Navigating mining challenges on the road to America’s EV future

To achieve the goal, president Biden has pushed to expand the domestic critical minerals supply chain, a move to break the dependence on other countries, especially China.

China produces 60% of all rare earth elements, 8% of the copper, and also has a 13% share of the lithium production market.

The country’s share of refining is around 35% for nickel, 58% for lithium, 65% for cobalt, and 87% for rare earth elements, according to Visual Capitalist.

“We can’t build a future that’s made in America if we ourselves are dependent on China for the materials that power the products of today and tomorrow,” Biden said at a White House event.

The goal is to create a fully domestic supply chain for the metals necessary to power electric vehicle motors, wind turbines, and more. The challenge is to ensure critical minerals production is sustainable and responsible. Biden himself has said the US will support new mines that avoid ‘historical injustices’.

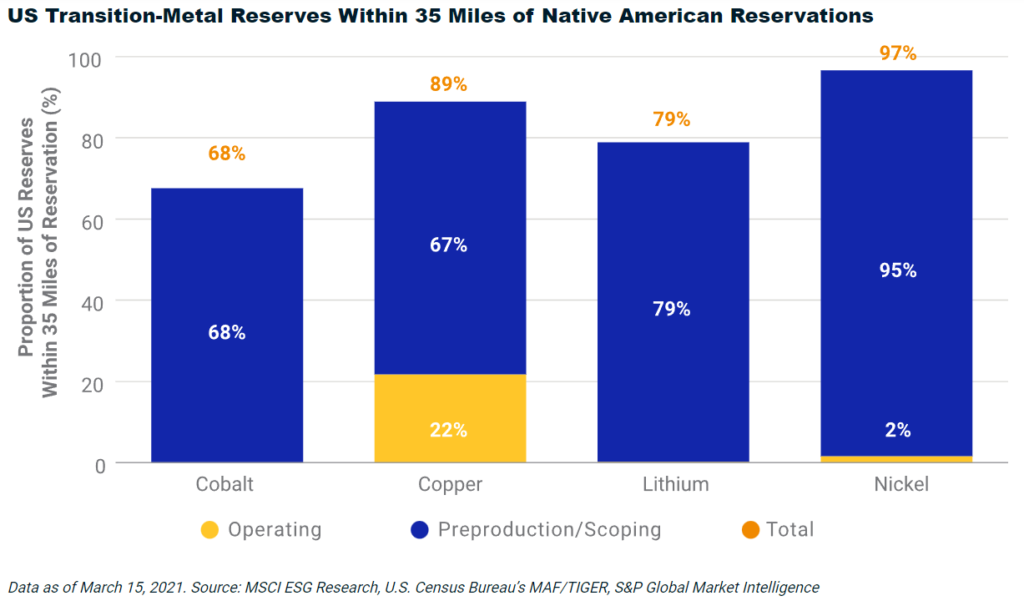

According to finance company MSCI, the majority of US reserves for cobalt, lithium, and nickel are located within 35 miles of Native American reservations and tribes have concerns about new mining projects.

President Biden came into office vowing to safeguard Native American resources and uphold the rights of Indigenous communities.

But even as the president stresses the need to boost domestic production of critical minerals, his administration has blocked several proposed US mines, including the Pebble project in Alaska, and Antofagasta’s Twin Metals project in Minnesota. It has also taken steps to slow down development of a lithium mine in Nevada from ioneer.

“Critical minerals play a key role in that transition so it is vital that the United States remain a leader in the responsible sourcing and recycling of those minerals,” said David Willms, senior director of Western wildlife and conservation at the National Wildlife Federation.

“We urge the administration to work with Congress for stronger safeguards for wildlife, vulnerable communities, and our public lands and waters in domestic mineral production and for the highest labor standards for the many new jobs that will be created.”

Climate concerns

One of the most talked about projects in the country is Talon Metal’s Tamarack nickel project in Minnesota.

Nickel is essential for the EV transition. While most conventional gas cars don’t contain metal, a single EV needs around 40 kgs to power the batteries.

The project is the only high-grade development-stage nickel mine in the country and is expected to start production in 2026, one year after the country’s only operating nickel mine, the Eagle Mine in Michigan, is scheduled to cease operations.

In January, Tesla announced a supply deal with Talon to buy 75,000 tonnes (165 million pounds) of nickel over six years, with an option to increase the delivered tonnage.

“The Talon exploration team has shown that the Tamarack Intrusive Complex has the potential to be a crucial source of carbon-neutral domestic nickel for US battery manufacturing,” said Talon’s president Sean Werger.

Talon is positioning Tamarack as a sustainable project. The company has received $2.2 million from the Department of Energy, and $4 million from Rio Tinto, to research a large-scale carbon sequestration system on the mine lands.

However, the project has also attracted the concern of native American tribes.

When nickel is mined from sulfide-bearing ores like those in Tamarack, tailings are typically exposed to air and often water. The resulting chemical reaction produces sulfuric acid and toxic metals that can seep into water and harm plants, animals, and humans.

“Sulfide mining has a long track record of polluting the environment. This entire region is a wetland with a complex and interconnected ecosystem. Pollution would affect every plant and animal that relies upon the land and water for survival,” Mille Lacs Band of Ojibwe Commissioner of Natural Resources Kelly Applegate told MINING.COM.

“We have Mille Lacs Band tribal members living just over one mile from the proposed mine,” Applegate said. We are very concerned about how the proposed Tamarack mine would disturb the land and its potential to pollute our waters and air.”

“Talon Metals believes that it can produce the feedstock for the domestic supply of nickel, cobalt, copper, and battery-grade iron powders that are required in the energy transition from the high-grade orebody at Tamarack, while also protecting the water-rich environment in our region that includes reservation and Treaty lands of the Ojibwe,” the company said in an email to MINING.COM.

The company said it has been collecting baseline information on the regional environment and sharing this data with regulators, tribal governments, and tribal members since 2006.

“We recognize that underground mining involves disturbance of the earth and that our community and tribal governments have concerns about the potential negative impacts on water, wildlife, air quality, and cultural resources. We have been working very hard to engage with our local community, tribal governments, and tribal members in our community to understand these concerns and use this understanding to shape the final mine plan,” Talon’s Head of Climate Strategy Todd Malan said.

“We can have a conversation about reducing mining in 2040, 2050, and 2060 but until we get the battery supply chain to have a big enough scale we will just fail at addressing climate change. So NGOs and civil society have got to understand that we have to move from yes or no to where and how and have a conversation about standards of responsible mining rather than keep it on the ground.”

At Talon’s invitation, Mille Lacs Band representatives attended meetings to hear about the mining proposal. Talon representatives also presented during a state-wide video conference of tribal natural resource managers from the 11 tribes in Minnesota.

“We hoped these meetings would provide information regarding the risks this project poses to our people and our environment. Even after these meetings, however, we have many questions that remain unanswered.”