Sell Exxon Mobil and other energy stocks before these headwinds hit prices once again

Energy stocks have been the star investment this year. Now it’s time to sell them and electrify your portfolio before investors once again focus on the industry’s long-term headwinds.

There are a host of headwinds that could threaten the surge: rising recession risk, consumer backlash from the high price of gasoline, and the push to electrify our economy.

The stock market is starting to realize this.

The Energy Select Sector SPDR ETF XLE,

West Texas Intermediate CL.1,

Since June 8, however, the ETF has skidded about 20%, the traditional marker of a bear market.

Here are three reasons to lock in your profits now:

Recession risk is rising

The Federal Reserve is raising interest rates and shrinking its balance sheet in an effort to tame inflation — which is being driven in large part by rising energy prices.

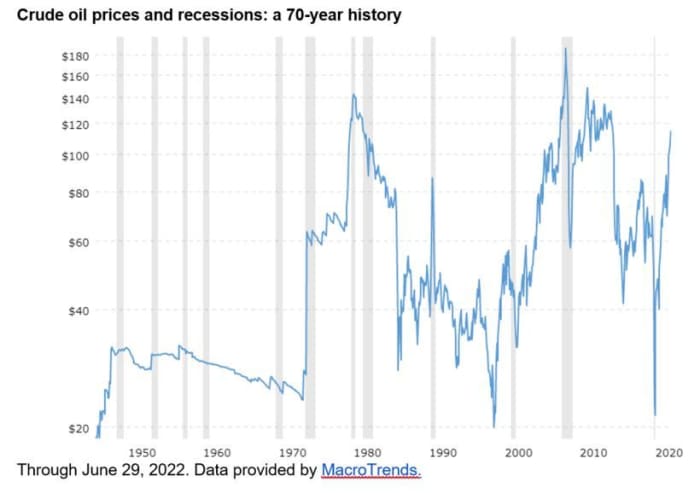

The result may be a recession. And that’s not good for oil prices, which historically are quite sensitive to economic recessions, or shares of energy companies, whose profit margins tend to rise alongside oil prices.

All recent economic recessions coincided with a significant and sudden drop in the price of crude oil, including the tech bubble of 2000, the September 11 attacks, the 2008 Great Recession, and the pandemic in 2020.

Oil prices have cooled off in recent weeks, and that trend could intensify given that risk of recession. Some investors, including ARK Invest CEO Cathie Wood, and stock market strategists believe that we are already in a recession.

Demand destruction

With oil prices this high, there are signs of consumer backlash, resulting in demand destruction for oil. That’s bad for oil company profits.

The four-week average of gasoline demand has fallen to 9.016 million barrels per day, as of June 10, 2022, according to the U.S. Energy Information Administration, down from 9.116 million barrels per day a year ago.

The national average of a gallon of gas stands at $4.88 a gallon, compared with $3.099 one year ago, according to AAA.

Market forces are at work. Yes, there is a limit to just how much consumers will pay for gasoline.

Electrification of our economy

It’s no secret that electric vehicles are at the center of our global energy transition. Still, this is fueling concerns of peak oil demand and, more alarming for investors, peak oil profits.

Consumers are increasingly putting their money where their mouth is by purchasing electric vehicles. Global electric vehicle sales hit a record 6.6 million vehicles in 2021, according to the International Energy Agency. And 52% of consumers planning to buy a car in the next two years intend to purchase an electric or hybrid vehicle, according to an EY study released in May.

Switching to an electric vehicle permanently reduces the demand for oil. Lower demand means less oil sold. That means less profits for oil stocks. Period.

While this is not news, it’s important to recognize the unique moment now facing stocks: a potentially once-in-a-lifetime confluence of events where the stock market is taking a break from pricing in the energy sector’s long-term headwinds and instead focusing on short-term upward catalysts. This has resulted, not surprisingly, in elevated stock prices for the energy sector — prices that we may never see again.

Take Exxon Mobil XOM,

Now is a prudent time for investors to sell their oil and energy stocks before the geopolitical and COVID-driven oil price bounce fades.

There’s an old adage on Wall Street that suggests that you won’t do any harm by taking profits.

Electrifying your portfolio

In our view, investors should completely avoid companies that are fossil fuel-based and create diversified portfolios that incorporate electrification like solar panels, wind energy, electric vehicles and batteries, which are all scaling exponentially.

But beware: some companies that appear “green” still have revenue tied to the fossil fuel industry. Instead, consider stocks and funds that have no revenue streams that serve the fossil fuel industry.

While household names like Tesla TSLA,

Zach Stein is the co-founder and chief investment officer of Carbon Collective, a climate-focused investment advisory firm.