Brian Moynihan dismisses Jamie Dimon’s warning on the economy: ‘You’ve got hurricanes that come every year.’

Jamie Dimon, the JPMorgan Chase JPM,

Brian Moynihan, the chairman and chief executive of Bank of America BAC,

In a bit of a rambling response, Moynihan made the point that the Fed’s challenge to hike rates is because of a strong underlying economy. What makes the Fed’s job tough right now is “actually a good thing — low unemployment and good wage growth and good consumer spending,” he said, according to a transcript from S&P Global Market Intelligence.

He was asked by Autonomous Research analyst John McDonald, who also quizzed Dimon, about the pressure bank stocks have seen. JPMorgan and Bank of America shares have each dropped 18% this year. Investors in the sector have been waiting quite literally for a decade to see interest rates rise, which would help margins, and now that they have, “the party seems over before it started,” McDonald said.

Moynihan said he understands the worries about recession, as he said credit costs will likely increase. But he said there isn’t the volatility around outcomes that investors may fear.

“Our [net interest income] grew strong from the fourth quarter to the first quarter, actually starting, second to third quarter last year,” he said. “We look at that year-over-year, it’s $2 billion more NII per quarter before the rate structure is actually coming through the system,” he said. He said the consumer is now catching up after activity was led by the commercial side.

The buzz

The posterchild of meme stocks, GameStop GME,

Hewlett Packard Enterprise HPE,

C3.ai AI,

The ADP private-sector payrolls report said jobs growth decelerated to 128,000 in May, with weekly jobless claims and factory orders data also on the docket. Cleveland Fed President Loretta Mester will be speaking as well.

The OPEC oil cartel is expected to keep to its production plans, amid reports Saudi Arabia is ready to replace any lost output from Russia.

The U.K. market is closed as Queen Elizabeth II celebrates her Platinum Jubilee.

The markets

U.S. stock futures ES00,

Oil futures CL.1,

Top tickers

Here were the most active stock-market tickers as of 6 a.m. Eastern.

| Ticker | Security name |

| GME, |

GameStop |

| TSLA, |

Tesla |

| AMC, |

AMC Entertainment |

| NIO, |

Nio |

| AMZN, |

Amazon.com |

| MULN, |

Mullen Automotive |

| AAPL, |

Apple |

| NVDA, |

Nvidia |

| FB, |

Meta Platforms |

| BABA, |

Alibaba |

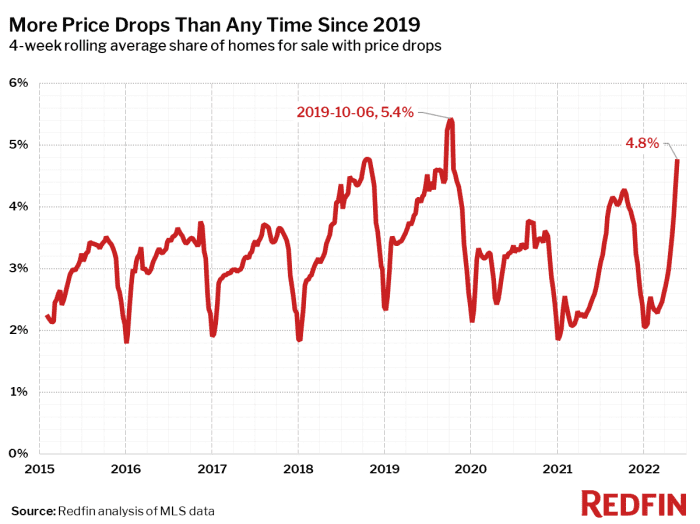

The chart

Will house prices finally cool off? Running at 21% year-over-year, they are bound to, and there’s some initial signs that it’s happening. The four-week average of the share of homes for sales with price drop has picked up, according to data analyzed by Redfin.

Random reads

Beer pong, and some of the other unusual ways that people are celebrating Queen Elizabeth’s Platinum Jubilee.

French diplomats have gone on strike.

A first: a 3-D printed ear, made with a patient’s own cells.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.