Which EV Charging Stocks Are the Best Bets? One Analyst Suggests 2 Names to Consider

The Biden administration is pushing hard to promote electric vehicles (EVs). From a $7.5 billion provision in the ‘Build Back Better’ bill to political pressure on automakers to commit to increased production with the goal of converting 40% of car sales to EVs by the end of this decade, it’s clear that under Biden, the government has the will to enforce a major shift in the automotive industry.

The Biden administration has also prioritized the production of EV battery systems, to the tune of $3.1 billion in Federal funding for battery manufacturers. With that support in place, investors may be able to find plenty of opportunity in EV charging stocks.

Against this backdrop, one analyst, Christopher Souther of B. Riley Securities, has picked out 2 stocks in the charging segment with potential for solid gains going forward – gains on the order of 50% or better. We ran the two through TipRanks database to see what other Wall Street’s analysts have to say about them.

Tritium DCFC Limited (DCFC)

Tritium is an Australian firm that’s been in the electric charger business since 2001. The company focuses on DC (direct current) fast chargers, manufacturing both the software and hardware for these advanced EV charging systems. The company has over 6,700 chargers in operation in more than 41 countries. Tritium’s fast chargers are designed to fill a major need in the EV segment by reducing recharge times; the DC fast charger tech can bring most consumer EVs to an 80% charge status in less than 45 minutes.

Tritium has recently announced moves to expand its product footprint. In April of this year, the company entered a multi-year contract with the energy sector giant BP, to provide chargers and support services for BP’s EV charging network. The initial order under this contract includes just under 1,000 charging stations in the UK, Australian, and New Zealand markets.

In May of this year, Tritium followed that up with an announcement that it had contracted to provide 250 chargers to the UK’s Osprey network, a fast-growing player in the British rapid EV chargepoint sector. Tritium’s contribution is expected to increase the Osprey network by more than 50%.

These moves bode well for Tritium, which entered the public markets through a SPAC merger in January of this year. Since going public, however, the stock is down by 42%.

In Souther’s comments on Tritium, he writes of his belief that this company has a leg up in the DC fast charge market segment, given its status as a pure-play actor in the field.

“We believe that Tritium is well positioned with key customers across public network operators, fleets, utilities, and heavy-duty/industrial vehicles, providing strong visibility on revenue growth. New customer wins have been driven by Tritium’s differentiated factors, including its products’ lower cost of ownership, its liquid-cooled technology, and its new modular scalable charging (MSC) platform,” Souther opined.

“As Tritium’s installed fleet grows, we believe revenue from recurring software and service is likely to scale to become meaningfully accretive to margins. We see the company’s hardware sales model as providing better operating leverage than peers with less-focused business models and higher cost structures,” the analyst added.

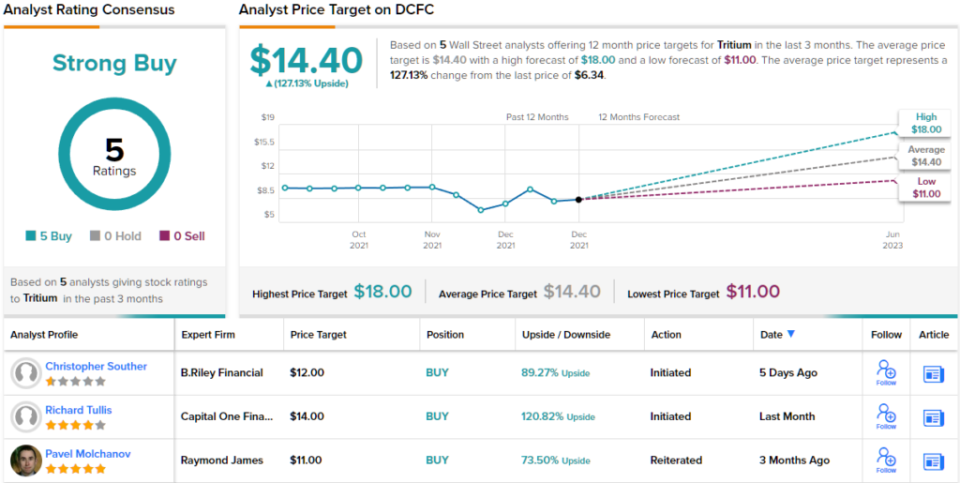

Along with this upbeat outlook, the analyst sets a Buy rating on Tritium shares, and a $12 price target that indicates confidence in an 89% upside for the coming 12 months. (To watch Souther’s track record, click here)

It’s not often that the analysts all agree on a stock, so when it does happen, take note. Tritium’s Strong Buy consensus rating is based on a unanimous 5 Buys. Tritium shares are priced at $6.34 and their average price target of $14.40 implies an upside potential of ~127%. (See Tritium stock forecast on TipRanks)

Beam Global (BEEM)

Beam Global, the second EV charging stock we’re looking at, provides a range of power products for use in a variety of charging and battery storage niches. The company’s most prominent product is the EV ARC, or autonomous renewable charger, a stand-alone EV charger that operates ‘off the grid,’ using built-in solar panels to provide power.

The EV ARC comes with several important selling points. It’s intended for easy deployment, can fit in or around standard parking spaces, and can accommodate most EV models’ charging needs. One EV ARC system can reach 6 vehicles at once, and can provide up to 265 e-miles of power daily. The deployment can be done without construction work, while the ‘off the grid’ feature allows for greater flexibility in siting.

Earlier this month, Beam announced that the second quarter of this year, so far, has seen both increased repeat orders and increased multi-unit orders of the EV ARC system.

These continued gains come after a company-record Q1, in which Beam saw $3.8 million in total revenues. This was up 175% from the year-ago quarter, and was driven by a 250% increase in system delivers over 1Q21. Beam, which typically runs a quarterly net loss, reported cash holdings of $19.2 million at the end of 1Q22.

B. Riley’s Souther describes this company’s uniquely flexible approach to EV charging as the key differentiator here, writing: “While we expect the vast majority of the EV charging infrastructure to be connected to the grid, we also expect Beam to benefit from the faster deployment times of its off-grid solutions as municipalities, fleets, and other players look to scale up more quickly than red tape or grid availability typically allows.”

“Additionally, in areas where resiliency is a key factor, such as on military bases and for local first responders and municipalities for disaster preparedness, we see Beam as having a unique competitive advantage versus grid-connected solutions. The ability to charge via renewable energy sources and provide off-grid alternatives is core to the company’s approach, but the products can also be integrated into the local grid in scenarios where it is beneficial,” Souther continued.

To this end, Souther attached a Buy rating to Beam shares, and his $23 price target implies ~52% upside this year.

This is hardly the only bullish review for Beam, although the company’s 6 recent analyst reviews do have an even split between Buys and Holds – making the consensus rating a Moderate Buy. BEEM shares have an average target of $29.50 and a current trading price of $15.09, suggesting ~95% upside going forward. (See BEAM stock forecast on TipRanks)

To find good ideas for EV stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.