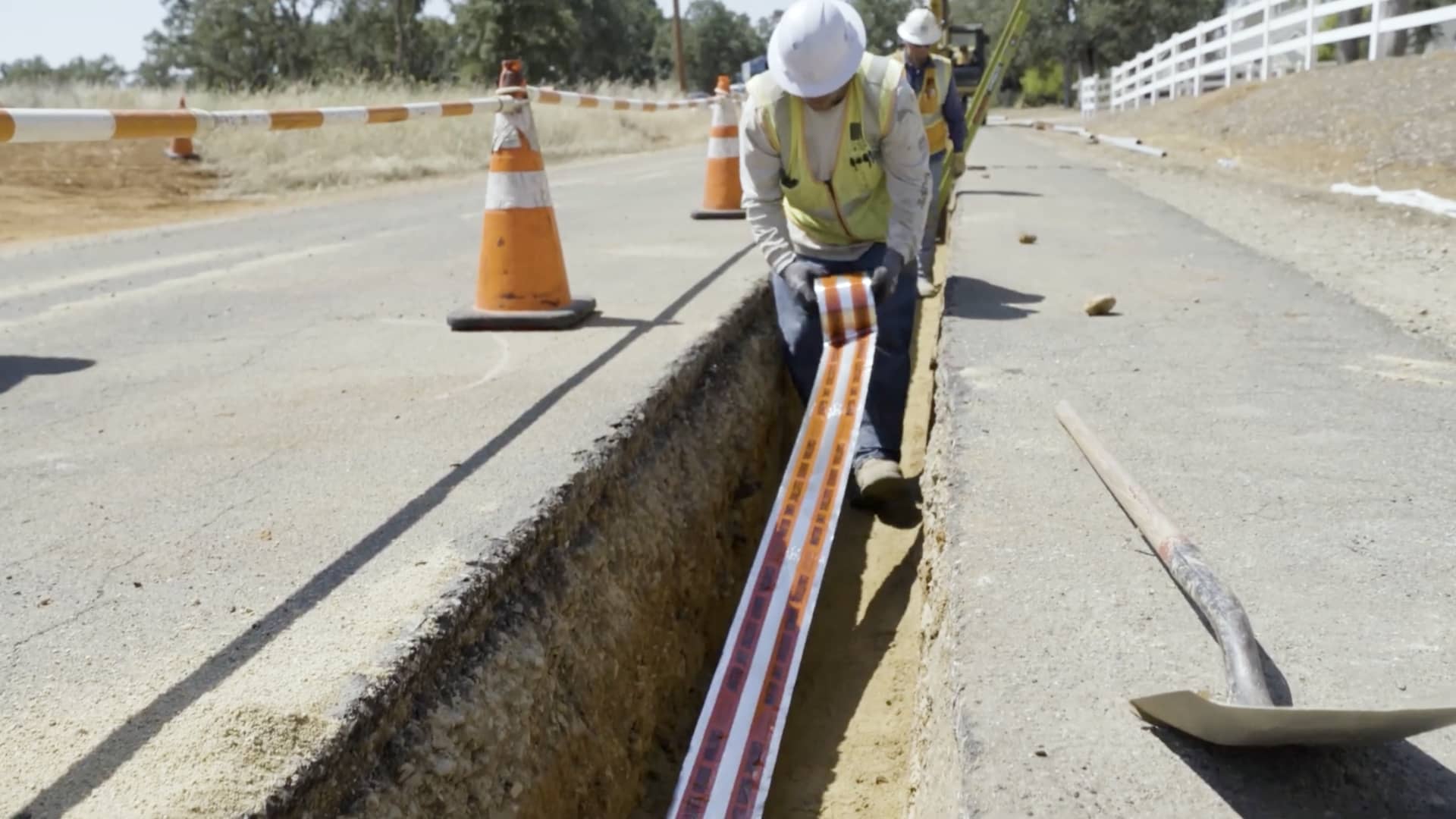

It may also mean less money for the Highway Trust Fund, which funds roads and bridges, as well as other transportation costs. The Senate bill proposes replacing the tax revenue that typically goes to the Highway Trust Fund with transfers from the general fund.

Federal taxes make up a small portion of what consumers spend on gas, according to AAA spokesperson Andrew Gross.

The cost of oil is the biggest determinant of the cost of gas, at about 56%, he said. The rest includes about 14% for refining, 15% for distribution and marketing and the remaining 15% for federal and state taxes.

AAA has opposed the proposed federal legislation alongside other organizations including the American Association of State Highway and Transportation Officials and the American Society of Civil Engineers.

“Gas taxes fund a lot of important road safety programs,” Gross said. “And it’s not like our road safety needs will take a holiday, too.”