Tesla’s Rally Creates $1 Billion Headache for Its Army of Shorts

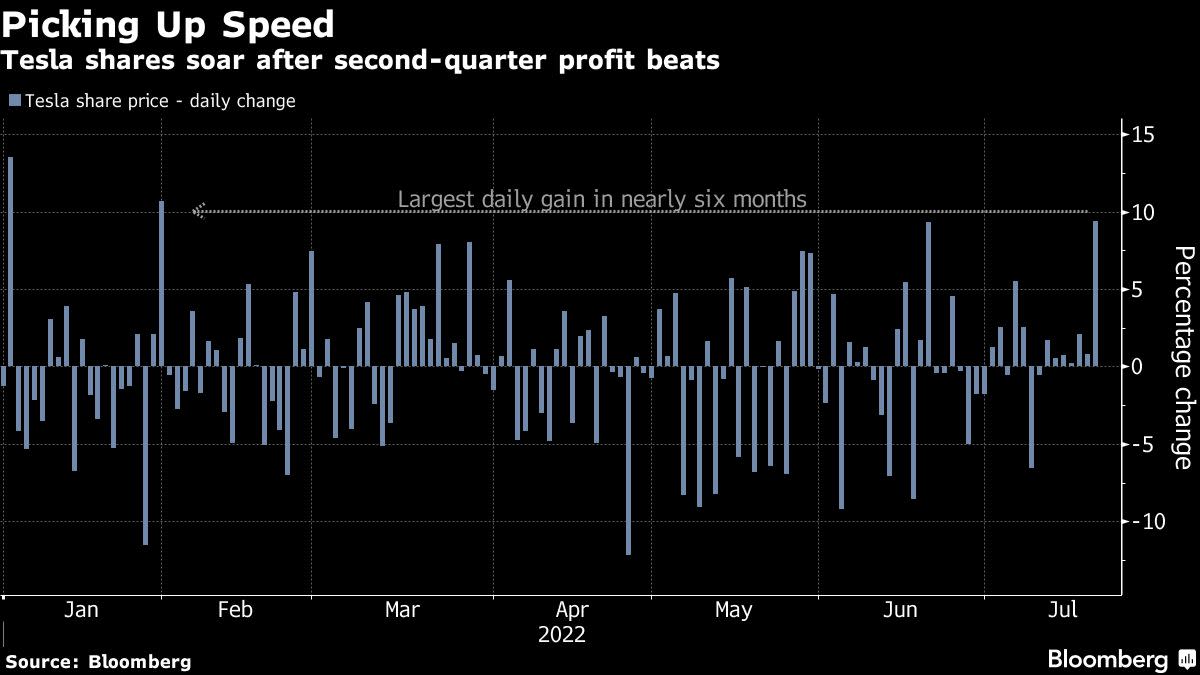

(Bloomberg) — The 10% surge in Tesla Inc. shares Thursday after the electric-vehicle maker reported strong earnings is creating one notable group of losers: The pile of traders betting against the stock.

Most Read from Bloomberg

Tesla is the most shorted stock in the world, with almost 3% of its float held in short-selling positions. S3 Partners estimates that these investors are taking in more than $1 billion in mark-to-market losses just on Thursday’s surge. That drives their losses this month to $2.67 billion, according to S3.

“Tesla short sellers were actively trimming their exposure ahead of the earnings release, covering 2.09 million shares, worth $1.55 billion, over the last 30 days,” S3’s managing director of predictive analytics Ihor Dusaniwsky wrote in a note. Short sellers could continue to get squeezed out of their positions due to such “large and sudden losses,” he wrote.

Shares of the Elon Musk-led company are on a seven-day winning streak and on pace to close at the highest level since May 6.

Of course, none of this diminishes the strong year Tesla shorts have enjoyed so far, racking up $6.34 billion in mark-to-market profits in 2022.

The reason is no surprise. Tesla is in the midst of a troubled year as the company battles supply-chain troubles and soaring raw-material costs. It was forced to tackle production disruptions in China due to Covid-related lockdowns. Then there’s Musk’s ill-fated pursuit of social-media company Twitter Inc., which weighed further on investor sentiment.

However, Tesla’s second-quarter results after the market closed on Wednesday helped allay many of those concerns. The company stood by its production outlook for the year and said demand was not a problem.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.