Market Rout Evokes Memories of Trading Before Lehman Blowup

(Bloomberg) — Quincy Krosby couldn’t wait for Monday’s trading session to be over.

Most Read from Bloomberg

“I was glued to the screen,” LPL Financial’s chief equity strategist said in an interview.

It was just one of those days with losses so gigantic that solely looking at stocks wasn’t enough. Her eyes strayed to bonds, to credit default swaps and elsewhere as she tried to figure out how bad things were and might get.

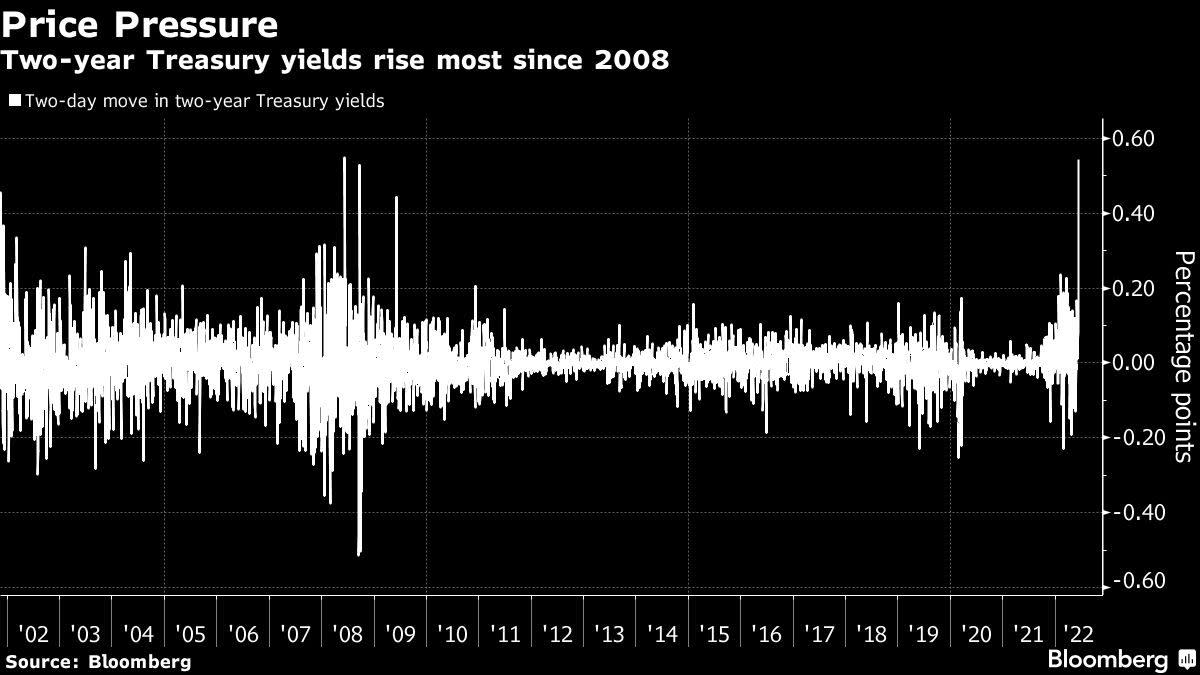

What she saw was ugly. Even by the standards of this volatile year, Monday’s wild ride throughout financial markets stands out. Two-year US Treasury yields surged 29 basis points as bond prices tanked. The yield jumped 54 basis points since Thursday night, the biggest two-day increase since 2008, a sign of just how rapidly traders are adjusting where they think the Federal Reserve will take interest rates.

All but five stocks in the S&P 500 tumbled, and the benchmark posted a more than 20% loss since its January peak, crossing into a bear market. On Tuesday morning in Asia, stocks extended the selloff as investors continued to process the possibility of more rapid Fed tightening, with MSCI’s Asia-Pacific share index falling more than 1.5%.

Cryptocurrencies plummeted so violently that a popular lending platform froze withdrawals to prevent a very modern kind of bank run. Over in old-school currencies, the U.S. Dollar Index roared to the highest level in almost two decades as investors sought safety.

It was enough, for some, to resurface scary memories of the global financial crisis more than a decade ago. Christian Hoffmann, a portfolio manager for Thornburg Investment Management, said market liquidity has deteriorated so much that he’s thinking about the dark days of 2008.

“Liquidity in the market is worse than it was leading up to Lehman,” said Hoffmann, who worked at the firm that imploded back then, triggering the worst financial crisis since the Great Depression. It’s the kind of problem that can exacerbate losses in a big way. “That creates even more risk, because if the market doesn’t have liquidity, it can gap down very quickly.”

Since a surprisingly hot inflation report Friday, investors have become increasingly worried that the Fed will have to tighten monetary policy so aggressively that it tips the economy into a recession. Economists at JPMorgan Chase & Co., Goldman Sachs Group Inc. and Nomura Holdings Inc. Monday joined their peers at Barclays and Jefferies to call for the central bank to announce a 75-basis-point hike on Wednesday, which would be the biggest increase since 1994.

Instead of serving as a haven in times like this, the Treasury market and its huge spike in yields has become a catalyst for the marketwide plunge. It reminded Priya Misra of former President Bill Clinton’s political adviser, James Carville, who famously observed that he’d like to be reincarnated as the bond market given how intimidating it is.

“It was quite the day. Like a freight train approaching and you can’t turn anywhere for help,” said Misra, global head of rates strategy at TD Securities. “Today the bond market was present in all ferociousness!”

Subadra Rajappa, head of U.S. rates strategy at Societe Generale, said poor liquidity, some “panic selling” and margin calls contributed to Monday’s rout. But even that couldn’t fully explain the market moves, she said.

Rajappa spent all day fielding calls from clients and scuttled between internal virtual meetings while working from home in Manhattan. A few clients were scratching their heads trying to figure out why the markets have sold off so much.

“People are trying to process what’s behind these large moves,” Rajappa said. “We don’t know for sure.”

(Updates with Asia market reaction in fifth paragraph. A previous version of this story was corrected to fix the spelling of a fund manager’s surname.)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.