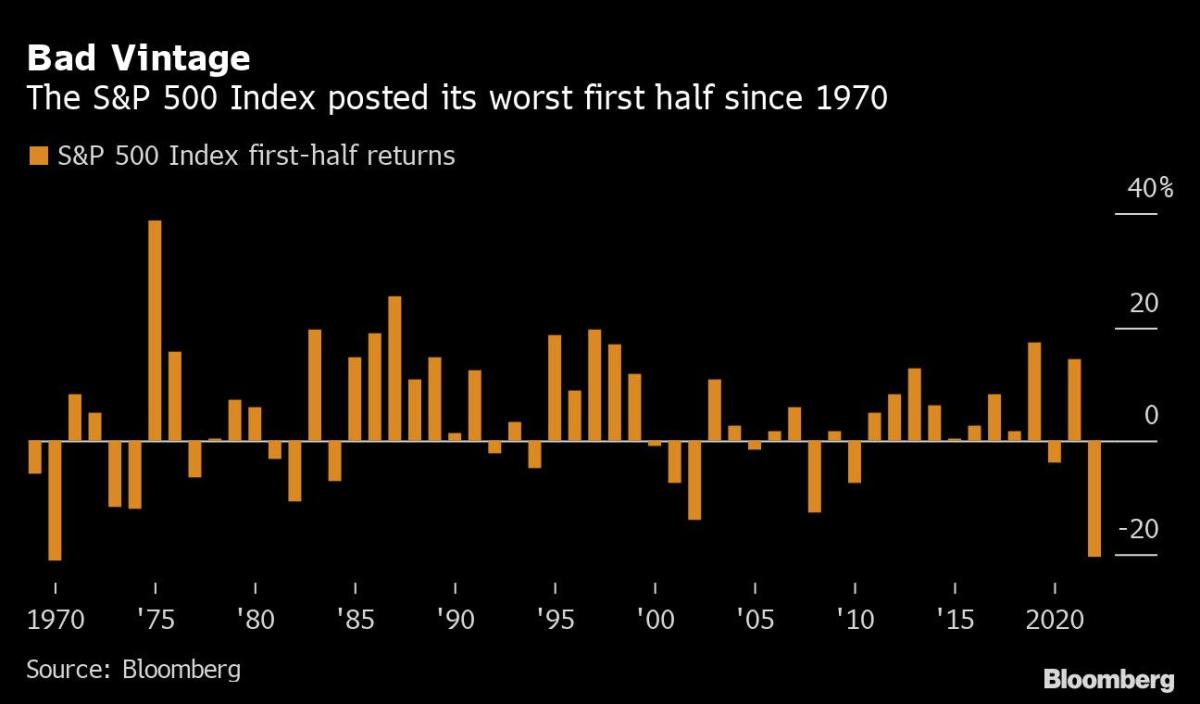

BofA Says Brace for Recession Shock After Worst Rout in 52 Years

(Bloomberg) — A “recession shock” begins for markets following the worst first-half for the S&P 500 in more than 50 years, Bank of America Corp.’s Chief Investment Strategist Michael Hartnett says.

Most Read from Bloomberg

While expectations of aggressive rate hikes by the Federal Reserve are peaking, inflation expectations are not, and Bofa’s bull and bear indicator remains at “maximum bearish” for a third week in a row, Hartnett wrote in a note.

Both stocks and bonds were rocked by outflows this week as investors fear the global economy could contract amid runaway inflation and hawkish central banks. About $5.8 billion exited global stock funds in the week through June 29, although US equities saw small inflows of about $0.5 billion, BofA said, citing EPFR Global data. Bonds had redemptions of $17 billion, the data show.

Markets have been roiled this year as investors dumped risk assets on worries of a looming recession while inflation remains sticky even as central banks kick off aggressive rate hikes. Stocks and bonds around the world combined have fallen by the most on record, according to Bloomberg data going back to 1990, with more than $8 trillion wiped off the S&P 500 Index alone in its worst first-half performance in over half a century.

Other seemingly bullish strategists broadly expect stocks to at least partially recover in the second half, according to Bloomberg surveys. But the likes of Michael Wilson at Morgan Stanley have warned of more declines until the market finds a bottom. Goldman Sachs Group Inc. strategists said on Friday that the risk of a renewed selloff in equity markets is still high as investors are only pricing a mild recession.

The upcoming earnings season is also going to be crucial for investors to gauge the impact of high prices and weaker consumer sentiment on corporate profits.

(Reworked lead to focus on recession comment, adds Goldman in 5th paragraph.)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.