Two Stocks To Watch As The Oil Industry Battles A Water Crisis

The era of casually disposing of water of any type is coming to an end. Water resources, particularly “fresh” water, are moving up the value chain. A resource most of us have taken for granted most of our lives is becoming more expensive and scarce. Drought is part of the reason for this new focus on water. As the NOAA map below shows, about two-thirds of the nation is experiencing at least moderate drought.

Drought conditions have been in place for years across much of the country. The term ‘Megadrought’ has been coined to describe a drought that goes on for decades. In a study published in Nature, February of 2022, the authors note-

“Rather than starting to die away after wet years in 2017 and 2019, the 2000s drought has ramped up with authority in 2020-2021, making clear that it’s now as strong as it ever was,” said Mr. Williams, a climate scientist at the University of California, Los Angeles.”

In fact, as a Wall Street Journal article notes, “In the American West, the last 22 years have been the driest period since at least 800 A.D.” A time spanning some 1,200 plus years.

This matters to us in an article targeted at oilfield operations, because water, and huge quantities of it, are required to force oil and gas out of the ground in the U.S. shale plays that generate most of our domestic production

Drilling down from here. What is rapidly emerging in frac and produced water disposal in hyperactive shale plays like the Permian, is the move toward recycling. This is being driven by companies’ own ESG goals of sustainable production and reducing their carbon footprint in fracking operations, as well as increasing government concerns. Concerns are driven by increasing seismic activity in oilfields being fracked.

Seismic activity – a fancy name for earthquakes in this case – in areas where it was previously unknown, is raising red flags and focusing a mitigation lens on companies looking to grow or maintain oil output. This isn’t a passing fad or something that is going away. Rystad notes in a recent article published in their monthly newsletter-

“The oilfield water market is poised for a very interesting 2022. M&A activity, regulatory responses to induced seismicity, and rising produced water volumes across the US lower 48 states have all set the stage in 2021 for what will certainly be the most dynamic market conditions in a growing oilfield segment,” says Ryan Hassler, senior analyst with Rystad Energy.”

Water is needed to frac – there is no substitute. It is one leg of the fracking triumvirate- pumping, sand, and water. Millions of gallons of it per well, as we have noted. When on production, wells make water that must be dealt with. At today’s oil prices, you can afford to pump a well with a water cut in the 90 percentile. That means that when you add the two together, there is a lot of water needing treatment!

The Rystad article notes that more than a dozen of operators with disposal permits in the Gardendale Seismic Response Area-SRA, affecting wells pumping into the Ellenberger formation, are coming under regulatory review, with deep impacts affecting some.

ConocoPhillips experiences the largest loss of disposal capacity, with a total of 186,000 barrels shuttered, followed by Rattler Midstream at 150,000 barrels and Wasser Operating and Fasken Oil and Ranch each with a loss of 120,000 barrels of permitted disposal capacity. If no other solution presents itself, these companies could be faced with curtailing operations in this area.

Rystad goes on to note: “The best way to hedge against regulation and cost is to invest now in the recycling network needed to handle future barrels of water. In the most recent round of sustainability reporting, many operators have been more transparent about their water stewardship, reporting standardized metrics for the investment community to analyze. In 2022, there are likely to be even more frameworks established to calculate ESG scores and benchmark operators on their water management practices, much like on emissions. Investments need to be made today to get ahead of the curve and position well for 2022”.

Thus far we have identified the challenge and outlined the scope of the problem. In the rest of this article, we will review two companies that are specialists in reclaiming the flow-back-water that is received after a frac when the well is first put into production, and produced water-water produced along with oil and gas. They offer both on-site and central recycling services to the industry.

The first one we will review, Select Energy Services, (NYSE:WTTR) is slightly smaller than the two in terms of footprint and revenue but has recently been awarded some big contracts that will boost revenues as they begin to be serviced. The next one we will look at is ARIS Water Services, (NYSE:ARIS), a company that just IPO’d last year to considerable fanfare. Both are selling at a solid discount to recent highs thanks to the Fed put and concerns about crude oil demand. We will present the case for both, and suggest one to you as the best choice given all factors.

Select Energy Services

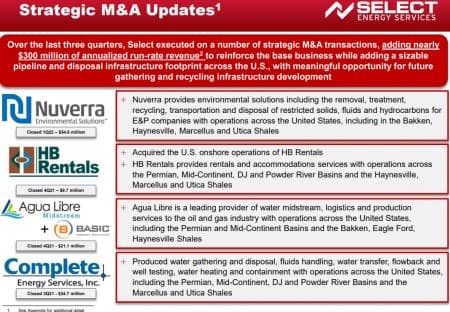

Select Energy Services, Inc stock hasn’t moved much in the last four months, a time when many of the Oilfield Service sector- OFS, names have doubled. This is an oddity, as if the frackers like Liberty Energy (NYSE:LBRT) are going to double, and the sand suppliers like U.S. Silica Holdings (NYSE:SLCA) do the same, why hasn’t WTTR done better? It is, after all, the third leg of the fracking triumvirate. The company has been on a torrid acquisition pace, gobbling up four companies in the last year and a half, and the capital cost and cash burn involved is likely the reason for at least part of the underperformance of the stock.

Now in fairness, the two companies I cited above as exemplars of out-performance have fallen 15-20% on valuation downgrades, and weakness in oil prices over the past couple of weeks. I am calling it the “June-Swoon.” In that light, WTTR’s performance, having nearly touched $10 in mid-June doesn’t look quite so bad. I still maintain that there are a lot of generally positive things happening for WTTR:

-

Share count reduction; down 2.6 mm shares in Q-1.

-

Growth (rapid) in core water recycling business (driven in part by increased seismicity in the Permian); up 25% QoQ.

-

Growth in chemicals business; up 15% QoQ.

-

Growth in the broader frac market; frac spreads have increased 30% this year.

-

Increasing margins across all business lines.

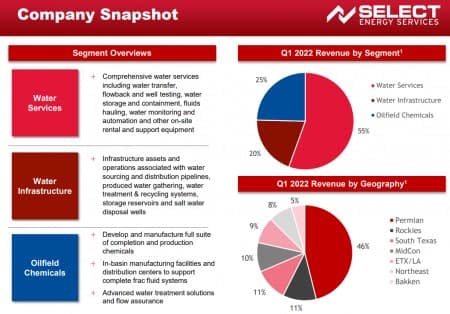

Select pursues water treatment business on three levels. They provide direct, well-site service for fracturing operations, and recycling of produced water, in their Water Services segment. The Water Infrastructure business builds pipeline distribution, recycling centers, and field gathering networks. The company also participates in the oilfield chemicals space, a business that has been enhanced by a recent acquisition – Complete Energy Services, to facilitate that business. This deal brought trained personnel, a premium these days, and an increased footprint in shale plays where they were marginal players. Production chemistry plays into the company’s strengths, and there is a lot of synergies that comes with the merger.

The company made a number of other acquisitions in 2021 as the slide below shows. Focusing on companies that complemented and extended their existing water flow back and produced water business, these acquisitions added $300 mm of run-rate revenue. These new business brought clients and revenue, but the capex involved in the purchase and integration of these new companies has been a drag on the performance of the stock.

Once you put these asset bases together, they really complement each other in a meaningful way when you consider their scope and discrete technologies. The industry has converted from fresh to produced water, if you will, the water has gotten dirtier and chemistry is very important when you apply it to make that water source usable, as well as chemistry is very important when you actually use the water and the frac process being a dirtier water solution is chemistry.

WTTR Financials Q-1, 2022

Revenue for the first quarter of 2022 was $294.8 million as compared to $255.1 million in the fourth quarter of 2021. Net income for the first quarter of 2022 was $8.0 million as compared to $11.2 million in the fourth quarter of 2021.

Total gross margin was 8.4% in the first quarter of 2022 as compared to 7.0% in the fourth quarter of 2021 and (3.1)% in the first quarter of 2021. Gross margin before depreciation and amortization (“D&A”) for the first quarter of 2022 was 17.4% as compared to 16.6% for the fourth quarter of 2021 and 12.0% for the first quarter of 2021.

Adjusted EBITDA was $32.2 million in the first quarter of 2022 as compared to $26.4 million in the fourth quarter of 2021 and $0.9 million in the first quarter of 2021. Adjusted EBITDA was negatively impacted by the deduction of $11.4 million of non-recurring bargain purchase price gains that benefited Net Income during the quarter related to our recent acquisition activity.

Cash flow from operations for the first quarter of 2022 was ($18.6) million as compared to ($2.4) million in the fourth quarter of 2021 and ($3.9) million in the first quarter of 2021. Cash flow from operations during the first quarter of 2022 was significantly impacted by a $44.9 million use of cash to fund the working capital needs of the business, including the settlement of acquired Nuverra liabilities

Total liquidity was $213.3 million as of March 31, 2022, as compared to $202.9 million as of December 31, 2021. The Company had available borrowing capacity under its sustainability-linked credit facility and its previous credit facility as of March 31, 2022, and December 31, 2021, of approximately $188.5 million and $117.1 million, respectively.

WTTR bought $16 mm worth of their stock back in Q-1 and has $25 mm remaining in authorization. I expect they will jump all over this with the prices where they are. That would take another 3-4 mm shares out of circulation. Eventually, this alone will boost the value of the stock.

Summing up for Select. You have a strong company that has used available cash to expand their market footprint and technological scope over the last year. Revenues and margins are increasing across all business segments. As noted the broader frac and produced market is expanding to support oil and gas production. I think that WTTR makes a solid investment case at current prices. Analysts are moderately bullish on the stock, with 2 out of the 3 covering it rating it a hold. Price targets range from $8.50 to $12.00, with the median at $11.50. If they were to hit the upper end of that range, it would equate to growth of almost 80%.

Select is clearly a solid choice in this sector, but, we are here to choose the best of two companies in the same service sector, so now we will take a look at ARIS.

ARIS

As we will see, in ARIS we have a well-capitalized provider of water services to the frac industry. To quickly recap what we discussed above in the Select review, the frac water treatment market is growing due to demand for oil and gas, and the absolute requirement that these resources be better utilized than in the past. Seismicity in some shale plays is bringing regulatory concerns that compel recycling vs disposal.

ARIS Water Solutions, (NYSE:ARIS) only IPO’d last fall. ConocoPhillips, (NYSE:COP) gave a big vote of ratification to the company, taking a nearly 40% stake, and giving it a contract to manage its frac and produced water. It also contributed to the water management midstream assets picked up in the Concho Resources acquisition in 2020. Some of the reasons COP saw the need to invest in a company like ARIS, will become apparent later in the article. Institutions, Mutual Funds, and ETF’s have also bought into ARIS in a big way as well.

The company participates in the same frac/produced water infrastructure and recycling space as Select Energy Services. A case that becomes more compelling daily in the current market meltdown. I think that higher oil prices are here to stay, there just isn’t enough of the stuff go around, and that sets up a continued bull run for oil companies and the companies that provide services to them.

ARIS has rallied some 30% from its IPO price, but is now pulling back along with everything else in the “Fed put” market tantrum now underway. In this article we will take a look at ARIS and see if there is an investment case, and at what level we might stick our toe in.

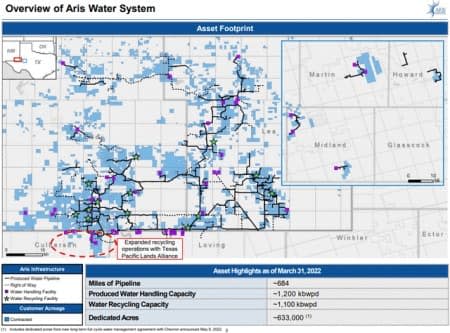

The company has made a significant movement in the recycling space, recently signing a long term contract with Chevron (CVX) This is a huge win for the company. CVX has publicly committed to growing production in the Permian, targeting a million BOEPD by 2025. When you add in similar contracts with ConocoPhillips, a company that is also growing in Permian, having bought Shell’s assets last year for $10 bn, on top of its $9.7 bn purchase of Concho Resources in 2020, and others, you have a repeatable book of business that will provide steadily increasing cash flows into the middle of this decade.

The graphic above shows the Delaware basin-centric layout of the ARIS distribution and processing network.

The Texas Pacific Land alliance is a masterstroke of strategic thinking for ARIS. TP&L owns in fee over 800K acres, mostly in the Permian and the alliance enables facilities and rights of way that just wouldn’t be possible otherwise. This deal impacts TP&L two ways as they are the lessors of much of the privately held lands to oil companies. Tyler Glover, CEO of TP&L summed it up in the press release:

“Having Aris develop additional strategic infrastructure on TPL’s surface acreage will further expand and enhance our ability to serve operators and customers. By working with Aris, we will drive more water volumes onto TPL’s surface acreage and facilitate further operator development on our oil and gas royalty acreage.”

Then you have a blue-chip oilfield leadership roster, led by Bill Zartler as Executive Chairman. Zartler also heads up another OFS company we’ve reviewed in the past. Solaris Oilfield Infrastructure, (NYSE:SOI), provides mobile sand silos, sand mixing and conveyors for field frac operations support.

Aris Water Solutions Q1 2022 Results

Revenues grew ~5% to $71 mm on volumes of 1.2 mm bbl of water daily. This was led by a near tripling YoY of produced water volumes to 273K BPD. Adjusted EBITDA rose to $35.9 mm, up 54% YoY. Margins per bbl grew to $.026 from $0.14 YoY. Capex declined by half YoY to $9.8 mm. The company has $67 mm in cash, no long-term debt and an undrawn $200 mm revolver. Total liquidity was $267 mm. The company paid a $0.09 quarterly dividend for the second quarter.

The company is guiding toward full-year EBITDA of $140-$175 mm, and ~$40 mm for Q-2. Capex will also increase to support the new CVX contract to $140-$150 mm on a full-year basis.

Analysts are unabashedly bullish on ARIS, with 7 of 10 rating it a BUY. The price target range runs from a low of 18.63 to $26. The median is $24.

On a forward EV/EBITDA basis the company trades at a multiple of 5.6X. Not excessive for a company with its growth prospects.

As I have said, I think the case for frac and produced water management is solid. There is no shale oil without fracking. Water comes out of the ground with the oil. It must be reclaimed going forward as opposed to just being pumped into the ground. Companies like ARIS should do well. ARIS is a clear leader in this market segment.

Your takeaway

Not everyone agrees with me, but I think there is a strong driver that will push OFS companies higher. Increasing activity, we have that. Increasing profitability, we have that. Sure, there’s inflation, but to a large extent, the OFS companies pass that along.

In the case of Select, they tell us the acquisition and integration expenses that have burned up cash over the last year are behind them, and the focus now will be on improving margins.

I think WTTR is de-risked at current prices. That doesn’t mean they are going higher, but I don’t see a lot of downside for anyone taking a position, absent the Fed put. We saw an example of that today. I see that as a tempest in a teapot, that will pass as demand continues to increase.

One risk is the low barrier to entry. Select really has no technology moat-except the recycling centers and drives business with price and service. There are a zillion water companies and all use much the same technology. That means there are two ways to grow:

-

You take business with price.

-

You buy market share with acquisitions.

Both are expensive ways to go after business.

With a capitalization of $971 mm and one-year run rate revenue of $1.2 billion the ratio is .8, which puts them well ahead of the sector median of 1.87. If we used that same 2X multiple then Select is a potential double from present levels! The stock buyback program will only add to the value of the stock.

Now for ARIS. Analysts are unabashedly bullish on ARIS, with 7 of 10 rating it a BUY. The price target range runs from a low of 18.63 to $26. The median is $24. On a forward EV/EBITDA basis the company trades at a multiple of 5.6X. Not excessive for a company with its growth prospects.

I think the case for frac and produced water management is solid. There is no shale oil without fracking. Water comes out of the ground with the oil. It must be reclaimed going forward as opposed to just being pumped into the ground. Companies like ARIS should do well. ARIS is probably the clear leader in this space and is our choice for investment in the frac water space.

I think there are three things that differentiate ARIS from Select Energy Services. The first is the alliance with Texas Pacific Land. The value of their footprint in the Permian, the area with the most intense activity, can’t be overstated. Rights of way and surface use leases are expensive and difficult to negotiate. ARIS has resolved much of this risk in this alliance, and I think that gives them a “moat,” or a competitive advantage.

The second is their success in recycling centers with Chevron and ConocoPhillips. These are the wave of the future in frac and produced water management. That is beyond dispute. The recycling centers provide volumes and the revenues that go with them and create a very “sticky” arrangement with clients.

Finally, we have the midstream gathering infrastructure that contributes revenue and gives easy assurance of product transport with low ESG impact. This is a definite advantage that sets ARIS apart from competitors.

As often happens in these comparisons, there are no bad choices. Either company will do well in the coming years as the focus on water management intensifies. In this comparison, we think ARIS is the best choice for growth and a modest income. The company declared a $0.09 quarterly dividend for the second quarter. This is a sign of confidence by management in the growth potential of the business. Investors with a moderate risk profile should carefully consider if ARIS rates a place in their portfolio.

By David Messler for Oilprice.com

More Top Reads From Oilprice.com: