Kremlin slashes spending by £24bn as West’s sanctions batter Russia – live updates

The Kremlin is poised to cut future spending plans by £24bn as Western sanctions against Russia bite.

Defence, technology and transport budgets are all set to be trimmed, according to Russian media.

More than 1.6 trillion roubles, or £24bn, has been slashed from the Russian state budget over the next three years as Moscow braces for a two-year recession.

Spending will be 557bn roubles (£8.2bn) lower in 2023 than previously approved plans, with similar cuts pencilled in for the following two years.

The budget tweaks are minor compared to the size of Moscow’s overall budget but the figures are one of the first signs of the fiscal blow being dealt by the conflict in Ukraine. The 2023 cuts are equivalent to just over 2pc of the Russian state budget.

While the Kremlin’s coffers are being boosted by rocketing energy prices, spending on its military has soared and non-energy tax receipts are being hit by the shrinking of its economy.

The plans will help balance the budget but will mean lower spending on state programmes funding transport, science and technology development, and defence, despite the conflict in Ukraine.

06:05 PM

Johnson calls on Saudi Arabia to increase oil production

Boris Johnson has urged Saudi Arabia to ramp up oil production in a bid to cool record fuel prices.

“There may be some question about quite how much more the Saudis could pump out at this particular moment,” Mr Johnson told the House of Commons on Monday. Nonetheless, “they need to produce more oil — no question.”

05:12 PM

Germany needs to act to tackle historic inflation, says Scholz

Olaf Scholz has said Germany needs to act quickly to tackle an “historic” surge in the cost of living, comparing the situation to the inflation crisis of the 1960s and 70s.

Bloomberg has the details:

The German leader convened representatives from employers, unions and the Bundesbank to come up with measures to ease the pain for consumers. The goal of the rare joint effort is to develop inflation-fighting policies in the coming weeks, he said on Monday after the first meeting.

“The current crisis won’t be over in the next few weeks.” Scholz said outside the chancellery in Berlin. “We must be prepared that this situation won’t change for the foreseeable future. To put it differently, we are facing a historic challenge.”

The German government is showing greater urgency to address a surge in prices that risks intensifying as gas costs soar after Russia slashed supplies. In an interview with ARD television on Sunday, Scholz said that rising costs of living could have “explosive” effects on German society by driving deeper divisions between rich and poor.

“For me it’s important to send the message: We’re standing united,” he said on Monday. “We want that all citizens get through these times well.”

04:08 PM

Handing over

That’s all from me for today – thanks for following! Simon Foy is in the hot seat for the rest of the day.

03:47 PM

Russian oil shipments to Asia falter

Russia’s seaborne crude exports rebounded in the last week of June from the previous week’s plunge, but shipments to Asia are slipping.

Aggregate crude flows from Russian ports were up by almost a quarter, recovering most of the volume lost over the previous seven days during a brief halt in shipments from the Baltic port of Primorsk.

Still, cargoes bound for Asia — a crucial market now western buyers have shunned Russian oil — were down by more than 15pc on both a weekly and four-week average basis from the highs seen at the end of May.

Overall, Russia’s seaborne shipments returned to 3.67m barrels a day, broadly in line with the level achieved since the start of April.

G7 leaders are exploring the idea of a price cap on Russia oil that would reduce the flow of funds to the Kremlin. However, questions remain over how such a cap could be imposed and how President Vladimir Putin might react.

03:33 PM

Gen Z ‘sheltered’ from cost-of-living crunch

Generation Z has been “sheltered” from the worst of the cost-of-living crunch as more young adults are avoiding spiralling household bills by living with their parents, research has found.

Here’s more from Hannah Boland:

According to a survey by PwC, adults between 18 and 24 were the only age group to feel positive about their finances, with consumer confidence the lowest among those aged 55 and over.

PwC said many younger people were likely to be “sheltered from heightened costs by living with parents or not being responsible for increasing bills”.

It added: “However, they are also most likely to benefit from recently entering the workforce and raising their income.”

Official government figures published in March suggested around 63pc of 18-24 year olds still lived with their parents last year, up slightly from 2020 when the figure was 61pc.

Experts have suggested this could increase further amid soaring house prices and rental payments. Jonathan Cribb, of the Institute Of Fiscal Studies, said earlier this year that it expected to see a rise in people moving back in with their parents because of a jump in gas and electricity prices.

03:13 PM

UK to roll out new sanctions on Belarus

The Government has said it’s introducing new economic, trade and transport sanctions on Belarus over the country’s support for Russia’s war in Ukraine.

The new package will include import and export bans on goods worth around £60m, including on exports of oil refining goods, advanced technology components and luxury goods, and imports of Belarusian iron and steel.

The UK will also ban more Belarusian companies from issuing debt and securities in London.

02:55 PM

New law would allow Nadine Dorries to censor internet, MPs warn

Nadine Dorries will be able to censor the internet unless new powers intended to make tech giants more accountable are reformed, MPs have warned.

Ben Woods has more:

The Online Safety Bill must be overhauled so that the Culture Secretary and her successors cannot order the industry regulator Ofcom to take down content before an assessment by Parliament, the MPs said.

In its current form the bill would allow Ms Dorries to directly intervene in Ofcom’s decisions over what to block or permit online.

Julian Knight, the chairman of the Digital, Culture Media & Sport select committee, said: “A free media depends on ensuring the regulator is free from the threat of day-to-day interference from the executive.

“The government will still have an important role in setting the direction of travel, but Ofcom must not be constantly peering over its shoulder answering to the whims of a backseat-driving secretary of state.”

The recommendations come as Ofcom is poised to inherit new powers to grapple with tech companies and social media apps by putting senior managers in jail or dishing out multi-billion pound fines worth up to 10pc of annual turnover if illegal or harmful content to children is found on their websites.

However, the bill has faced fierce scrutiny from news publishers over fears it could muzzle free speech without stronger exemptions for journalism.

02:39 PM

Coinbase-backed crypto lender Vauld freezes withdrawals

Vauld, a crypto lender backed by Coinbase, has frozen withdrawals and hired advisers for a potential restructuring as the cryto market crisis intensifies.

Darshan Bathija, chief executive of Vauld, said customers had withdrawn around $200m (£165m) over the last three weeks as market conditions deteriorated.

The Singapore-based company has suspended all withdrawals, trading and deposits on the platform. It’s also hired Kroll as financial adviser, as well as two law firms.

The move comes less than three weeks after Vauld said it was processing withdrawals “as usual and this will continue to be the case in the future”.

The about-face hints at the speed with which plunging prices are rippling through the sector, bringing firms ranging from Celsius to hedge fund Three Arrows Capital to their knees.

Read more on this story: Crypto hedge fund collapses after defaulting on $674m loan

02:24 PM

AO World insists finances are strong after shares crash to two year low

AO World has been forced to reassure investors after concerns about its finances sent shares crashing to a two-year low, writes Laura Onita.

AO World said it had access to a £80m credit facility and was working on “actions to strengthen its balance sheet”. The company said it was trading in line and focused on “profit and cash generation.”

The reassurances came after AO World’s share price fell by more than 18pc at one point today. The slump was triggered by a credit insurer cutting cover for the company’s suppliers.

Numis and Jefferies said Atradius, the credit insurance provider, pulled cover at the start of May. The Sunday Times first reported the move.

Credit insurance typically protects companies against the risk of customers going bust between the delivery of an order and payment being made.

A lack of cover could put pressure on AO’s cash position if suppliers ask for earlier payment or collateral when delivering orders.

02:11 PM

£15bn sale of UK Power Networks collapses in row over price

The £15bn takeover of Britain’s biggest electricity distributor has collapsed after its Hong Kong owner raised the price at the last minute.

CK Infrastructure Holdings, owned by billionaire tycoon Li Ka-shing, was due to sell UK Power Networks to a consortium led by private equity firms KKR and Macquarie.

But the owner tried to increase the sale price just two days before an agreement was due to be signed last month, prompting the buyers to pull out of the deal, the Financial Times reports.

CK’s attempt to hike the price is said to have come in response to inflation, while currency movements were also a factor.

01:54 PM

Church of England to sell bonds for first time

The Church of England’s main foundation is raising money in the debt market for the first time.

While it’s high unusual for a religious organisation to sell bonds, the CoE has a track track record of active investment – especially in socially responsible causes.

The Church Commissioners for England, which manages a £10bn investment portfolio on behalf of the church, will sell the pound-denominated bond.

Proceeds will be used for general purposes, as well as environmental and social projects, Bloomberg reports.

01:40 PM

Milk does not make cereal healthier, High Court rules

Putting milk on your cereal does not make it healthier, judges have ruled after Kellogg’s took the Government to court over its plans to tackle obesity.

Laura Onita has the details:

The maker of Crunchy Nut corn flakes argued that the sugar content of its cereals should be measured after milk is added and brought a High Court case in April.

A High Court judge has now ruled against Kellogg’s claims that the regulations were unlawful and that they failed to take into account the nutritional value of the milk added to the product.

The ruling means some cereals may no longer be prominently displayed on supermarket shelves if they have a high sugar content.

Chris Silcock, the UK managing director, said the cereal firm was “disappointed” with the decision, but it would not appeal.

A ban on ‘buy-one-get-one-free’ or three-for-two offers on unhealthy food and drinks will be introduced in October 2023.

12:57 PM

German bankers fear defaults as Russia cuts gas supplies

German bankers are getting increasingly worried that lenders will have to put aside extra funds to cover a potential surge in defaults if Putin cut off gas supplies to the country.

Lutz Diederichs, head of BNP Paribas in Germany, warned the scenario would spark a recession in Europe’s largest economy and require lenders to back up corporate loans with more capital.

That echoes comments made by Bettina Orlopp, chief financial officer at Commerzbank, over the weekend.

Banks are said to be particularly worried about planned maintenance work on the Nord Stream pipeline between Germany and Russia, as there’s a risk supplies won’t resume as before once the work is completely.

German banks’ provisions for the fallout from the war have so far been lower than the reserves built up during the pandemic.

However, the country’s heavy reliance on Russian gas means a complete supply cut-off would deal a huge blow to the economy.

12:39 PM

SAS warns future at risk as pilots go on strike

EasyJet isn’t along in facing chaos this summer – Scandinavian rival SAS has just announced it’s facing a crippling strike after it failed to reach a deal with pilots.

SAS said the planned walkout was “devastating for SAS and puts the company’s future together with the jobs of thousands of colleagues at stake”.

Unions representing about 1,000 SAS pilots warned last month they would walk out at one of the airline’s busiest times of year after failing to reach a new collective labour agreement in the spring.

The airline, whose debt has mounted during the pandemic, is also working to secure backing for a $3bn (£2.5bn) financial lifeline that involves finding new equity investors and converting existing debt into shares.

SAS said the possibility of rebooking customers affected by cancelled flights would be “highly limited” and that it was instead planning to offer refunds or tickets for a later date.

12:16 PM

EasyJet focused on ‘reliable’ summer schedule

Here’s the full quote from Johan Lundgren, chief executive of easyJet, after the departure of the airline’s chief operating officer:

I would like to thank Peter for his hard work and wish him well. Everyone at easyJet remains absolutely focused on delivering a safe and reliable operation this summer.

I am pleased that operations will be in the very capable hands of David Morgan who can move seamlessly into this role having previously led the operation, as interim chief operating officer, throughout 2019.

David has significant experience and deep knowledge of the business and operation and will provide strong leadership for the airline this summer.

11:47 AM

The secret billionaire scrap dealer making a killing on car shortages

The little known family behind the UK’s biggest private scrap merchant is verging on billionaire status as profits and revenues at their business soar, writes Howard Mustoe.

Warrington-based European Metal Recycling is emerging as one of the UK’s largest private companies after posting profits of £250m on sales of £4.7bn last year.

EMR is led by Chris Sheppard, the son of the company’s founder, Phillip, who was dubbed “the god of metal recycling” in the press.

It has recently been capitalising on booming steel prices and reaping profits from its steady expansion in the US over the years, Mr Sheppard said in an interview.

While last year might prove a one-off for high profits, the company’s longer-term track record would probably attract a valuation of at least £1bn, according to an estimate from a City source.

The company is owned by Ausurus Group, which is controlled by the Sheppard family.

11:30 AM

Suez Canal pulls in record $7bn revenue

Egypt’s Suez Canal Authority has unveiled a record revenue for the year after it hiked fees amid global supply chain chaos.

The canal pulled in $7bn (£5.8bn) in revenue in the year to June – over a fifth higher than the previous year’s total and the highest figure ever recorded.

Around 1.3bn tonnes of cargo were shipped through the key route, accounting for roughly 10pc of global maritime trade.

The Suez Canal has increased passage tolls for vessels, including fuel tankers, twice this year.

In April, the waterway recorded its highest-ever monthly revenue of $629m despite the rise in oil prices due to Russia’s invasion of Ukraine.

11:21 AM

ECB to push climate-friendly investments

The European Central Bank has unveiled plans to integrate climate change into its monetary policy in a bid to encourage eurozone businesses to pay more attention to their environmental impact.

The ECB said the measures “aim to better take into account climate-related financial risk” and “support the green transition of the economy in line with the EU’s climate neutrality objectives”.

Under the new plans, the central bank will aim to gradually decarbonise corporate bond holdings from October this year, shifting them towards issuers with better climate performance.

This will be measured through indicators such as lower greenhouse gas emissions, more ambitious carbon reduction targets and better climate-related disclosures.

The ECB’s portfolio of asset purchases worth around €350bn (£300bn) is currently heavily weighted towards big polluters.

The central bank will aim to “tilt these holdings towards issuers with better climate performance” as it reinvests around €30bn euros a year.

11:09 AM

Pound inches higher ahead of BoE speeches

Sterling has edged up this morning, pulling away from two-week lows as investors look for more signs from the Bank of England on future interest rate rises.

The pound rose 0.1pc against the dollar to $1.2109. It also strengthened against the euro, rising 0.1pc to 86.08p.

Sterling last week concluded its steepest six-month drop since 2016, down more than 10pc versus the dollar so far this year.

It’s a quiet week for economic data, so traders will be focused on speeches by two MPC members for any hints about the Bank of England’s monetary policy plans.

Chief Economist Huw Pill will speak on Wednesday, while Catherine Mann will speak on Thursday.

10:57 AM

Gas prices jump as supply woes deepen

Natural gas prices in Europe have surged to their highest level in almost four months as strikes in Norway threaten to wreak more havoc amid supply cuts from Russia.

Benchmark European prices jumped as much as 9.8pc this morning. The UK equivalent was up 20pc.

Norway’s oil and gas lobby warned around 13pc of the country’s daily gas exports are at risk from plans to escalate an impending strike by managers.

Three fields are set to be shut by the strike starting tomorrow, while planned action the following day would take out another three projects.

The move will add to fears that Europe may not have enough gas to fill storage sites in time for winter.

Putin has slashed shipments to the continent through the Nord Stream pipeline, while a major fire at a key export facility in the US has also hit deliveries.

10:43 AM

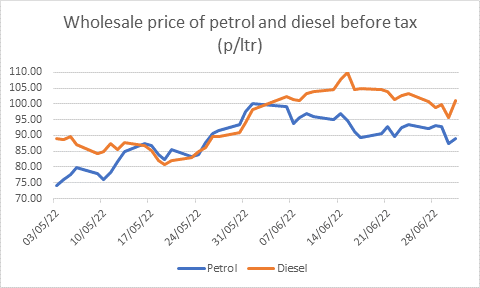

Fuel prices cling to record highs despite lower wholesale costs

Fuel prices across the UK have clung to record highs despite almost a month of falling wholesale costs.

Petrol hit a new all-time high of 191.53p a litre yesterday while diesel stuck close to record levels at 199.03p a litre, having set a new one of 199.07p on Friday, according to the AA.

That’s despite a sustained decline in wholesale petrol costs, which started falling after the Jubilee weekend and have been down at least 5p a litre for more than a fortnight.

They ended last week 10p down on the record highs of early June.

Likewise, diesel costs heading to the pump have been lower over the past fortnight albeit to a lesser extent.

Luke Bosdet, AA fuel spokesman, said:

It is an outrage, plain and simple, that the fuel trade could be slashing petrol prices as the nation heads towards the holiday season, but isn’t.

The retailers came up with an excuse that demand had fallen to 80pc for some. Yet, last week, official statistics showed that petrol consumption is still at 94pc of normal.

That is incredible given the enormous pump-price pressure on drivers and underlines once again that road fuel is an essential expenditure for private car users and their families across the UK.

10:30 AM

City banks defy Brussels to out-earn French rivals

ICYMI – British banks have made more profit than French rivals for the first time since 2015, despite efforts by EU officials to shift more jobs out of London and onto the continent post-Brexit.

Lucy Burton has the story:

UK banks generated $55.1bn (£46bn) in pre-tax profits last year as big lenders benefited from an economic bounce back from Covid, a private equity deal-making boom and a soaring housing market.

British lenders managed to narrowly beat their counterparts in France on profits for the first time since before the EU referendum, according to The Banker’s Top 1000 World Banks ranking. UK banks collectively made more profits than any other European country.

It comes despite efforts by Brussels to push more business out of London post-Brexit. The European Central Bank (ECB) recently ordered eight banks to relocate more traders out of London and into financial hubs within the EU, such as Paris or Frankfurt, amid concerns that companies are out of reach of European regulators.

Britain’s lucrative finance industry has been a key battleground ever since the vote to leave the EU in 2016, with rival European cities fighting to lure bankers away from the City of London.

10:13 AM

Rouble slides to two-week low

The rouble slid to a two-week low against the dollar and euro this morning, extending losses sustained in the previous session as the market awaited more information on possible currency interventions.

Russian stock markets slumped late last week after gas giant Gazprom cancelled dividend payments for the first time in more than two decades.

The rouble, having lost the support of last week’s tax-driven dollar and euro sales, dived sharply away from more than seven-year highs.

The currency was 1.4pc weaker against the dollar at 55.27 this morning after dropping to its weakest point since June 20.

Last week Finance Minister Anton Siluanov said Russia could cut state spending and channel funds to foreign currency interventions to keep a lid on the rouble’s strengthening, which threatens budget revenues.

09:44 AM

ECB to block banks from interest rate windfall

The European Central Bank is exploring ways to prevent banks from earning billions of euros of extra profit once it starts raising interest rates later this month.

The ECB provided $2.2 trillion of subsidised loans to banks to help avert a credit crunch when the pandemic hit. But the planned increase in rates is expected to provide extra earnings worth up to $24bn for eurozone lenders.

The ECB’s governing council will discuss how it can block this windfall that hundreds of banks will be able to earn by simply placing the loans back on deposit at the central bank, the Financial Times reports.

09:32 AM

Pub numbers crash to lowest on record

The number of pubs in England and Wales has crashed to the lowest level ever recorded.

There were just 39,970 pubs in June, a fall of more than 7,000 since 2012, according to real estate consultancy Altus Group.

Thousands of pubs have shuttered over the last decade as they battled with increased competition from supermarkets and higher tax burdens.

In 2019 the sector expanded for the first time in a decade, suggesting pubs could be back on the rise.

But the pandemic put paid to that progress, while Altus warned boozers were now grappling with soaring prices and energy bills.

According to the research, the West Midlands saw the biggest number of pub closures in the first six months of 2022, with 28 shutting.

It was followed by London and the East of England which both lost 24.

09:14 AM

Turkish inflation soars to nearly 80pc

Inflation in Turkey surged to its highest since 1998 last month as President Recep Tayyip Erdogan’s policies worsen the country’s economic crisis.

Annual inflation rose to 78.6pc, with consume prices rising 4.95pc on a monthly basis.

While many countries are suffering from surging inflation, critics say Erdogan’s approach is exacerbating the problem.

The Turkish leader insists that high borrowing costs cause inflation – a position that contradicts established economic thinking – and instead advocates lowering interest rates to boost growth and exports.

Turkey’s central bank had cut rates by 5 percentage points since September to 14pc before pausing the cuts in January. The Turkish lira lost 44pc of its value against the dollar last year.

09:02 AM

Pret a Manger swings back to profit

Pret a Manger returned to profitability in March after suffering another year of hefty losses in 2021 amid lockdowns and Covid restrictions.

The group revealed it remained in the red with operating losses of £225.9m last year.

However, this was an improvement on the £343m loss seen in 2020 at the height of the pandemic, thanks to a 17pc rise in revenues to £461.5m as restrictions lifted and workers returned to offices.

The coffee chain said its recovery has “continued and accelerated” in 2022, with half-year revenues up 230pc to £357.8m, helping it return to profitability in March and becoming cash flow positive since May.

The figures come ahead of the launch of Pret’s new affordable menu range later this week in response to the cost-of-living crisis.

The firm said its recovery came as it boosted its presence outside London – where trade was hit particularly hard by the switch to working from home – with sales growth faster outside the capital.

08:37 AM

FTSE risers and fallers

The FTSE 100 has staged a strong start to the day as markets regained some composure after a torrid first half of the year.

The blue-chip index rose 1pc, boosted by oil stocks as crude prices pushed higher amid supply concerns.

BP and Shell rose 3.6pc and 2.9pc respectively, providing the biggest boost to the index. Harbour Energy was the biggest riser, up over 4pc.

The FTSE 250 inched up 0.1pc. Grafton Group was the biggest laggard, shedding 6.5pc after the building materials supplier announced the departure of its chief executive.

08:33 AM

Germany posts first monthly trade deficit since 1991

Germany has reported its first monthly trade deficit in three decades after exports fell unexpectedly in May.

The shortfall of €1bn (£860m) was the first since 1991, with cross-border sales declining 0.5pc. At the same time, imports rose 2.7pc – much more than anticipated.

The figures highlight the disruption sparked by Russia’s war in Ukraine and China’s continued Covid lockdowns.

Germany’s economy – the largest in Europe – is heavily focused on exports.

08:21 AM

Budget airlines enjoy passenger boost

Ryanair and Wizz Air have both reported a jump in passenger numbers in June as holidaymakers flocked back to travel despite widespread chaos.

Ryanair said the number of passengers it carried tripled to 15.9m compared to last year, while its load factor increased to 95pc.

Meanwhile, Wizz Air carried 4.3m passengers last month – up 180pc year on year.

The numbers come in spite of weeks of travel chaos at airports, with many airlines forced to slash flights due to staff shortages.

08:16 AM

Rush hour chaos as fuel price protests block motorways

Drivers are facing more chaos during this morning’s rush hour as campaigners blocked motorways in a protest over soaring fuel prices.

Protesters created a rolling blockade along the M4, heading towards the Prince of Wales bridge. Similar demonstrations are also expected in Yorkshire and Essex.

Police warned of “serious disruption throughout the day”, with motorists urged to stay at home where possible.

It comes amid growing discontent about the surging cost of petrol and diesel on petrol station forecourts, which has been driven higher by Russia’s war in Ukraine.

But motoring groups have complained that pump prices have remained high even after wholesale costs began to fall back.

Howard Cox, founder of the FairFuelUK Campaign, said:

These are not just demonstrations against the record excruciatingly high petrol and diesel prices that rise each and every day.

They are also about the sickening chronic manipulation of pump prices and the complete lack of scrutiny by our out of touch Government, in allowing unchecked petrol and diesel profiteering to run rife.

A slow-moving rolling roadblock is underway on the M4. A number of vehicles will head east over the Prince of Wales Bridge and expected to exit the M4 at J22 (Pilning). There they plan to re-join westbound towards Wales.

A similar protest from the England side is also expected.

— Avon and Somerset Police (@ASPolice) July 4, 2022

08:02 AM

FTSE 100 opens higher

The FTSE 100 has pushed higher at the open, providing some much-needed relief to stocks after last week’s sell-off.

The blue-chip index rose 0.9pc to 7,231 points.

07:53 AM

Poorest families ‘brutally exposed’ to price rises

Meanwhile, there’s a damning report out this morning from the Resolution Foundation showing that almost two decades of income stagnation has left the poorest British families “brutally exposed” to the current crisis.

The think tank said too many families faced the current crisis already struggling with low incomes, scant savings and ungenerous welfare support.

Adjusted for inflation, the disposable income of a typical household grew just 0.7pc annually in the 15 years before the Covid pandemic, and the poorest fifth of the population were no better off at all.

It blamed an abysmal productivity performance that has depressed pay levels and entrenched decades of inequality.

A typical wage would be £9,200 higher today had pay continued to grow as it did before the 2008-09 financial crisis.

Britain’s recent history of low income growth and high inequality has left many households struggling to cope. Turning this around requires higher pay and productivity, a stronger safety net and building on our strengths – such as boosting employment for lower-income households. pic.twitter.com/riWquQgd2w

— Resolution Foundation (@resfoundation) July 4, 2022

07:48 AM

BCC: Red lights are flashing

Shevaun Haviland, director general of the BCC warns “the red lights on our economic dashboard are starting to flash”.

Nearly every single indicator has seen a deterioration since our last survey in March. Business confidence has taken a significant hit and fears over inflation and cost pressures are at new record highs.

07:45 AM

UK firms to raise prices further

Good morning.

It seems the cost-of-living crisis has much further to run as a record number of UK companies are planning imminent price increases.

Almost two-thirds of firms expect to raise prices over the next three months, according to the British Chambers of Commerce. This rises to 80pc in the retail, construction and manufacturing sectors.

The respondents cited concerns about higher energy prices, wage bills, fuel and raw material costs, while the BCC warned the “red lights were starting to flash” on its economic dashboard.

Meanwhile, a report from the Resolution Foundation found the poorest British families had been left “brutally exposed” to the cost-of-living crunch after almost two decades of income stagnation.

Adjusted for inflation, the disposable income of a typical household grew just 0.7pc annually in the 15 years before the Covid pandemic, while the poorest fifth of the population were no better off at all.

5 things to start your day

1) Boris Johnson urged to back bid for factory at heart of Britain’s food supply: Last-minute appeal for Boris Johnson to smooth path for takeover of fertiliser plant before August shutdown

2) City banks defy Brussels to out-earn French rivals: British banks have made more profit than French rivals for the first time since 2015, despite efforts by EU officials to shift more jobs out of London and onto the continent post-Brexit.

3) Tesla loses $440m as Elon Musk’s Bitcoin bet sours: carmaker’s $1.5bn investment sheds value amid cryptocurrency plunge

4) RAF’s flagship drone squadron has no drones: The RAF’s flagship drone trials squadron owns no drones and has carried out no in-house trials with the uncrewed craft in the two years of its existence.

5) Roger Bootle: Public sector pensioners will be the winners from this inflation disaster

What happened overnight

Asian markets were mixed and oil fell as traders fret over a possible recession caused by central bank interest rate hikes aimed at fighting soaring inflation.

Hong Kong dropped while Shanghai, Seoul, Taipei and Jakarta were also down.

However, Tokyo, Sydney, Singapore, Taipei and Wellington rose.

Coming up today

Corporate: No scheduled updates

Economics: Producer price index (EU)