‘Squeezable’ AMC, GameStop stocks break out to multi-month highs

Shares of both AMC Entertainment Holdings Inc. and GameStop Corp. surged to multi-month highs Wednesday, as they extended breakouts above previous chart resistance levels.

The rallies come after Ihor Dusaniwsky, managing director of predictive analytics at S3 Partners, said in a recent note to clients that the two “meme” stocks made his list of the 25 most “squeezable” U.S. stocks, or those that are most susceptible to a short-covering rally.

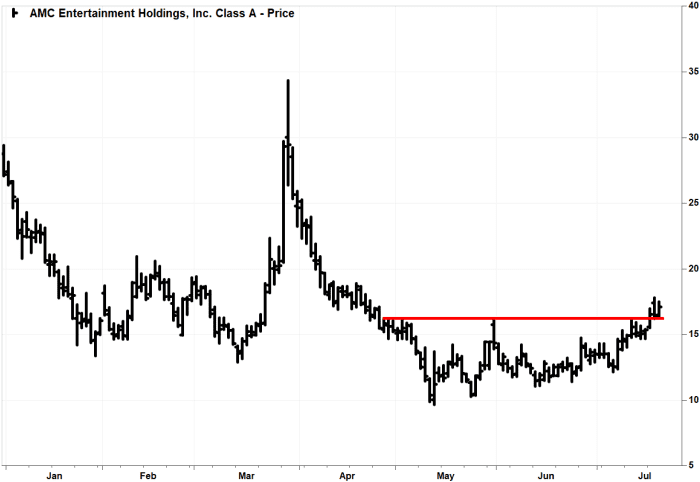

AMC’s stock AMC,

The movie theater operator’s stock’s gains in the past few months had been capped just above the $16 level, until it closed at $16.54 on Monday to break above that resistance area. On Tuesday, the stock ran up as much as 7.7% to an intraday high of $17.82, before suffering a late-day selloff to close down 1.% at $16.36.

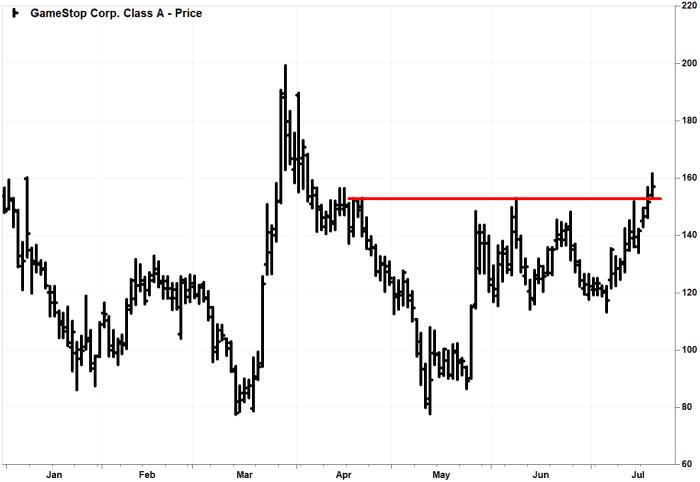

GameStop shares GME,

On Monday, the stock closed above the $150 level for the first time in three months, after multiple failures to sustain intraday gains to around that level over the past couple months.

Meanwhile, S3’s Dusaniwsky provided his list of 25 U.S. stocks at most risk of a short squeeze, or sharp rally fueled by investors rushing to close out losing bearish bets. Read more about the mechanics behind short selling.

Dusaniwsky said the list is based on S3’s “Squeeze” metric and “Crowded Score,” which take into consideration total short dollars at risk, short interest as a true percentage of a company’s tradable float, stock loan liquidity and trading liquidity.

Short interest as a percent of float was 19.66% for AMC, based on the latest exchange short data, and was 21.16% for GameStop.

Don’t miss: These are the most important things to check on a stock’s quote page before deciding whether to buy or sell.

He said an additional variable that makes a stock “squeezable” is substantial net-of-financing mark-to-market losses.

Over the past month, AMC’s stock has soared 37.0% and GameStop shares have hiked up 16.5%, while the S&P 500 index SPX,

“[T]he chances of getting a tap on the shoulder from a Chief Risk Officer to cut losses and get out of a trade is higher for these stocks,” Dusaniwsky wrote. “The higher chance that short sellers may be forced to buy-to-cover will only help push stock prices even higher — and making the squeeze even tighter for the shorts still in the stock.”

AMC, which had about $1.50 billion in short interest still open as of Monday’s close, was 16th on Dusaniwsky’s list, and GameStop, with $1.92 billion in short interest, was 24th.

Read more: AMC may have been a meme-stock darling, but weakness in some key areas has the company on shaky ground.

Meanwhile, the top 5 stocks on Dusaniwksy’s list were those of Faraday Future Intelligent Electric Inc. FFIE,