5-Star Analyst Pounds the Table on Amazon Stock

Amazon (AMZN) has had a hard time sustaining the massive growth seen during the pandemic. At the same time, its profitability profile has suffered given the heavy investment made in growing the workforce and expanding its logistics and fulfillment abilities. As a result, the share price has taken a beating too – down 34% year-to-date.

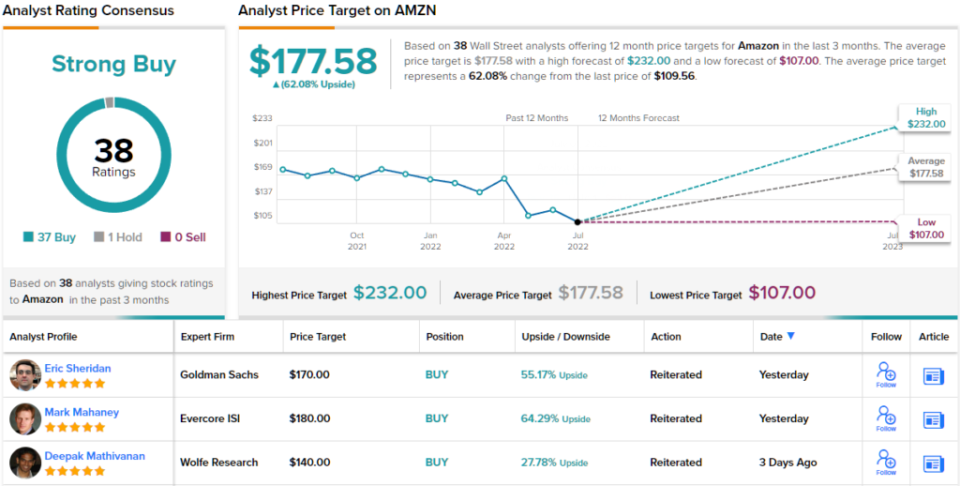

However, these issues are of little concern to Tigress analyst Ivan Feinseth. In fact, the 5-star analyst is currently the Street’s most prominent Amazon bull. He rates the stock a Buy along with a Street-high $232 price target, suggesting shares have room for 112% growth in the year ahead. (To watch Feinseth’s track record, click here)

So, what is driving the bullish sentiment? Lots, as it happens.

For one, there’s the “incredible value proposition of Amazon Prime.” This includes the “ultrafast” delivery and growing video content, which keeps on driving membership additions while Prime members “continue to represent an accelerating growth segment of AMZN’s customer base.”

Secondly, Amazon’s cloud dominance is driven by the continued success of AWS, with an ever-expanding services portfolio. In the latest quarterly report – for 1Q22 – net sales rose by 7% to a record $116.4 billion, with AWS heavily contributing to that growth by increasing 37% year-over-year, an acceleration on the past two years’ annualized growth rate of 34%.

Additionally, over the last two years, the consumer business has grown meaningfully and has required the doubling in size of the fulfillment network. Eventually, says Feinseth, the company will be able to “fulfill the ongoing growth and demand driven by its increasing market share penetration and ongoing customer growth.”

There’s more. Amazon continues to be a one-stop shop for practically all customer needs thanks to its growing momentum among small and medium-sized third-party sellers, while third-party sellers gain from the constantly expanding logistics and fulfillment capabilities.

Lastly, there’s Alexa, which driven by substantial in-house and third-party development keeps adding abilities and skill sets, and this in turn drives the smart home portfolio’s expansion with continued integration into additional applications.

Feinseth might be Wall Street’s biggest Amazon fan but it’s not as if the stock is lacking additional support. Amazon’s Strong Buy consensus rating is based on 37 Buys and just 1 Hold. The average price target is more conservative than Feinseth’s, and at $177.58, implies upside potential of 62%. (See Amazon stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.