A surging stock market is on the verge of signaling a ‘huge’ move — but there’s a catch

Here’s another wrinkle in the market-bottom versus bear-market bounce debate.

The pace of the stock market’s rise as it continues a bounce off the June lows is nearing a magnitude that’s preceded “huge” moves in the past. The dilemma for investors is that those moves can be in “either direction,” analysts at Jefferies observed in a weekend note.

Through Friday, the S&P 500 SPX,

Read: Why the U.S. stock rally looks more like a new bull market than a bear bounce to these analysts

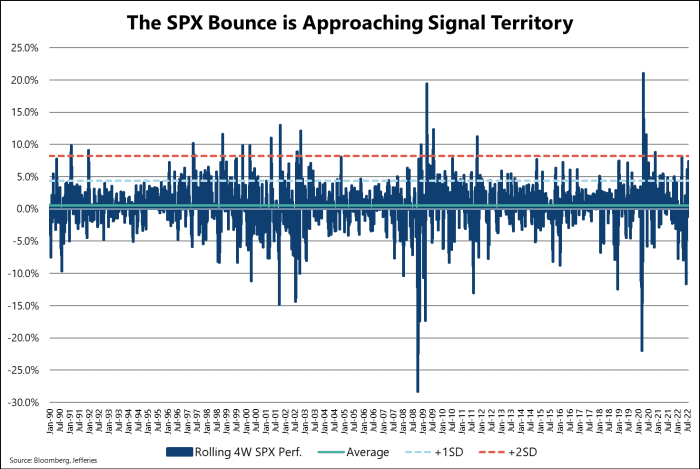

But it’s the large-cap benchmark S&P 500’s more-than-7% rise over the past four weeks that is “dangerously close to extremely interesting from a signal perspective,” wrote Jefferies strategists, including Andrew Greenebaum, in a Sunday note.

A rise of just more than 8% over four weeks would mark a two-standard deviation for S&P 500 rallies, they observed, based on data going back to 1990, which means the market won’t need “much more juice” to hit statistically significant territory.

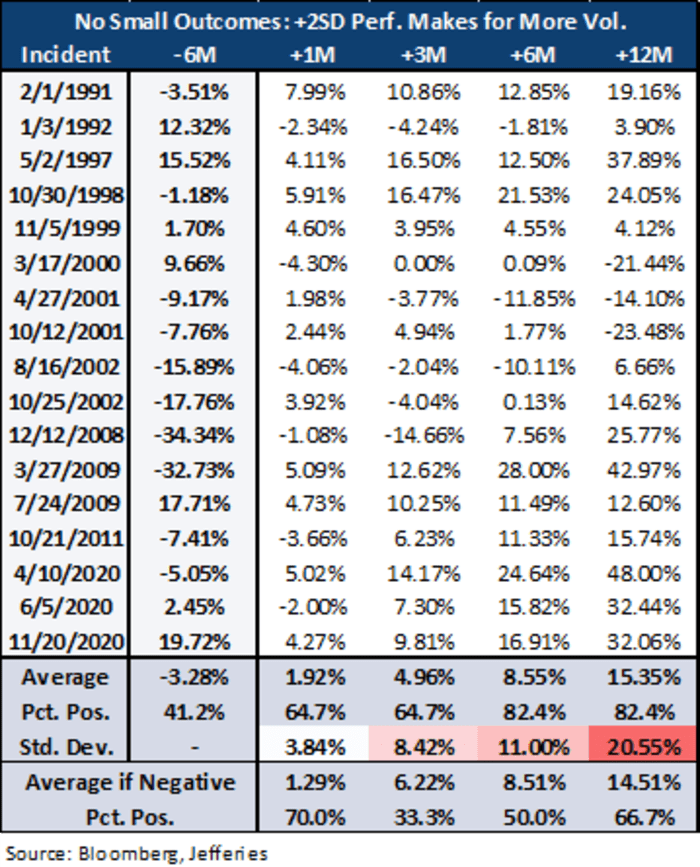

And in the 17 times the S&P 500 has hit that threshold, the subsequent performance “looks massive,” they wrote, averaging 9% over the next six months. But there’s a notable caveat in that there were also several instances that saw double-digit negative returns. And when the prior six months were negative — as would be the case this time around — “the likelihood of positive returns drops precipitously,” they wrote (see chart and table below).

The takeaway, they said, is that “while the seemingly unstoppable bounce may lure folks in, there is still a strong chance it’s just a (quite tradeable) bear market rally.”

See: Why the S&P 500’s ‘bounce within a bear market’ could fizzle before it hits 4,200