Why stock-market investors are ‘nervous’ that an earnings recession may be looming

Investors are anxious the stock market may be facing an earnings recession, potentially leading to deeper losses after the S&P 500 index just suffered its worst week since March 2020.

“It’s pretty clear that earning estimates are probably going to come down after rising since the first of the year,” said Bob Doll, chief investment officer at Crossmark Global Investments, in a phone interview. “That’s what the market’s nervous about,” he said, with investors questioning how “bad” earnings may become in a weakening economy as the Federal Reserve aims to rein in surging inflation.

The Fed has become more aggressive in its battle to tame inflation after it surged in May to the highest level since 1981, heightening fears that the central bank could cause a recession by destroying demand with interest rate hikes aimed at cooling the economy.

Equity valuations have already come down this year as stocks were too expensive relative to the high rate of inflation and interest rates that are no longer near zero, according to Doll. He said stocks remain under pressure as room for the Fed to engineer a soft landing for the U.S. economy appears to be narrowing, with increased concern over slowing economic growth and the cost of living still stubbornly high.

“People are concerned about the Fed needing to hike so much that it would push the economy into a recession,” said Luke Tilley, chief economist at Wilmington Trust, in a phone interview. “They’re not trying to cause a recession,” he said, but they would induce one if needed to keep long-term inflation expectations from becoming “unanchored” and “getting out of hand.”

Whatever the probabilities of “a soft landing” were before the consumer-price-index report on June 10 revealed higher-than-expected inflation in May, “they’re smaller now,” said Doll. That’s because the report moved the Fed, which is behind the curve, to become more aggressive in tightening its monetary policy, he said.

The Fed announced June 15 that it was raising its benchmark interest rate by three-quarters of a percentage point — the largest increase since 1994 — to a targeted range of 1.5% to 1.75% to combat the unexpected surge in the cost of living.

That’s far below the 8.6% rate of inflation seen in the 12 months through May, as measured by the consumer-price index, with last month’s increase in the cost of living driven by a rise in energy and food prices and higher rent.

In recent quarters, companies in the U.S. have successfully raised prices to keep up with their own cost pressures, such as labor, materials and transportation, said Doll. But at some point the consumer takes a pass, saying, “‘I’m not paying that anymore for that thing.’”

U.S. retail sales slipped in May for the first time in five months, according to a report from the U.S. Department of Commerce on June 15. That’s the same day the Fed announced its rate hike, with Fed Chair Jerome Powell subsequently holding a press conference on the central bank’s policy decision.

“Markets should be bracing for both weaker growth and higher inflation than the Fed is willing to acknowledge,” economists at Bank of America said in a BofA Global Research report dated June 16. “Chair Powell described the economy as still ‘strong.’ That is certainly true for the labor market, but we are tracking very weak GDP growth.”

The BofA economists said that they’re now expecting “only a 1.5% bounce back” in gross domestic product in the second quarter, after a 1.4% drop in GDP in the first three months of the year. “The weakness isn’t broad enough or durable enough to call a recession, but it is concerning,” they wrote.

Stocks, CEO confidence sink

The U.S. stock market has sunk this year, with the S&P 500 index SPX,

The Dow ended Friday bruised by its biggest weekly percentage drop since October 2020, according to Dow Jones Market Data. The S&P 500 had its worst week since March 2020, when stocks were reeling during the COVID-19 crisis.

Selling pressure in the market has been “so extraordinarily strong” that the possibility of a sharp reversal is “ever present,” if only as “a counter-trend rally,” said James Solloway, chief market strategist at SEI Investments Co., in a phone interview.

Meanwhile, confidence among chief executive officers has declined.

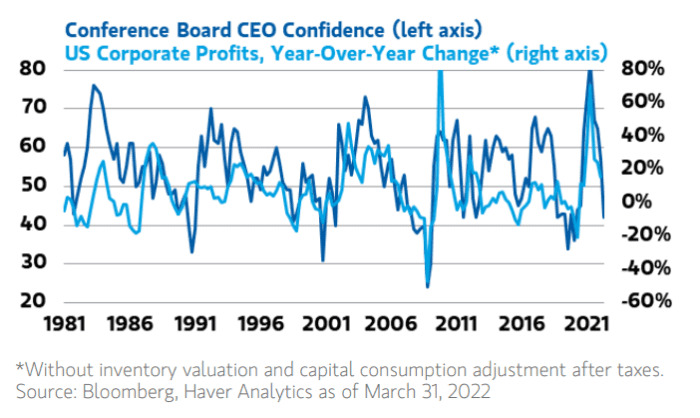

“The Conference Board Measure of CEO Confidence has recently suffered one of the steepest sequential drops in decades,” said Lisa Shalett, chief investment officer of Morgan Stanley’s wealth-management business, in a June 13 note. It collapsed toward 40, “a reading which historically has coincided with profits recessions, or negative year-over-year change in earnings.”

The drop in confidence is “at odds” with the current trend in bottom-up analyst profit estimates, which have moved higher since January to imply 13.5% year-over-year growth in 2022, Shalett said in the note. It seems unlikely that companies will sustain “record-high operating profit margins” given slowing GDP growth, she said.

A new survey released Friday by the Conference Board found that more than 60% of CEOs globally expect a recession in their region before the end of 2023, with 15% of chief executives saying their region is already in recession.

According to Yardeni Research, the probability of a U.S. recession is “high,” at 45%.

“While industry analysts are trimming their profit margin estimates for 2022 and 2023, the forward profit margin rose to a record high last week,” Yardeni Research wrote in a note dated June 16. “A few sectors are starting to get pulled down by gravity: namely, communication services, consumer discretionary, and consumer staples, while the others are still flying high.”

Crossmark’s Doll said an economic recession could drag the S&P 500 below 3,600, and that the stock market faces elevated volatility as it lacks visibility to the end of the Fed’s hiking cycle. The probability of a recession went up “a fair amount” after the inflation reading for May, he said.

Next week investors will see fresh U.S. economic data on home sales and jobless claims, as well as readings on U.S. manufacturing and services activity.

“The window for a soft landing is indeed narrowing,” Solloway said. “The question is how long it will take for a recession to materialize,” he said, saying his expectation is that “it’s going to take a while,” maybe at least a year to 18 months.