SEC v Ripple: XRP in a Rut as Investors Await Court Ruling

Key Insights:

-

XRP bucked the broader market trend on Monday, falling by 1.17%. On Sunday, XRP trailed the top ten cryptos with a 6% gain.

-

Investors are awaiting a court ruling on the Hinman speech-related docs that could prove pivotal to the case.

-

Technical indicators remain bearish, with XRP sitting below the 50-day EMA.

On Monday, XRP fell by 1.17%. Partially reversing a 6.12% gain from Sunday, XRP ended the day at $0.3222.

XRP saw red despite the broader crypto market finding support. The total crypto market cap rose by $4.37 billion to consolidate a $62.6 billion gain on Sunday.

A lack of news on the SEC v Ripple case left XRP under pressure, with XRP continuing to hover near the current-year low of $0.2868.

Since the SEC filings on Thursday and Friday, it is now in the hands of the courts to deliver a key ruling in the SEC v Ripple case.

Court Ruling on the Hinman Speech-Related Documents Pending

Following the SEC June 14 filing on the William Hinman speech-related documents, the parties and the markets now await a court ruling on whether the documents are under the client-attorney privilege.

The ruling could materially impact the direction of the case.

In 2018, the former SEC Director of the Division of Corporation Finance said that Bitcoin (BTC) and Ethereum (ETH) are not securities.

Before a court-scheduled June 7 conference, the SEC filed at least six motions attempting to shield the Hinman speech-related documents under the attorney-client privilege.

However, the focus on William Hinman does not end there.

In December, Empower Oversight, a non-profit government watchdog, filed a lawsuit against the SEC. The lawsuit claimed that William Hinman received millions of dollars from his former employer, Simpson Thacher.

Simpson Thacher is part of a group that promotes Enterprise Ethereum. Empower Oversight claimed that the Hinman speech caused an ETH price spike before the SEC lawsuit against Ripple Lab, claiming that XRP is a security.

To make matters worse, for the SEC, Hinman continued to meet with Simpson Thacher despite warnings from the SEC ethics team.

In April, Empower Oversight forced the SEC to release emails relating to the Ripple case. The emails in question insinuate that Hinman continued to meet with Simpson Thacher, despite warnings from the SEC ethics team.

While the court ruling could materially impact the SEC’s position, the story may not end there.

Hinman’s influence on XRP and ETH could lead to further investigation. The SEC’s claim that Hinman was under the legal advice of SEC counsel in preparing for his 2018 speech makes it all the more interesting.

XRP Price Action

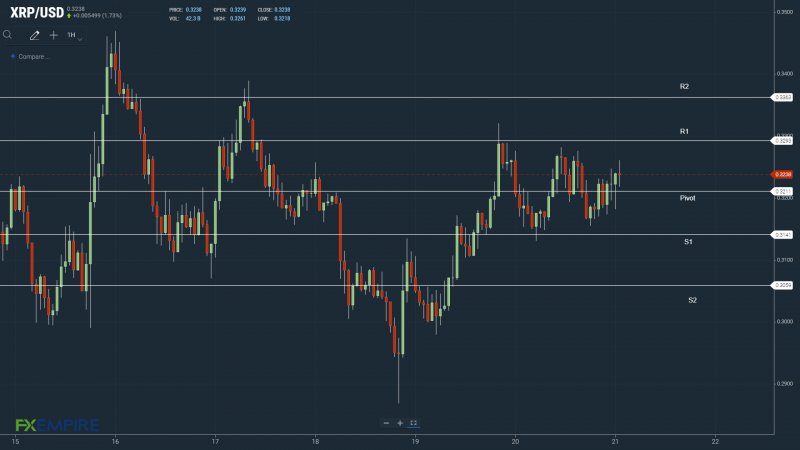

At the time of writing, XRP was up 0.43% to $0.3236.

A mixed start to the day saw XRP fall to an early low of $0.3182 before striking a high of $0.3261.

XRP left the Major Support and Resistance Levels untested early on.

XRP Technical Indicators

Avoiding a fall through the $0.3211 pivot would bring Monday’s high of $0.3282 and the First Major Resistance Level at $0.3293 into play. XRP would need the broader crypto market to support a breakout from the morning high of $0.3261.

In the case of an extended crypto rally, XRP could test the Second Major Resistance Level at $0.3363 and resistance at $0.34. The Third Major Resistance Level sits at $0.3515.

A fall through the pivot would bring the First Major Support Level at $0.3141 into play. Barring an extended sell-off throughout the afternoon, XRP should avoid sub-$0.30. The Second Major Support Level at $0.3059 should limit the downside.

The EMAs and the 4-hourly candlestick chart (below) send a bearish signal. At the time of writing, XRP sits below the 50-day EMA, currently at $0.3263. Today, the 50-day EMA flattened on the 100-day EMA. The 100-day EMA eased back from the 200-day EMA, XRP price negative.

A return to $0.33 would support a run at the 100-day EMA, currently at $0.3463.

While the technicals need considering, a court ruling will weaken support or resistance levels depending on the decision.

This article was originally posted on FX Empire