Elon Musk joins the growing chorus fearing a U.S. recession. But there are stocks for that.

Look out above, the dip buyers are back in town.

Stocks are soaring — for now — as Wall Street returns from a long holiday weekend, with Fed Reserve Chair Jerome Powell testifying in front of Congress this week. The buying mood comes after the S&P 500’s worst week since March 2020, including its fall into a bear market and the biggest Fed hike since 1994.

But while bargain hunters are on the prowl, so too are the U.S. economic doomsters.

Enter Tesla TSLA,

“I think that a recession is inevitable at some point. As to whether there is a recession in the near term, I think that is more likely than not,” Musk told Bloomberg in an interview early Tuesday at the Qatar Economic Forum.

Musk’s comment lines up with an email he reportedly sent to company executives earlier this month, where he spoke of a “super bad feeling” about the global economy and said 10% of Tesla jobs needed to go, knocking shares of the company at the time.

Read: Stocks are still too expensive and rising rates may shock financial system, Seth Klarman warns

Via video to those Qatar attendees, Musk confirmed that, saying 10% of Tesla’s salaried head count would be eliminated in the next three months, though a year from now salary and hourly head count would be higher.

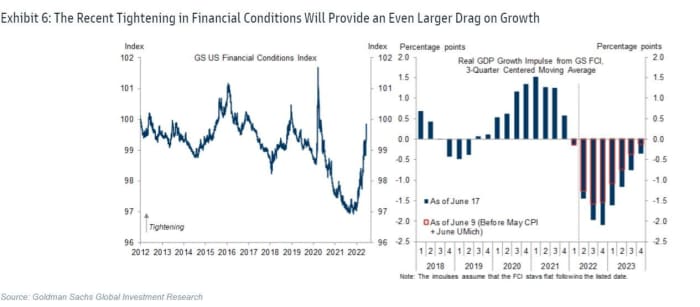

As for that bearish economic view, Wall Street bank forecasts are dropping like flies. Goldman Sachs now sees a 30% chance of an economic slowdown over the next 12 months, from a previous 15% on worries the Fed will “feel compelled to respond forcefully” to high inflation.

Nomura was even more pessimistic, telling clients Monday that a “mild recession starting in Q4 2022 is now more likely than not,” cutting its gross domestic product forecast to 1.8% from 2.5% for 2022 and to 1% from 1.3% for 2023. Deutsche Bank sees sub-1% growth in the first half of 2023 and the first quarter of negative growth in Q3 2023.

Read: This recession call is coming from inside the house. Why one New York Fed model is so bleak.

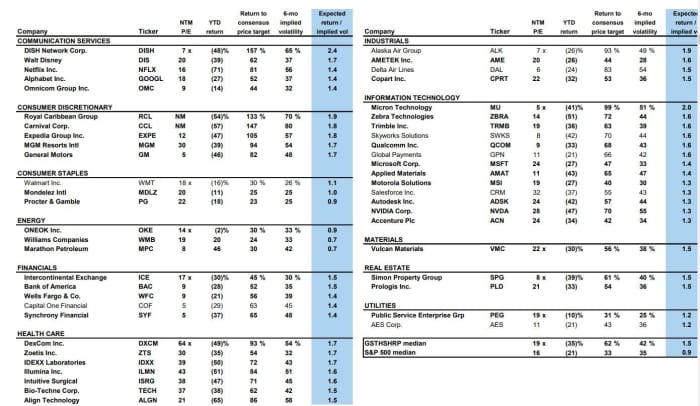

As for stocks, Goldman’s U.S. equity strategist David Kostin said separately that “investors concerned about tightening financial conditions, slowing economic growth, and elevated market volatility should own stable stocks” — low share price volatility and stable earnings growth.

The High Sharpe ratio basket “also takes volatility into account, but maximizes prospective risk-adjusted returns.” The median stock in that basket is expected to generate two times the return of the median S&P 500 stock with only slightly higher implied volatility, said Kostin.

Here’s a peek at that basket:

The buzz

Spirit shares SAVE,

Kellogg K,

Stock in AI supply chain group Symbotic SYM,

St. Louis Fed President James Bullard played down fears of a growing recession in the coming months. And former U.S. Treasury Secretary Larry Summers said unemployment needs to surge to curb inflation. President Joe Biden said a recession can be avoided.

Biden will also decide by the end of the week whether to order a holiday on the federal gasoline tax that could save as much as 18.4 cents a gallon.

Existing home sales are due after the market open, and we’ll hear from Cleveland Fed President Loretta Mester and Richmond Fed President Tom Barkin.

Italian helicopter maker Leonardo LDO,

The markets

The Dow DJIA,

Read: Tom DeMark identified the bitcoin downside in March. He’s got good news and bad news.

The chart

Goldman’s chief global equity strategist Peter Oppenheimer said markets are likely headed for a cyclical bear market — brought on by rising rates and looming recessions. But that’s not quite being priced in, so more selling is likely. (See chart of the day below).

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m. Eastern:

| Ticker | Security name |

| TSLA, |

Tesla |

| GME, |

GameStop |

| AMC, |

AMC Entertainment |

| NIO, |

NIO |

| AAPL, |

Apple |

| AMZN, |

Amazon |

| MULN, |

Mullen |

| TWTR, |

|

| RDBX, |

Redbox Entertainment |

| BABA, |

Alibaba |

Random reads

Hong Kong’s famed floating restaurant, where Tom Cruise and other celebrities have dined, sinks.

An inability to balance on one leg for 10 seconds may mean a shorter life.

Welcome to the longest day of the year

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers