Powell’s Fed Rate-Hike Plans Get Jolted by Inflation: Eco Week

(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

Most Read from Bloomberg

Jerome Powell could deliver a hawkish surprise on Wednesday even after effectively pre-announcing 50 basis-point interest-rate increases at the Federal Reserve’s meeting this week and in July.

May’s red-hot inflation print hardened expectations the Fed would keep raising borrowing costs at that pace through September, with some investors betting the Fed chair will deliver a super-sized 75 basis-point move unless price pressures cool.

Powell could reinforce that speculation during his post-meeting press conference by declining to take 75 basis points off the table — as he explicitly did last month by stating such a move wasn’t being actively considered — or by emphasizing the need for nimble policy to cool surging prices.

Data released Friday hammered home the message that the US central bank has a lot of work still to do in containing price pressures. Consumer prices excluding food and energy rose 8.6% in the 12 months through May, quickening to a fresh 40-year high.

Traders following the data release saw even odds of the Fed raising rates by three-quarters of a percentage point in July, while economists at Barclays Plc changed their rate call to expect such a hike as soon as this week.

What Bloomberg Economics Says:

“Powell will have a chance at the upcoming meeting to assert that inflation is still on an upward trajectory, and that the Fed will keep hiking by 50 basis points per meeting as long as that’s the case.”

–Anna Wong, Yelena Shulyatyeva, Andrew Husby and Eliza Winger. For full analysis, click here

The central bank’s updated quarterly projections will also likely steepen the expected path of future hikes and eventual peak. Officials in March saw rates reaching 1.9% this year and peaking at 2.8%, according to the median estimate.

A survey of Bloomberg economists — conducted before publication of May’s consumer price data — saw the projections advancing to 2.6% this year and 3.1% in 2023.

The Fed will be the highlight in a big week for central banks. The next day, the Bank of England will also probably hike rates and is likely to debate a half-point move, and on Friday the Bank of Japan will take its own decision at a time when the weakness of the yen is proving increasingly hard to stomach.

Click here for what happened last week and below is our wrap of what else is coming up in the global economy.

Asia

In a key week for central bank action, the BOJ meets Friday to decide on policy. Even with the yen languishing at two-decade lows as the Fed prepares to hike US borrowing costs, Governor Haruhiko Kuroda is widely expected to stick with rock-bottom interest rates. But the trajectory of the yen over the course of the coming days could make the BOJ’s position increasingly awkward.

On the data front, readings on China’s retail spending, industrial output and investment on Wednesday should show the economy is beginning to claw out of the Covid-lockdown affected slump in April, though the May numbers are likely to remain downbeat.

Jobless numbers from South Korea and Australia will likely show no impediment to further rate hikes in both countries.

New Zealand will release growth figures showing the economic rebound has slowed there as the strongest inflation in more than three decades eats into household budgets.

And India’s inflation rate likely remained well above the central bank’s comfort range, data Monday is set to show.

Europe, Middle East, Africa

The BOE is poised to deliver a fifth consecutive rate hike on Thursday, at a time when pressure is mounting on both Governor Andrew Bailey and Prime Minister Boris Johnson over the cost of living.

With inflation at 9% and the central bank’s own survey showing the worst approval rating since the poll began in 1999, an intense debate is likely among officials on whether or not to accelerate tightening with a half-point increase.

Several data reports will inform their decision, including gross domestic product on Monday that may show growth at the start of the second quarter after a decline in March, and then more evidence of a taut labor market on Tuesday expected with a drop in unemployment and accelerating wage increases.

The same day as the BOE, the Swiss National Bank will deliver a pivotal decision of its own. With officials now acknowledging the threat of inflation even in Switzerland, whose strong currency has insulated the economy from surging global prices, a shift toward finally lifting the world’s lowest rate is now imaginable.

Paving the way to that move has been the neighboring European Central Bank, which last week firmed up tightening plans that could even lead to a half-point hike.

But with market jitters reverberating as investors ask how that would impact weaker countries, several speeches by policy makers will take prominence. They include ECB Executive Board members such as President Christine Lagarde, as well as governors from France, Germany, the Netherlands, Italy and Spain.

Elsewhere in Europe, an expected acceleration in Swedish inflation to 7% on Tuesday may prove crucial for Riksbank officials ahead of their decision later this month.

Further south, Turkish data due Monday are expected to show the current-account gap widening further as a global rally in energy prices exacerbates the country’s foreign trade imbalances.

On Wednesday, Namibia’s central bank will probably match a decision by neighboring South Africa to raise its benchmark by 50 basis points to safeguard its currency peg with the rand.

And data due Thursday is likely to show Israel’s inflation accelerating further above the government’s 1% to 3% target range, a trend which has already led the central bank to hike more aggressively than expected.

Latin America

A potentially eventful week could become hectic should support staff and Brazil’s central bank hammer out a new labor contract. Odds are they won’t, and so a backlog of releases dating to late April only grows.

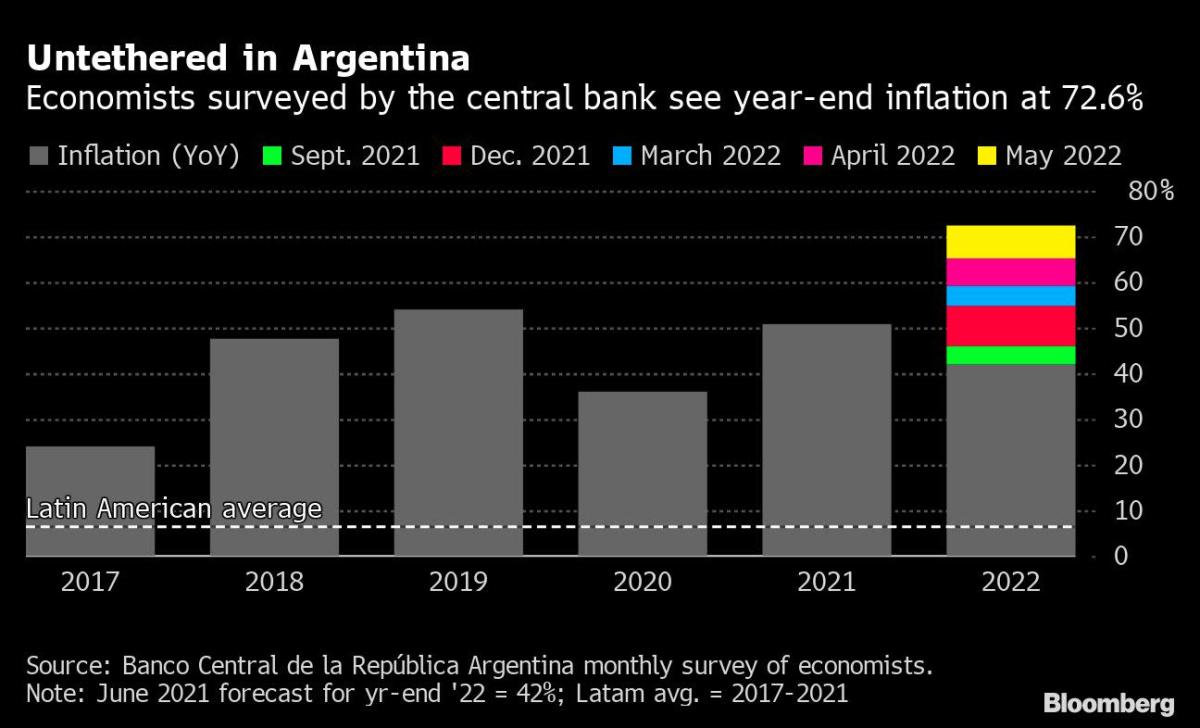

Few countries have been spared the scourge of inflation this year but among Group of 20 nations only Turkey’s is running faster than Argentina’s. Early estimates see the May print topping 60% while the most recent central bank survey of economists puts the year-end figure at 72.6%.

Heading in the opposite direction, Brazil’s consumer prices eased more than expected in May, possibly buttressing a dovish argument for an August rate pause. Even so, analysts still see the central bank raising the key rate Wednesday for an 11th straight meeting to 13.25%. The post-decision communique will be a must-read.

The labor market in Peru’s megacity capital of Lima isn’t back to pre-pandemic levels while the national GDP-proxy may slow from February’s post-omicron bounce.

After a strong January-March showing, look for the April data out this week to be consistent with forecasts that Colombia’s economy may lose a step in the second quarter yet still lead output among Latin America’s big economies.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.