Beware of a ‘bear trap’ retreat in stocks after the big summer rally, strategists warn

It looks like a “bear trap” may be lurking in this summer’s big bounce for the stock market, one that could lead to painful losses for investors, Glenmede strategists warned in a Monday report.

Investors already appear to be reconsidering some factors of this summer’s powerful rebound, including rethinking hopes that the Federal Reserve may not hike interest rates as aggressively as previously thought.

The S&P 500 index SPX,

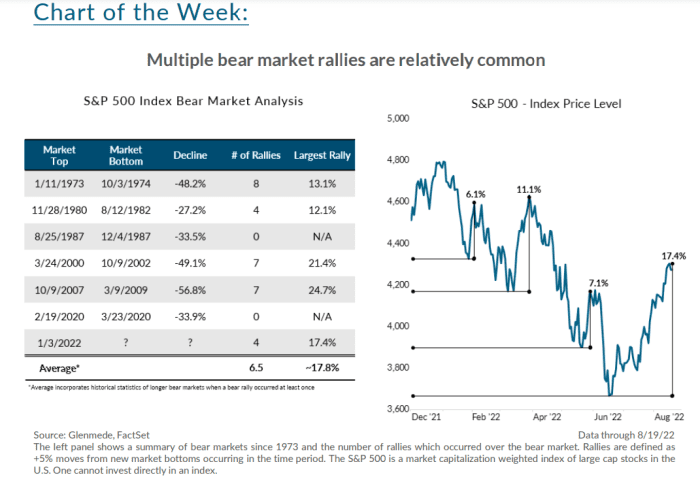

That might sound like an aberration, but Glenmede’s investment strategy team found four instances of multiple bear-market bounces (see chart) in U.S. stocks over roughly the past 50 years, when examining periods after the S&P 500 initially plunge at least 20% from its prior peak.

Bouncing bears aren’t that rare

Glenmede Investment Strategy, FactSet

Of the last six bear markets, four produced a series of short-lived rallies that had an average of 6.5 upswings. The S&P 500 confirmed its move into a bear market on June 13.

“The 17% rally off the June 16th low seems consistent with historical bear market rallies, on average returning over 17.8% before reversing course and hitting new market lows,” the Glenmede team wrote, in a Monday client note.

“While economic recession has not yet been confirmed, the path ahead will strongly depend on the different inflation and interest rate outcomes.”

Stocks were lower to kick off the week, with the S&P 500 down about 2% at last check after it closed Friday 15.3% below its 12-month closing low of 3,666.77 set on June 16, according to Dow Jones Market Data.

The Dow Jones Industrial Average DJIA,

Economists expect Federal Reserve Chairman Jerome Powell to stress this week at his Jackson Hole speech that a 2% inflation target remains a key focus, even if trying to achieve it means sparking a recession. The rate of inflation in the 12 months ended in July retreated to 8.5% from a 41-year high of 9.1% in June.

But Federal officials warned in July that the U.S. central bank could move into a “restrictive” stance of policy, enough to slow economic growth, while it works to cool inflation from its highest levels in decades.

Read: Here are 5 reasons that the bull run in stocks may be about to morph back into a bear market

On the bullish side, however, there has been hope that consumer prices may have finally peaked this summer and corporate earnings and consumer spending have remained fairly strong, the Glenmede team said.

Even so, “markets continue to price in a relatively rosy profit outlook as earnings continue to rise for the next three years.”