TSMC Sales Soar 44% in Another Sign of Resilient Tech Demand

(Bloomberg) — Taiwan Semiconductor Manufacturing Co. reported better-than-expected quarterly revenue, providing another signal that electronics demand is holding up better than feared.

Most Read from Bloomberg

The world’s largest contract chipmaker booked NT$534.1 billion ($17.9 billion) of revenue for the second quarter, according to Bloomberg’s calculations, compared with the average analysts’ estimate of NT$519 billion.

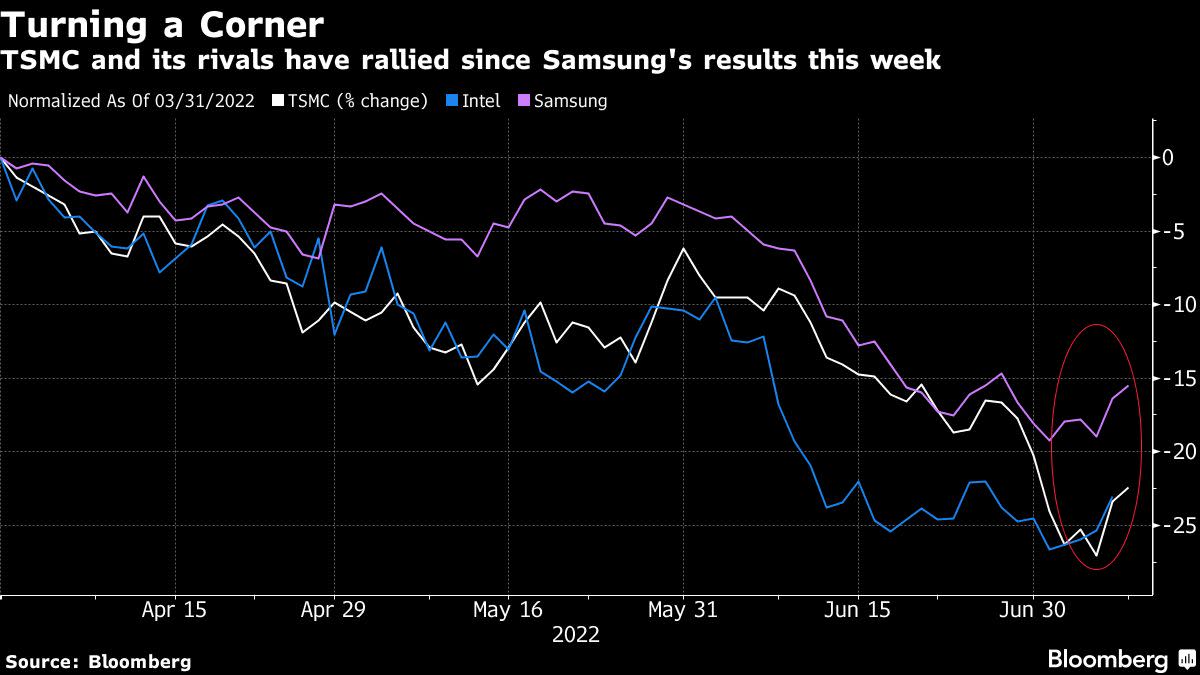

The results from Apple Inc.’s most important chipmaker may allay investors’ worst fears about the impact of weakening demand and soaring costs on the $550 billion semiconductor industry. On Thursday, Samsung Electronics Co. also reported a better-than-anticipated 21% jump in revenue, triggering an Asian stock rally.

While concerns linger about the longer-term impact of a potential global recession, investors seized on Samsung’s top-line expansion as a sign that chip stocks may have been oversold. TSMC may be able to exceed its goal of growing sales by 30% in US dollar terms this year, said Jeff Pu, an analyst with Haitong International Securities.

“TSMC’s second-quarter sales is slightly lower than the most recent market expectations,” Pu said. “But the company’s third quarter revenue may outperform consensus, aided by its price hike and Apple’s new product launch.”

Read more: Samsung Sparks $30 Billion Tech Rally After 21% Sales Jump

TSMC, the world’s most advanced maker of silicon chips, has benefited from its most important customer. Over the past year and a half, Apple has launched five types of Mac chips. The Taiwanese firm also continues to ride the auto industry’s growing demand for semiconductors as cars become more digitized.

Signs are emerging that the chip supply issues that plagued gadget companies and automakers for more than a year are easing. Auto executives have said they are seeing an improvement in component supply, while delivery times for chips fell by one day in June.

Shares of TSMC closed up 2.1% on Friday ahead of the revenue announcement, but are still down 24% this year after a broader tech selloff on recession worries.

“Robust demand for high-performance computing and automotive chips should prevail, while negative impacts from a weaker smartphone-chip demand outlook may not kick in until 4Q,” Bloomberg Intelligence analyst Charles Shum wrote in a note ahead of TSMC’s Friday announcement.

(Updates with analyst’s comment from the fourth paragraph)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.