The S&P 500 is clinging to a key support level after Friday’s meltdown, here’s what happens if that fails

Last week’s shock U.S. inflation number continues to tear through markets, with dip buyers seemingly in hiding. Hardest hit Nasdaq-100 futures are down 3%.

Investors are now focused squarely on Wednesday’s Fed outcome, with expectations the central bank may need to do something bold, driving even more anxiety out there.

The aftermath of Wall Street’s Friday bloodbath left the S&P 500 SPX,

Our call of the day from RBC Capital’s head of equity strategy Lori Calvasina lays out just what could happen next, along with sectors that could shelter investors a bit.

If that May 19 low doesn’t hold and the index “breaks below 3,850 (the outer bound of growth scare territory, i.e., the 2011 and late-2018 drawdowns), we see potential downside in the S&P 500 to a little over 3,200,” she tells clients in a new note.

“That would represent a 32% drawdown in the S&P 500 from the early January 2022 high, which is in line with the average recession drawdown in the S&P 500 peak to trough since the 1930s,” said Calvasina.

The pandemic’s early 2020 drawdown of 34% marks a “reasonable starting point for thinking about how low the S&P 500 could go this time in a recession drawdown. It’s equally important to keep in mind, however, that there is precedence for US equities stabilizing above that level,” she adds.

For example, recession drawdowns in the early 1980s totaled 17% and 27%, and in 1990 that peak-to-trough move totaled 19.9%. “The 18.7% move down that’s already been seen in early 2022 is worse than one of the 1980s drawdowns and close to the 1990 drawdown. A 27% drawdown would take the S&P 500 to just below 3,500,” she said.

Apart from Friday’s CPI horror show, Calvasina said their economic team was particularly alarmed by a move up in 5-year inflation expectations to 3.3% from the University of Michigan consumer sentiment survey released later that day. Like others they worry about more aggressive Fed hikes, hurting consumers.

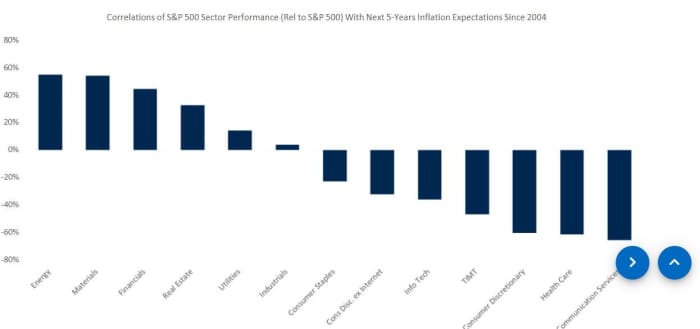

Which stocks might fare better in this scenario? Calvasina and the team examined how different sectors within the S&P 500 and Russell 2000 have traded over history in relation to inflation expectations.

Within large and small cap, they found energy and financials had the most positive correlations with long-run inflation expectations and outperformed when those were rising. Large-cap materials also tend to outerperform the S&P 500 in this scenario.

Healthcare stocks have had the most negative correlations to inflation expectations, within both small and large-caps, while consumer discretionary and communications services have fared even worse, she said.

Check out: These 19 large-cap stocks have now dropped at least 60% from their 52-week highs

“The bigger-picture conclusion: this change in long-run inflation expectations could delay the shift from Value back to Growth that we’ve been expecting,” she adds.

As for recession itself, small-cap stocks tend to be hardest hit in drawdowns associated with recessions, but then see powerful rebounds that start midway through those downturns, Calvasina notes. So given small-caps are pure plays on the domestic economy, they are the ones to watch when recession risks are in the water.

Calvasina saw one encouraging sign from Friday — the resilience of the Russell 2000 RUT,

A final word from the strategist — based on history, if a recession is beginning, some sectors are probably nearer to pricing it in than others.

“As of May 19 (which remains the YTD low in the S&P 500 as of Friday), the declines that had been seen in the S&P 500 Communications Services, Consumer Discretionary, and Consumer Staples sectors were getting close to the average moves lower that were seen in these sectors in the last four broader market recession related drawdowns. Most other S&P 500 sectors had sizable gaps, with the biggest seen for Energy,” she said.

The buzz

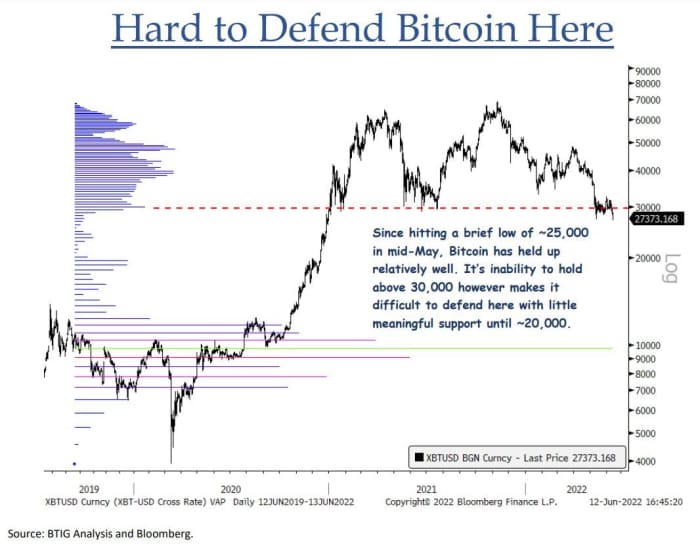

Cryptocurrencies continued to selloff through the weekend, with bitcoin BTCUSD,

And shares of technology MicroStrategy MSTR,

Digital World Acquisition DWAC,

EV startup Electric Last Mile Solutions ELMS,

Asian markets are getting battered both by U.S. inflation and mass testing in a heavily populated district of Beijing suffering a “fierce” COVID outbreak.

The data calendar for Monday is empty, leaving markets to just simmer away in panic this morning. Along with Wednesday’s Fed outcome, May retail sales will mark the week’s data highlight.

The markets

Stock futures ES00,

The chart

Here’s a breakdown of what’s going with bitcoin from BTIG’s Jonathan Krinsky, who points out that the crypto’s inability to hold $30,000 means it could tumble all the way down to $20,000:

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m. Eastern:

| Ticker | Security name |

| TSLA, |

Tesla |

| GME, |

GameStop |

| AMC, |

AMC Entertainment |

| RDBX, |

Redbox Entertainment |

| NIO, |

NIO |

| AAPL, |

Apple |

| AMZN, |

Amazon |

| IMPP, |

Imperial Petroleum |

| NVDA, |

Nvidia |

| BABA, |

Alibaba |

Random reads

Google employee suspended for claiming AI chat bot has thoughts and feelings

This lion nearly went blind until Indian doctors stepped up

How bad is inflation? Even Snoop Dogg’s blunt roller is getting a raise

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.