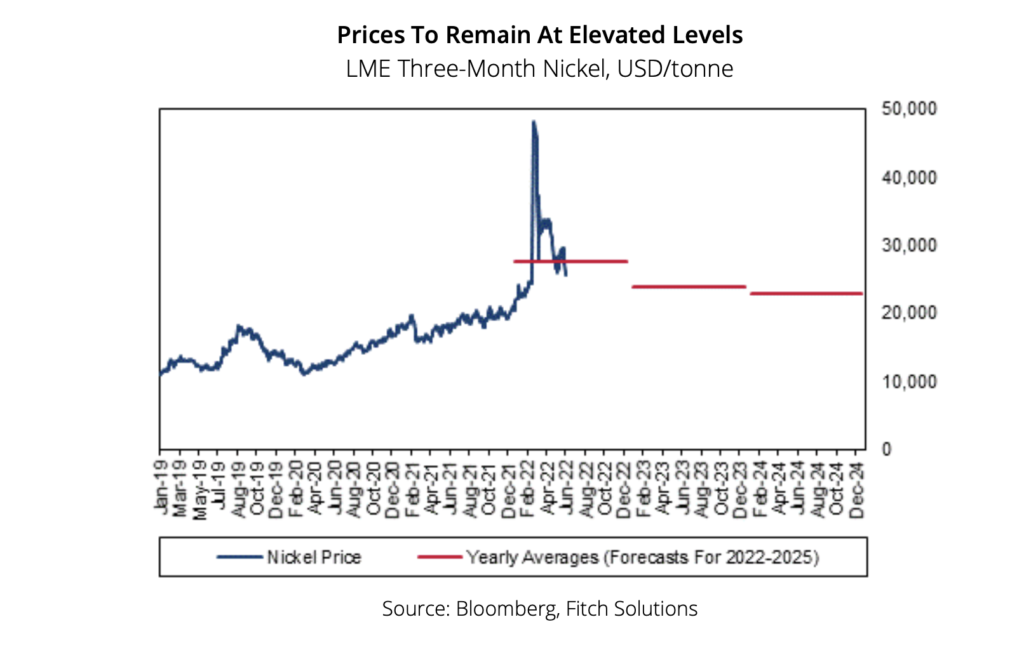

Fitch maintains its nickel price forecast for 2022 at an annual average of $27,500/tonne, while noting significant downside risks to its outlook contingent on Chinese lockdowns and economic activity.

Nickel prices have averaged $27,912/tonne in the year-to-date and are currently hovering around $25,600/tonne. After being driven up to record highs following the Russian invasion of Ukraine in late February, over fears of reduced exports from Russia, prices have collapsed as a result of Chinese lockdowns and poor downstream demand for the metal.

Fitch expects that the new stimulus measures announced by the Chinese government on May 31 will provide demand-side support to prices, driving them higher than current levels in Q322.

Covid-related restrictions in China had weakened demand in Q222 and saw prices fall to a quarterly low of $25,675/tonne on June 14. A number of the stimulus measures will increase nickel demand, including the new rules for increased quotas on car ownership, reduced purchase taxes for certain vehicles, and incentives to increase infrastructure construction, Fitch says, adding that together, these measures will help reverse the trend of declining demand seen over Q222 and push prices higher in the short term.

On the supply side, the ongoing war in Ukraine will continue to weigh on Russian production and exports. While Russian nickel firms have not been directly targeted by sanctions, they are impacted by supply chain and financing difficulties as Western firms increasingly abandon the Russian market, Fitch notes.

Freight and logistics have also become more complex as insurance and transport becomes less readily available. Nickel importers in the West are increasingly shunning Russia-origin metals, primarily due to risks of further sanctions, concerns over the extent of sanctions recently announced, and reputational risks associated with deals with Russian entities while the crisis continues. Reduced supply from Russia to global markets will have a significant impact on prices, Fitch forecasts, as in 2021 the country was responsible for 9.3% of the world’s nickel mine production and around one fifth of refined nickel.

In Q422, however, Fitch expects prices to fall slightly as refinery production ramps up, especially in Indonesia. The Indonesian government’s ban on nickel ore exports, implemented in January 2020, caused short-term supply issues but has also led to greater investment in the country’s downstream industry and we expect double-digit growth in nickel output in Indonesia over the remainder of the year.

Related: The 18 minutes of trading chaos that broke the nickel market

Low levels of LME nickel stocks continue to pose threats to volatility in the short term, Fitch points out. Along with the unravelling of Xiang Guangda’s short position that led to prices momentarily breaching $100,000/tonne, low stocks were a factor which contributed to the price spike in March 2022 and which continue to pose upside price risks.

From a multi-year high of 264.6kt in April 2021, inventories fell to 75.0kt on March 8 and are slightly lower still as of June 6, at 71.4kt.

These low levels increase the possibility of sharper price rises in future in the event of significant supply- demand mismatch in the short term, the analyst says.

(Read the full report here)