This strategist said hold on to stocks at the June lows. Now he says it’s time to cut exposure.

July has been a sensational month for stocks — the S&P 500 SPX,

It isn’t that the news has been so wonderful, but perhaps less bad than feared. Some companies that have missed on earnings, such as Alphabet GOOGL,

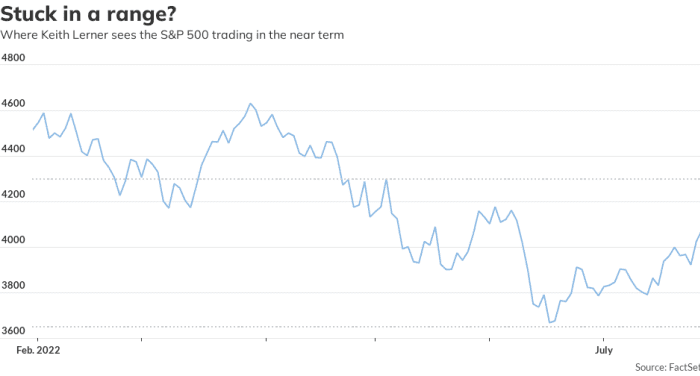

So where do things go from here? A continued straight line up? Keith Lerner, chief market strategist at Truist Advisory Services, says stocks are stuck in a range — and there’s more downside from here.

Amid the continued debate of whether the U.S. in a recession or not, he says the main White House defense — that the economy is still producing jobs growth — isn’t necessarily the last word. In 1973, for instance, monthly employment stayed positive for nine months in the recession. In any case, the firm says an eventual recession is more likely or not, given the Fed rate increases, red-hot inflation, the inversion of the yield curve, tightened financial conditions, the drop in leading economic indicators, the worst-ever consumer sentiment, the rise in initial jobless claims, the savings rate moving down and revolving credit moving up. Phew.

Lerner says any recession is likely to be mild, but its downside and duration could be worse if inflation is sticky, like in the 1970s.

For the market, given at the very least a slowdown if not outright recession, the S&P 500’s upside is limited to the 3% to 6% range, or 4200 to 4300. The forward price to earnings has already bounced from 15.3 in mid June to about 17 now.

There’s more downside, though he doesn’t see a precipitous drop. He says 3650 on the S&P 500 should be well supported. “Thus, the short-term risk-reward does not look that appealing, in our view. This is even as our work suggests that generally stocks have a more favorable outlook over the next three years and longer after a 20% decline,” says Lerner.

In mid-June, he said it wasn’t time to sell stocks. But now, for investors who have overallocated to stocks relative to the long term, “this would be more reasonable place to trim exposure,” he says.

The market

U.S. stock futures ES00,

The buzz

The employment cost index jumped 1.3% in the second quarter, or 5.1% year-over-year, showing no sign of the kind of wage relief that would satisfy Federal Reserve policymakers. June releases of the PCE price index, personal spending and personal income each were stronger than forecast.

In the eurozone, inflation rose a stronger-than-forecast 8.9% in June, while second-quarter GDP topped expectations.

Hedge-fund titan Bill Ackman says Powell is wrong on where the neutral level of interest rates is.

Apple AAPL,

Intel INTC,

Friday’s wave of earnings was led by oil giants Exxon Mobil XOM,

Best of the web

Behind the secret talks by Senators Chuck Schumer and Joe Manchin that produced a draft climate and spending package.

It’s tough enough with strikes and labor shortages, but airlines also are having trouble finding key parts.

San Francisco is facing an office market reckoning.

JPMorgan has hired a scientist to deal with the looming threat that quantum supremacy will render today’s cryptography useless.

Top tickers

Here are the most active stock market tickers as of 6 a.m. Eastern.

| Ticker symbol | Security name |

| TSLA, |

Tesla |

| AMZN, |

Amazon |

| GME, |

GameStop |

| AAPL, |

Apple |

| AMC, |

AMC Entertainment |

| NIO, |

NIO |

| INTC, |

Intel |

| META, |

Meta Platforms |

| NVDA, |

Nvidia |

| BABA, |

Alibaba |

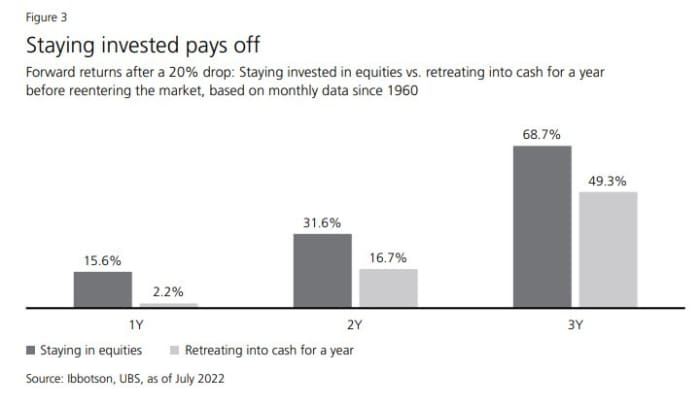

The chart

Is it worth waiting to get back into the market? Historically, the answer to that question is no. Since 1960, a strategy that waited for a 10% correction before buying the S&P 500 and then sold at a new record high would have underperformed a buy-and-hold strategy by 80 times, according to strategists at UBS.

Random reads

There are mysterious holes on the ocean floor.

An ancient dinosaur skeleton sold for $6 million.

America’s most misunderstood marsupial.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.