Here’s the incredibly strong signal for stocks that is coming from the corporate bond market

Is it a false dawn in the stock market or is there something real? The S&P 500 has never lost ground over the following year when advancing volume was at least 85% of volume for two out of three days coming off a 52-week low, according to Jason Goepfert, the founder of Sundial Capital Research. That has happened 13 times.

Here’s another: The S&P 500 SPX,

But our call of the day studies the link between the corporate bond and stock markets. Spreads in both investment grade and riskier high-yield bonds have narrowed rapidly over the last three weeks.

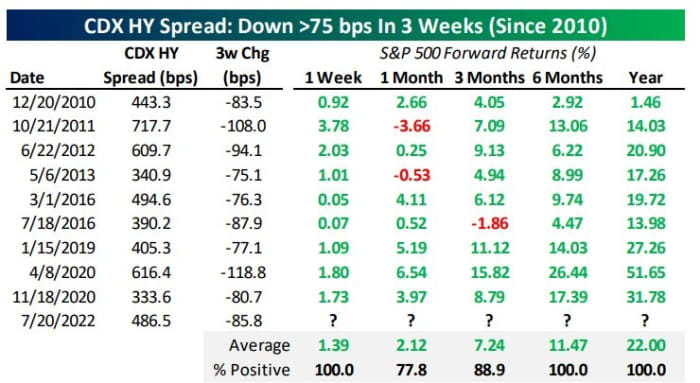

Analysts at Bespoke Investment Group studied the history of such spread compression, though it isn’t a long series since the popular credit-default swap indexes were only invented this century.

The signal is incredibly strong on the junk-bond side. In the nine previous times when the CDX HY spreads fell at least 75 basis points in three weeks, the S&P 500 rose over the next week, six months, and year, with 22% average returns over the next year. “It’s awfully hard to come up with a market signal that looks much better than that long-term,” said the Bespoke analysts.

On investment-grade bonds, it is less strong but still positive. When the CDX IG spread has fallen at least 15 basis points over three weeks, and that has happened 14 times since 2005, the S&P 500 rose in a year’s time in 12 of those occasions, with an average gain of 13%.

A word of warning, however. At current pricing, junk bonds JNK,

The buzz

Tesla TSLA,

Aluminum producer Alcoa AA,

Amazon AMZN,

The European Central Bank made its first rate hike in a decade with a half-point increase, somewhat surprising the market, as it also approved what it’s calling the Transmission Protection Instrument, to limit bond yields spreads in the eurozone.

U.S. jobless claims rose 7,000 to 251,000, as the Philadelphia Fed manufacturing index moved deeper into negative territory with a -12.3 reading.

Italy’s Prime Minister Mario Draghi resigned, throwing the eurozone’s third-largest economy into political turmoil and sending Italian bond yields higher.

Russia’s Gazprom resumed sending gas to Germany through the Nord Stream 1 pipeline at the same 40% rate it did before the planned maintenance period. Russia also said it is planning annexation votes in Ukraine regions by Sept. 15. Ukraine devalued its currency, the hryvnia, by 25% against the U.S. dollar.

The market

U.S. stock futures ES00,

Top tickers

Here were the most active stock-market tickers as of 6 a.m. Eastern.

| Ticker | Security name |

| TSLA, |

Tesla |

| GME, |

GameStop |

| AMC, |

AMC Entertainment |

| XELA, |

Exela Technologies |

| FAZE, |

FaZe Holdings |

| NIO, |

NIO |

| AAPL, |

Apple |

| AMZN, |

Amazon.com |

| NVDA, |

Nvidia |

| NFLX, |

Netflix |

Random reads

General Motors GM,

A possible Fabergé egg was recovered on a seized Russian oligarch’s yacht.

This bride had to hitchhike to her own wedding.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.