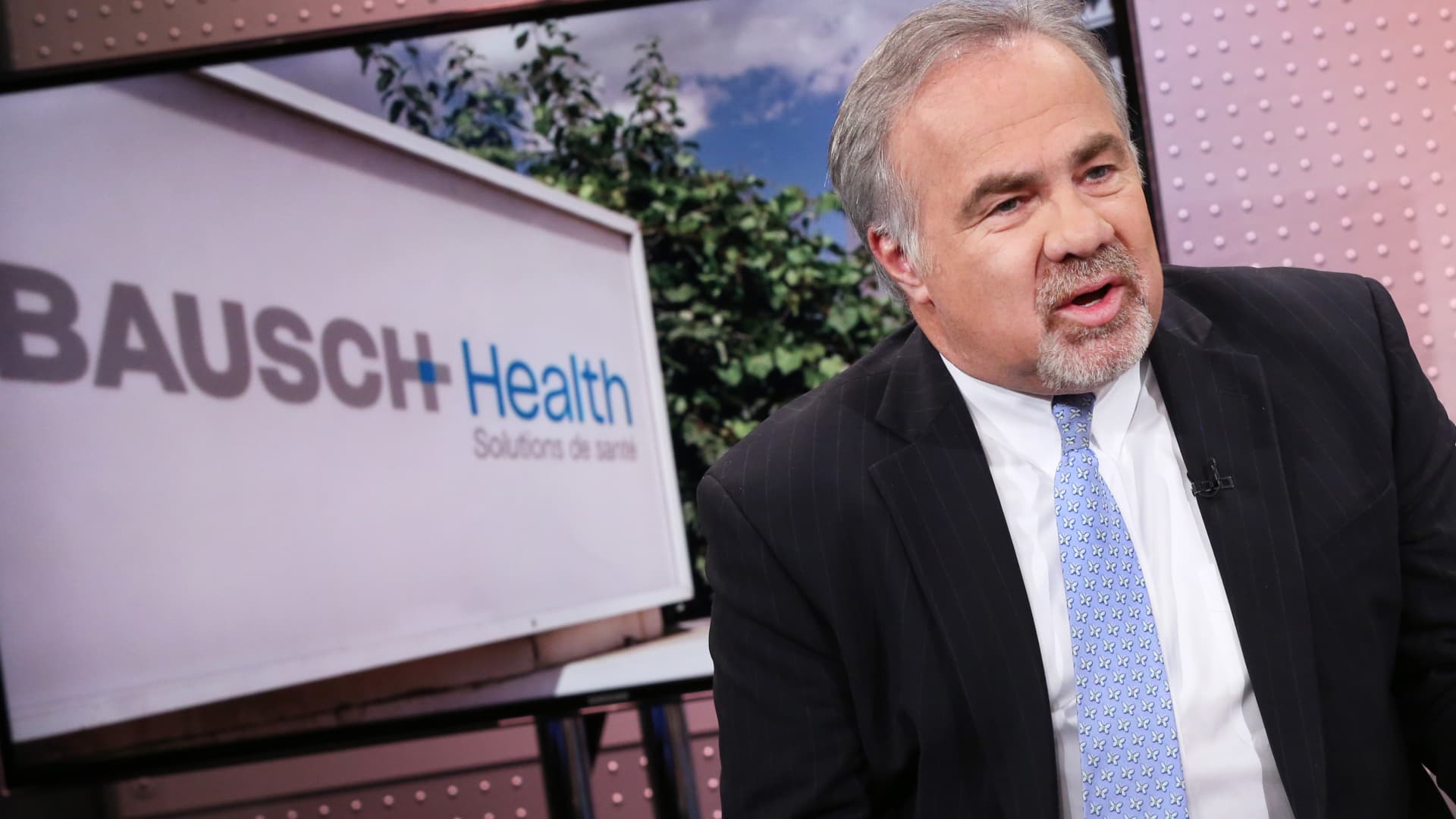

There has been a shakeup at the top of Bausch Health ‘s (BHC) board of directors, an incrementally positive development for this beleaguered Club stock and one that has two of the most successful billionaire investors’ hands all over it. The market also likes what it sees, sending shares up more than 17% on Friday. What’s new In a securities filing Thursday, Bausch Health announced that Joe Papa stepped down as chairman of the board of directors, effective immediately. He’s being replaced by John Paulson, the hedge fund veteran who made a fortune betting against subprime mortgages in 2007. Meanwhile, Icahn Enterprises ‘ Brett Icahn and Gary Wu joined the board of Bausch + Lomb Co. (BLCO), the eyecare company that Bausch Health spun out into a separate publicly traded firm in May. Papa is still chairman and CEO of BLCO. Brett Icahn is also a director on Icahn Enterprises’ board of which his father, Wall Street legend Carl Icahn, is chairman. The Club does not own any BLCO. But as Bausch Health shareholders we’re an interested party because BHC has, for now, retained roughly 90% ownership in BLCO. BHC has already used the IPO proceeds to pay down some of its massive debt. In the future, the pharmaceutical company plans to monetize the rest of that ownership. Some context on these moves: Paulson was on the board of Bausch Health from June 2017 to May 2022. He became an independent director at BLCO when it went public. Now, he’s back on the board at BHC as chair. In the SEC filing, Bausch Health said Papa’s resignation was “not due to any dispute or disagreement with the Company, its management or the Board on any matter relating to the Company’s operations, policies or practices.” Bausch Health’s two largest institutional shareholders are Icahn Associates, a hedge fund affiliated with IEP, and Paulson & Co., owning 9.61% and 7.15%, respectively, of the company, according to FactSet. The ownership stakes are especially noteworthy. As BHC shares have tanked this year, the firms have suffered, just like the Investing Club and the rest of the company’s shareholders have suffered. Carl Icahn will often take a stake in a company and then try to push for changes that he believes will create shareholder value. It doesn’t always work out for Icahn, to be sure, but he’s among the most well-known activist investors. Our take We’re pleased to see these moves, but we’re not willing to buy any more shares of Bausch Health just yet as we await more information on what the new chairmen and board members plan for the two businesses. It is too early to speculate — but at the very least, though, it’s a recognition that the stock situation as gone awry, and something needs to be done about it. The issue for now: It’s not entirely clear what will be done next. So, we’re hesitant to buy additional BHC shares. (Note: We are restricted from trading the stock for 72 hours because Jim Cramer mentioned BHC stock on CNBC on Friday on CNBC. But as always, that doesn’t stop us from informing Club members on what we’d otherwise do. A description of the Club’s trading rules is always at the bottom of our our stories.) “I still say work in the progress,” Jim Cramer said during Friday’s “Morning Meeting” for Investing Club members. “I don’t trust this situation yet.” We feel confident in saying that, at a basic level, the new board members’ goal is to restore some of the shareholder value that’s been obliterated — down nearly 74% this year as of Thursday’s closing price. We just don’t know their precise vision for doing that yet. “The thing to watch here is, ‘How much is Icahn really involved?” Cramer said. “Because if Icahn is involved, I think you get a transaction. If it’s just a sightseer, where he’s got a big position and he’s underwater and wants to saber rattle, that’s what I worry about. That would be a definitive negative once again.” BHC background We recognize the Bausch Health situation may be a little confusing in general, so here’s a little breakdown of what our investment thesis was and why it has not worked out. We bought into BHC in December, thinking that the company’s three-way breakup plan would create additional value for equity investors as Bausch Health used proceeds from two spinoffs to pay down its large debt burden. The debt load has been an overhang on Bausch’s stock multiple, but we thought as its liabilities shrunk, investors would be more willing to pay a higher price for future earnings. As of March 31, according to FactSet, BHC’s net debt stood at more than $20.7 billion. It’s not gone to plan. Bausch Health did accomplish one of those spinoffs in May, with BLCO going public as we mentioned above. However, that took longer than expected to occur and general market conditions soured so much this year that the BLCO offering was smaller than we expected. The deal raised $630 million for BHC, much less than what was anticipated before Russia’s war in Ukraine broke out and the Federal Reserve aggressively started raising interest rates, which is something that has contributed to price-to-earnings multiple compression of nearly all equities. As of last week, the second part of the three-way breakup plan is now on hold. Bausch Health said in a release June 16 that it was suspending plans to take skin-care unit Solta Medical public, citing “challenging market conditions and other factors.” Bausch Health believes that the interests of the Company’s stakeholders are best served in the near-term by focusing on driving Solta’s revenue, profits and cash flow while also achieving key operational and regulatory milestones. For now, Solta will remain as part of Bausch Health and continue to contribute to the deleveraging of the Company’s balance sheet. The Company will revisit alternative paths for Solta in the future. At this stage, we ultimately think the Solta decision is the right one. Sentiment is so negative right now it’s hard to see how that IPO could’ve raised enough money for BHC to make a meaningful reduction in its debt. Looking ahead, we’ll be keeping an eye on Bausch Health’s decisions regarding Solta and the rest of its nearly 90% BLCO stake. Some of that is expected to be sold for the purpose of paying down debt, and the expectation is that a spinoff will take place to distribute the remaining portion to BHC shareholders. This last part is the most important event in terms of bringing out value. In both cases, the higher BLCO is trading, the better for us as BHC shareholders. Bausch + Lomb rose about 3% in Friday’s trading but remained well below its disappointing IPO price of $18. — Jeff Marks , the CNBC Investing Club’s director of portfolio analysis, contributed to this report. (Jim Cramer’s Charitable Trust is long BHC. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.