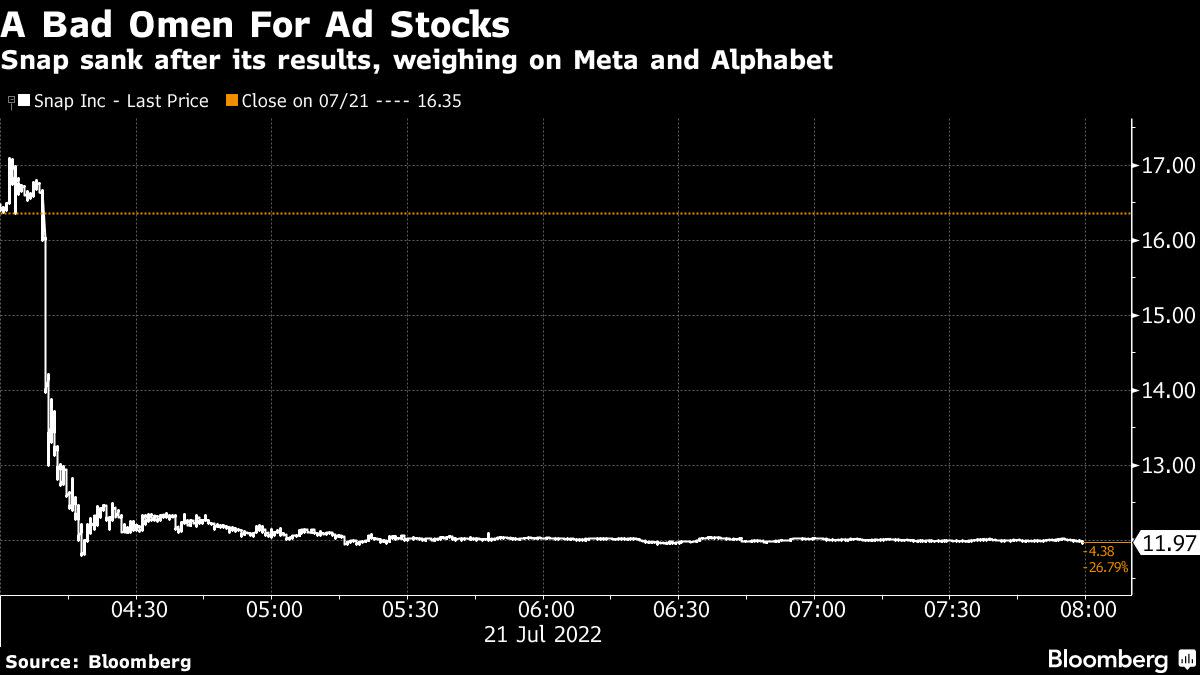

‘Awful’ Snap Sales Wipe $47 Billion From Social Media Stocks

(Bloomberg) — US social-media giants shed nearly $47 billion in market value in extended trading Thursday, as disappointing revenue from Snap Inc. raised concerns about the outlook for online advertising.

Most Read from Bloomberg

The Snapchat parent plummeted 27% in the after-hours session. Facebook parent Meta Platforms Inc. and Pinterest Inc dropped more than 4% each, while Google owner Alphabet Inc. and Twitter Inc. also slipped.

The losses mark the second major sector selloff sparked by Snap in two months, as its results become a barometer for investors trying to decipher how economic uncertainty has impacted ad spending. There are growing signs that tech companies are preparing for a recession with some pulling back on hiring, while Meta has lost about half of its value this year after disappointing revenue forecasts.

“The earnings optimism may come to a pause for now,” said Tina Teng, a markets analyst at CMC Markets Plc. in Auckland. “Snap’s miss on earnings expectations indicates the severe challenges facing its tech peers, typically on social platforms such as Meta Platforms.”

Snap — which saw $6 billion in market cap erased after hours on Thursday — didn’t issue financial guidance for the third quarter, except to say that revenue so far in the period is about flat compared with last year. Management also reiterated it plans a “substantially reduced rate of hiring,” echoing plans by Apple Inc. and others.

Vital Knowledge called the results from Snap and hard-disk-drive maker Seagate Technology Holdings Plc “awful” and “ugly.” Already battered tech stocks may face more pressure as earnings season ramps up next week.

READ: Snap Growth Muted Through 2023 on Uncertainty: Bloomberg Intelligance

“With more and more mega-cap tech companies planning to slow hiring and downgrade their growth expectations, the economic outlook is certainly not in good shape,” CMC’s Teng said.

(Adds context and analyst comments)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.