Consolidation in gold mining sector to continue — report

According to the market research firm, the strategic rationale behind this M&A is similar to other large deals completed in the last few years, and includes (1) achieving scale, (2) diversifying geographically, and (3) replenishing project pipelines.

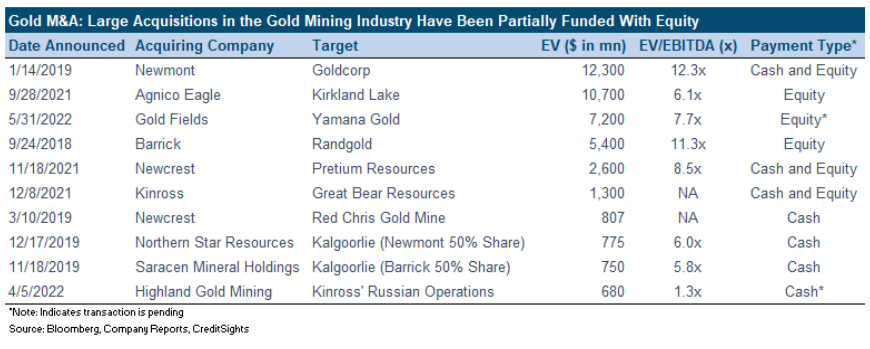

“Cost synergies have been less of a driver, particularly for the latest deal, with Gold Fields’ assets residing mostly in Africa and Australia, while Yamana operates mainly in Canada and Latin America. It is interesting to note that the large M&A deals in the space have been funded with mostly equity despite the fact that the companies have the financial wherewithal to finance the deals with debt,” CreditSights says.

For the industry as a whole, CreditSights acknowledges that organic growth has been stagnant in recent years, given the natural declines in existing mines and with companies unwilling to invest in major greenfield projects, which are generally fraught with execution risk, geopolitical concerns, environmental issues, and time and cost overruns.

The report highlights the unknown fate of Barrick’s Pascua-Lama capex project, for which it recorded over $5 billion in impairment charges, and the gold mining giant’s decision to resurrect a greenfield project in Pakistan that will take 5-6 years to complete and cost $7 billion. Barrick’s CEO has been talking up M&A over the years, but cited unattractive valuations for remaining disciplined and not aggressively pursuing deals.

Still, CreditSights believes the trend of M&A’s is expected to continue as mining companies look to replace their dwindling reserves.

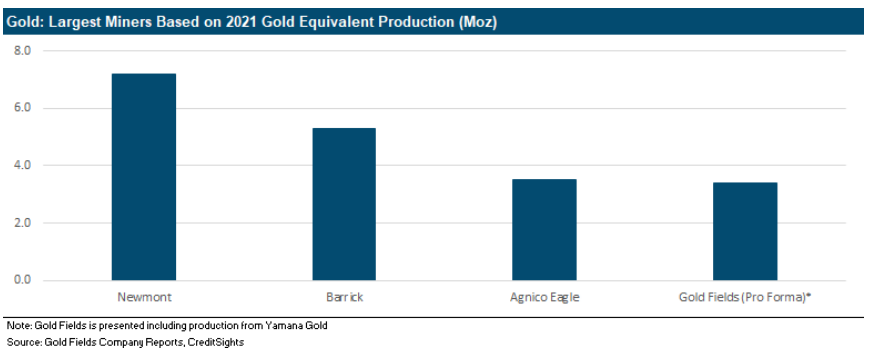

“The gold mining industry is still a very fragmented market with the top 4 players accounting for roughly 20% of total output globally despite the recent spate of M&A deals. So, scaling up to become more relevant to investors makes strategic sense as well,” the report reads.

Read More: Gold Fields to become world’s no. 4 gold miner with Yamana acquisition