Billionaire Ray Dalio Loads Up on These 3 “Strong Buy” Stocks

In the last month, both the S&P and the NASDAQ climbed back out of bear territory, and are registering 10% and 13% gains respectively. It’s enough to make investors’ heads spin. Let’s not forget, the markets presented investors with a bearish challenge in 1H22, with 6 straight months of losses. Headwinds, in the form of supply chain problems, Russia’s invasion of Ukraine, inflation at generational high levels, rising interest rates, all combined to give investors the shivers.

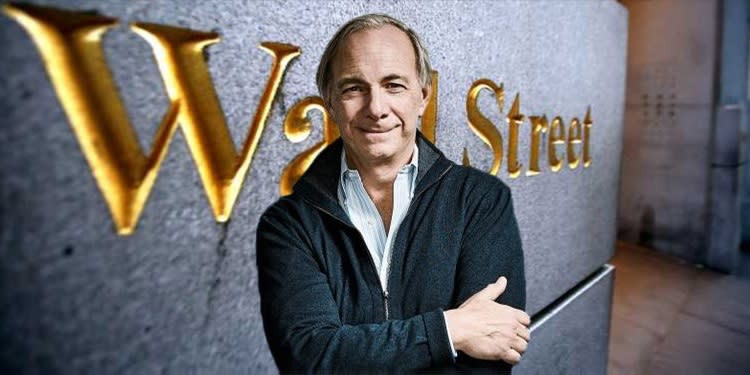

For the retail investor, looking to find some sense, following some of the investment market legends makes a sound strategy. Ray Dalio, the billionaire founder of Bridgewater Associates, has a reputation as one of the hedge world’s most successful investors – and he doesn’t rest on his laurels. Bridgewater, which now manages over $150 billion in total assets, boasts that its flagship Pure Alpha II fund beat the bear – and gained a whopping 32% in the first half of the year.

Looking to Dalio for investing inspiration, we used TipRanks’ database to find out if three stocks the billionaire recently added to the fund represent compelling plays. According to the platform, the analyst community believes they do, with all of the picks earning “Strong Buy” consensus ratings.

Builders FirstSource (BLDR)

We’ll start with Builders FirstSource, a Dallas-based supplier of construction materials for the homebuilding industry. Builders FirstSource has a wide range of products, from pre-fab framing to ready lumber to roofing shingles to insulation and weatherproofing to siding and windows – just to name a small selection. The company also offers finishing products, for decking, doors, ceilings, stairs, and interiors. Support services include drafting and estimates, delivery and pickup, custom millwork, and installation. The company boasts 565 showroom and distribution locations across 42 states.

Over the past two years, BLDR has benefited greatly from the end of COVID restriction, the return of normal business conditions, and a hot real estate market. The company has consistently reported year-over-year top line quarterly gains – and the most recent quarter, 2Q22, showed a company record revenue print of $6.9 billion, up 24% from the year before. Net income grew even more, jumping 98.5% y/y to reach $987.2 million, or $6.26 per diluted share on an adjusted basis. The company saw $881 million in free cash flow during the quarter.

It’s no wonder, then, that an investor like Dalio would take an interest in a company like Builders FirstSource. Dalio’s Bridgewater bought up 196,973 shares of the stock in the last quarter, increasing its holding by 2,397%. The firm’s total stake in BLDR is now worth $14.3 million.

This action will not be surprising to Benchmark’s 5-star analyst Reuben Garner, who takes an upbeat stance on this company and its stock.

“We view BFS as occupying unique positioning in the building products ecosystem. As one of the largest players in the distribution space, there is a clear runway for organic growth to meet the long-term targets… given a more bullish housing environment, particularly given the traction of BFS’ digital foray. In the event of an industry soft period (which we continue to believe will be more modest and short-lived than feared), we view BFS’ scale and balance sheet as attractive characteristics that should lead to continued outperformance in any environment,” Garner opined.

Garner doesn’t just write up a glowing review, he backs it with a Buy rating and a $125 price target that implies ~81% upside for the next 12 months. (To watch Garner’s track record, click here)

Overall, 13 analysts have weighed in on Builders FirstSource, and their reviews include 10 to Buy and 3 to Hold, for a Strong Buy consensus rating. The shares are priced at $69.20 and the $92.17 average price target suggests ~33% one-year upside. (See BLDR stock forecast on TipRanks)

Sarepta Therapeutics (SRPT)

Next up is Sarepta Therapeutics, a gene editing biopharmaceutical company focused on the treatment of genetically based diseases, especially muscular dystrophy. The company has both an active pipeline of new drug candidates, at the discovery, pre-clinical, and clinical-trial stages, as well as three FDA-approved medications for the treatment of Duchenne muscular dystrophy. This combination gives Sarepta the best of both worlds in the biopharma sector: marketable, commercial stage drugs generating sales and revenue, along with an extensive research program and the potential of additional marketable products in the future.

On the clinical trial side, Sarepta most advanced drug candidate, SRP-9001, has advanced to the point that the company is ready to submit the Biologics License Application (BLA) to the FDA. This is an important regulatory milestone on the way to approval, as it seeks an accelerated process from the Federal agency. SRP-9001 is an investigational gene therapy for Duchenne, and Sarepta is working on it with partner Roche, which has the exclusive right to launch and commercialize the drug in markets outside of the US. Recent data releases from the clinical trials show that SRP-9001 is demonstrating long-term positive effects in patients, including improved muscle function.

The commercial stage products include three gene therapy drugs for Duchenne; Exondys 51, Vyondys 53, and Amondys 45. In 2Q22, the company realized over $211 million in sales revenues from these drugs, a gain of 49% year-over-year. Total revenue, which also includes collaboration feed, was reported at $233.5 million. The company had $1.9 billion in cash and liquid assets as of the end of Q2.

Ray Dalio, who doesn’t choose stocks lightly, picked up 121,144 shares of Sarepta last quarter, a 2,700% increase from his firm’s existing holding. Bridgewater now owns 125,518 shares of SRPT, which are worth $13.6 million.

RBC Capital analyst Brian Abrahams is also bullish on Sarepta’s potential, writing of the approaching BLA submission: “We continue to see substantial appreciation potential in shares on approval following ph.III, and believe the potential for accelerated approval provides additional upside optionality to expedite the drug’s revenue contribution and potentially reduce pivotal study risk. Despite shares ticking up recently, we continue to see an attractive entry point ahead of ‘9001 regulatory events.”

Putting his stance into numbers, the analyst sets a $182 price target on SRPT, along with an Outperform (i.e. Buy) rating. His price target suggests a 68% one-year upside potential. (To watch Abraham’s track record, click here)

Overall, it’s clear from the breakdown of the analyst reviews that Wall Street is siding with the bulls. There are 18 reviews on record, including 14 to Buy against just 4 Holds, backing up the Strong Buy consensus rating. The stock is selling for $108.39, and its $131.94 average target implies ~22% one-year upside potential lying ahead. (See Sarepta stock forecast on TipRanks)

Brunswick Corporation (BC)

Now we’ll turn to the leisure sector, where Brunswick builds and markets a line of boats and marine engines, as well as their accessories and parts. Boating enthusiasts will be familiar with Brunswick’s brand names, which include SeaRay, Mercury, and Boston Whaler.

Brunswick’s financial results have been improving – and improving dramatically – over the past couple of years. Brunswick has found that the leisure sector – especially the boating segment – has been profitable despite the effects of the COVID pandemic. Boating and other marine activities can easily lend themselves to both social distancing and social conviviality, as conditions permit, and Brunswick has ridden that fact to high revenues.

In 2Q22, the company brought in $1.84 billion at the top line, the latest in a two-year series of quarters showing consistent year-over-year revenue gains. At the bottom line, the company reported a net profit of $197.3 million, translating to adjusted earnings of $2.82 per share. Looking forward, Brunswick is guiding toward full-year results of $6.9 billion to $7.1 billion in revenue, which would mark a 19% y/y revenue gain at the midline.

Ray Dalio likes what Brunswick has to offer. In Q2, Bridgewater bumped up its holding by 3260% when it bought up 136,377 shares. Now, the fund’s total position comes in at 140,561 shares worth 11.89 million at current prices.

This company has also picked up the attention of Baird analyst Craig Kennison, a 5-star analyst, who writes of its situation: “Demand remains well ahead of supply, suggesting retail should recover as availability improves. Meanwhile, we believe the market has overlooked the impact of fresh engine capacity coming online in late 2022, including a heavy mix of higher horsepower engines. We are mindful of economic uncertainty and acknowledge that it is tough to call the bottom, but we see excellent value for investors shopping for early cycle names in a late cycle market.”

In Kennison’s view, Brunswick has earned an Outperform (i.e. Buy) rating, and the analyst’s $120 price target indicates room for ~42% share appreciation in the coming year. (To watch Kennison’s track record, click here)

Kennison represents the bullish take on this stock – and he’s clearly in the mainstream. BC shares have 10 unanimously positive reviews from the Street’s analysts backing up the Strong Buy consensus rating. The average price target of $103.20 implies ~22% one-year gain from the current trading price of $84.64. (See Brunswick stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.