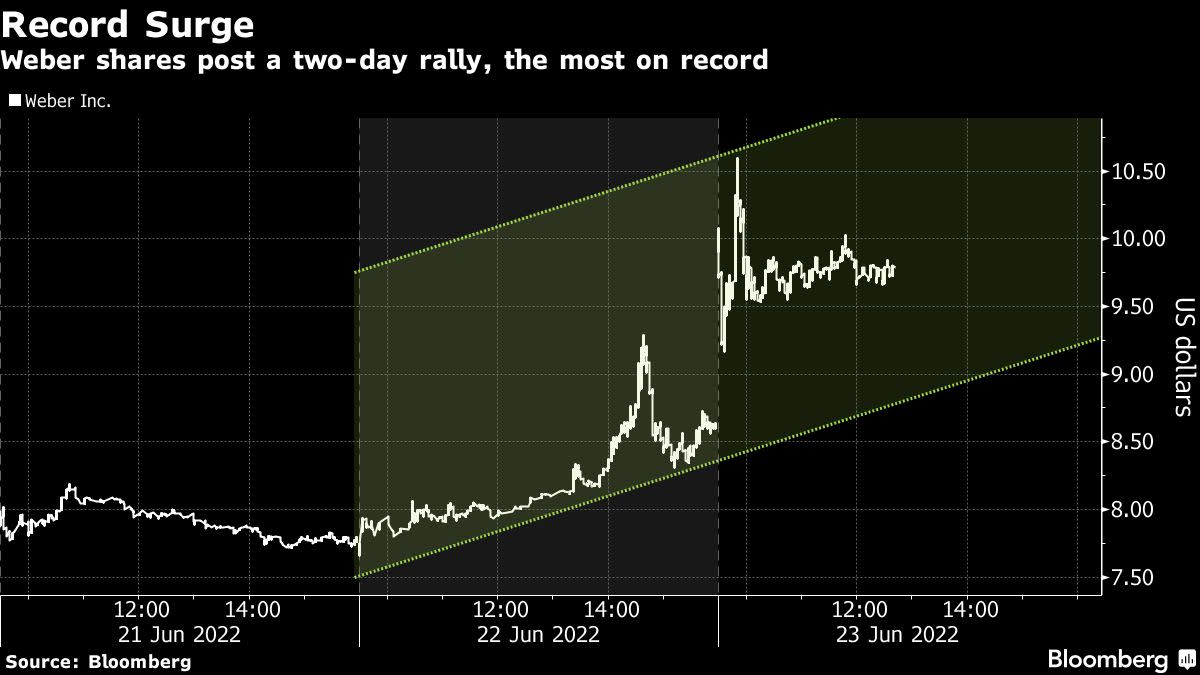

Grill-Maker Weber’s Record Two-Day Rally Punishes Short Sellers

(Bloomberg) — Shares of heavily-shorted outdoor grill makers surged for a second day, erasing paper profits for investors betting against companies like Weber Inc., according to S3 Partners.

Most Read from Bloomberg

Weber jumped as much as 36%, putting its shares on pace for a two-day rally that’s the biggest since it went public in August. Trading volume soared with almost 3 million Weber shares exchanging hands, more than ten-times the average over the past month, according to data compiled by Bloomberg. Peer Traeger Inc. rallied 15% over two days.

Weber’s gains on Thursday made for short-seller mark-to-market losses of almost $12 million, turning their year-to-date profits into losses of about $450,000, S3 Partners said in an email to Bloomberg News. In June, Weber shorts have suffered mark-to-market losses of about $22.1 million and more pain could be ahead, according to the analytics firm.

“With added buy-side pressure from buy-to-covers and virtually no sell-side relief from short-selling Weber’s stock, price trajectory should continue a steady climb as long as long stock buyers remain active,” said Ihor Dusaniwsky of S3 Partners.

Weber’s ticker saw an increase in mentions on Reddit’s WallStreetBets over the past day with touts rivaling those for Revlon Inc. Call options for the stock to trade above $12.50 — a level it hasn’t closed above since January — saw a jump in activity and were the second-most traded derivative tied to the company.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.