Summer travel costs are soaring and Canadians appear happy to pay the price

The cost of getting out of Canada hasn’t been this expensive in years, yet Canadians appear willing to pay the price

Article content

The cost of getting out of Canada hasn’t been this expensive in years, yet Canadians appear willing to pay the price.

Advertisement 2

Story continues below

Article content

Summer vacation is only getting started, but so far pent-up demand for travel after two years of pandemic restrictions is more than offsetting soaring costs related to a surge in the price of jet fuel and a battered airline industry that still is struggling to put as many planes in the air as it was a few years ago.

“We observe that consumers are ready to accept price hikes,” Annick Guérard, chief executive of holiday airline Transat A.T. Inc., said in a press release on June 9, adding that the company she runs would have made money in its most recent quarter if not for the spike in fuel prices.

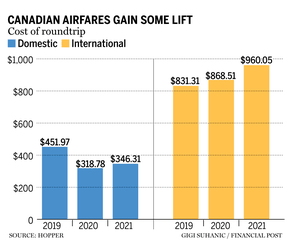

The average international airfare from Canada is now $960, up 15 per cent compared with 2019, according to data collected by Hopper Inc., the Montreal-based company behind the travel app of the same name. Soaring fuel costs, industry labour shortages, and fewer seats are among the factors contributing to the rise in prices, said Haley Berg, Hopper’s lead economist.

Advertisement 3

Story continues below

Article content

“We know demand has surged since the beginning of the year, given borders have opened, many Canadians are looking to travel again,” Berg said. “So, you have a gap of more people who want to travel than seats that are available to be booked.”

We observe that consumers are ready to accept price hikes

Annick Guérard

Evidence that travellers are willing to absorb higher prices is good news for industries that depend on travel and tourism, which have been among the slowest to recover form the COVID recession. For example, employment in the accommodation and food services industry — hotels and restaurants, essentially — was still below pre-pandemic levels in May, according to Statistics Canada’s latest Labour Force Survey, published June 10. Transat’s share price is about 75 per cent lower than it was at the start of 2020, reflecting the near impossibility of turning a profit in the airline industry over the past couple of years.

Advertisement 4

Story continues below

Article content

“When the effect of Omicron subsided at the end of February, operations and sales rebounded strongly,” Guérard said.

After a couple of years of traveling locally, if it all, Canadian appear to be suffering from wanderlust. Among the highest increases from 2019 prices are tickets from Canada to China, a 91-per-cent change to $1,392 in 2022 from $728 in 2019. Larger cities in China, including Shanghai and Beijing, have remained under lockdown due to COVID-19 fears and strict travel restrictions are driving fewer flights to and from the area.

-

Canada temporarily lifting random COVID testing amid massive bottlenecks at airports

-

JetBlue launches service to Canada with daily flights between Vancouver and JFK

-

Air Transat loses $112 million in the second quarter: What you need to know

Advertisement 5

Story continues below

Article content

The most costly ticket from Canada is for a flight to Australia, which is now around $1,695, up 32 per cent from $1,288 in 2019.

These sorts of increases are happening around the world. Americans are also spending more to travel this year, with the U.S. Travel Association reporting US$100 billion in travel spending in April – three per cent above the 2019 levels.

Travellers will also likely have to pay more if they hope to stay in a hotel during their trip. Canadian hotel rates averaged $155.80 per day in April, 2.5-per-cent higher than the same month in 2019, according to data gathered by Smith Travel Research Inc. In comparison, U.S. hotel rates averaged US$149.90 in the same period, up 14 per cent from 2019.

Canadians have the savings muscle to do it

Claire Fan

Many Canadians appear willing to spend what it takes to fly out of the country, perhaps because they have plenty of money in the bank.

Advertisement 6

Story continues below

Article content

A report released June 8 by the Royal Bank of Canada said demand for travel is strong enough to power through inflationary pressures, even as they eat into household incomes.

“Canadians have the savings muscle to do it,” wrote Royal Bank economist Claire Fan, noting that households accumulated a massive $300 billion savings stockpile during the pandemic, in part because lockdowns restricted leisure and hospitality services.

Royal Bank pointed to a surge in trip bookings, with purchases of flights and hotels moving back above pre-pandemic levels by mid-March, based on its tracking of its own debit and credit card transactions.

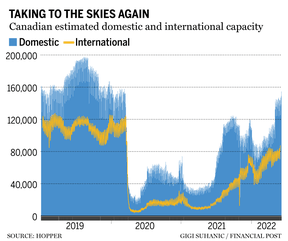

Despite this, the Royal report said passenger traffic at Canadian airports was still running 30 per cent below pre-pandemic levels as of May. And Hopper’s data showed that there were only about 80,000 daily plane seats slated for international departures in the late spring and early summer, down from 100,000 to 120,000 in the same period in 2019.

Advertisement 7

Story continues below

Article content

In stark contrast, the cost of flying within Canada is lower than it was in 2019.

Domestic flights cost about 23-per-cent less than in 2019, with prices averaging about $350 for a roundtrip ticket, compared with well over $400 in 2019, Berg said.

“The number of seats flying internationally from Canada has not recovered as quickly as domestic capacity has,” said Berg, adding that domestic capacity is close to 85 per cent of pre-pandemic norms, whereas international capacity is only at 73 per cent.

Berg said getting capacity back up to 100 per cent is going to take time, especially for Canadian airlines that suffered from fully closed borders for a very long time.

Airlines will need to rehire staff, retrain pilots, get their hours back up, rebuild their networks and decide which routes they’ll fly on what cadences, all while also balancing rising costs such as that of jet fuel, which is up 124.4 per cent from a year ago, according to the International Air Transport Association.

“It’s a complicated task to rebuild networks back up from zero and that’s causing the slower ramp up, especially in the international market,” Berg said.

Royal Bank’s Fan said the biggest concern for Canada’s travel businesses is staffing.

“Amid a historic labour crunch, the sector is still down 177,000 workers,” she wrote. “Businesses are trying to recoup those losses. In April, there were 80 per cent more hospitality and tourism job postings than there were prior to the (COVID-19) crisis in Canada.”

• Email: dpaglinawan@postmedia.com | Twitter: denisepglnwn

Advertisement

Story continues below