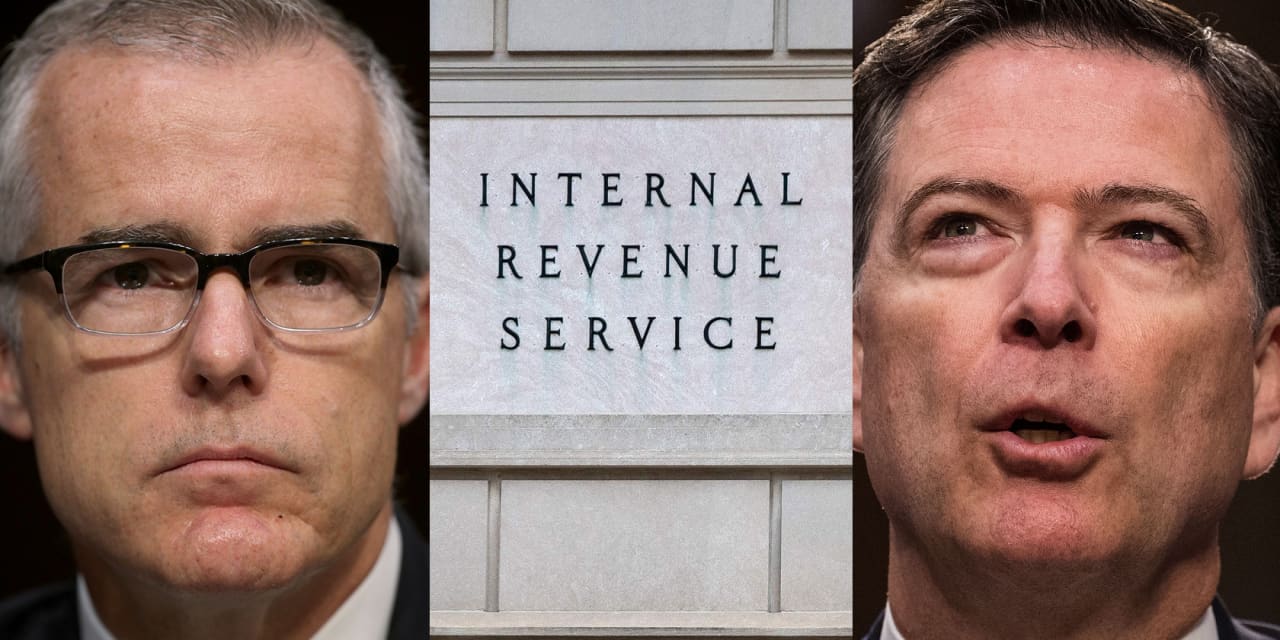

‘It just defies logic:’ The IRS audited both ex-FBI director James Comey and former deputy Andrew McCabe. What are the odds?

In recent years, the Internal Revenue Service has been processing around 150 million to over 160 million tax returns annually, doing the work with a shrinking staff and an inflation-adjusted budget that’s shrinking too.

Speaking of shrinking, that’s also what’s been happening to IRS audit rates. By one count, audit rates on all returns dropped from 0.9% in tax year 2010 to 0.25% during tax year 2019.

So what are the chances that in the vast pool of potential taxpayers up for audits, two of them are high profile ex-government officials who left on sour terms with the former administration?

“‘It just defies logic to think that there wasn’t some other factor involved here. I think that’s a reasonable question. I think it should be investigated.’”

That’s Andrew McCabe, the former FBI deputy director, speaking Wednesday night on CNN after the New York Times broke the story that both McCabe and James Comey, the former FBI director, had both been audited by the IRS.

Now the IRS is asking a Treasury Department watchdog agency to look into the audits and the selection circumstances behind them.

President Donald Trump fired Comey in May 2017. Comey’s audit pertained to his 2017 return and Comey learned of it in 2019, according to the New York Times. It resulted in a $347 refund, according to the article.

McCabe said the IRS notified him of an audit in October 2021 for his 2019 tax year information and returns. So the audit notice came with Democrat Joe Biden in the White House, but it covered a tax period during the Trump administration. “I ended up having to pay a small amount for an oversight. An unintentional oversight,” McCabe said in his CNN interview.

Jeff Sessions, the onetime U.S. Attorney General, fired McCabe in March 2018 alleging McCabe leaked to the media and “lacked candor” in a following probe. McCabe last year won back his full pension in a legal settlement and has said the firing was politically motivated.

An IRS spokesperson said the agency could not discuss specific taxpayers because of privacy laws, but lashed out at any insinuation the agency had specially trained its audit sights on anyone.

“Audits are handled by career civil servants, and the IRS has strong safeguards in place to protect the exam process — and against politically motivated audits. It’s ludicrous and untrue to suggest that senior IRS officials somehow targeted specific individuals for National Research Program audits,” an IRS spokesperson said in a statement to MarketWatch.

It’s worth noting that “National Research Program” audits are the agency’s random audit program. The audits in that category are geared to help officials understand and sniff out potential patterns and the prevalence of under-payment or non-payment of taxes, explained a 2021 study with authors including IRS staff.

Audits can happen for various reasons, Jackson Hewitt, the national tax preparation chain, noted last year. When it comes to the National Research Program, “Seemingly benign tax returns have been randomly selected but have gone through months of IRS audit work — all in an effort for the IRS to gather information so that they can do a better job in selecting others for an audit. The complaint — that is a lot of taxpayer burden for IRS learnings.”

Rep. Richard Neal, a Democrat from Massachusetts who heads the House of Representatives’ Ways and Means Committee, called the two audits “an unlikely coincidence” that “reeks of political targeting.”

He sent a letter Thursday to Inspector General J. Russell George, head of the Treasury Inspector General for Tax Administration, asking for answers on questions including whether the picks were “truly random,” who knew of the picks, and who could remove audit candidates from the list.

“It’s something worth looking into,” said Garrett Watson, senior policy analyst at the Tax Foundation, a right-leaning think tank. At the same time, he added, “it’s definitely worth being cautious about drawing conclusions one way or another.”

Whatever happens next, the story could spark more discussion about how IRS staffers select households for audits, whether via the agency’s random selection program or otherwise. And the story is hitting at a rough time for the agency as it seeks more budget money on a multi-year basis, Watson noted.

For starters, the IRS has been the target of other complaints when it comes audits.

One big criticism is that the agency goes too easy on rich taxpayers and too hard in poor ones. Audit rates have been falling across all income groups in recent years, but the sharpest rates of decrease from tax year 2010 to tax year 2019 came for taxpayers the top of the income ladder, according to a May report from the federal Government Accountability Office.

“Although audit rates decreased more for higher-income taxpayers, IRS generally audited them at higher rates compared to lower-income taxpayers,” the GAO report noted.

As with the Comey-McCabe matter, the IRS bristles at the idea it’s giving wealthy taxpayers a pass. In May, the IRS’ annual data book showed a fiscal year 2021 bounce back in the number of audited returns, though still off from 2017 levels.

Supplemental audit data shows climbing rates for richer taxpayers, the IRS emphasized.

The IRS is led by Commissioner Charles Rettig, a tax lawyer appointed in 2018 during the Trump administration who has continued to serve during the Biden administration. Rettig’s term is scheduled to end in November.

The IRS has had a heavy workload during the pandemic, sending out cash relief to Americans through three rounds of stimulus checks and six monthly installments of child tax credit advances.

At the same time, it’s still slogging through a backlog of returns and hasn’t publicly explained how mounds of tax information from elite captains of industry ended in the hands of reporters at ProPublica, an investigative news outlet.

Worries about politics mixing with tax enforcement have happened before. The IRS during the Obama administration applied extra scrutiny to conservative tea party groups seeking tax-exempt status. The agency apologized, but said there was no political rationale. The saga ended with legal settlements, reached during the Trump administration, for sums between $1 million and $10 million.

On Thursday, the IRS said “whenever allegations of wrongdoing are raised on a tax matter, we routinely reach out to the Treasury Inspector General for Tax Administration for further review.”

The agency has referred the Comey-McCabe matter to the Treasury Inspector General for Tax Administration for review, a spokesperson told MarketWatch. “IRS Commissioner Rettig personally reached out to TIGTA after receiving a press inquiry,” the agency said in a statement.

The Treasury Inspector General for Tax Administration did not immediately respond to a request for comment.