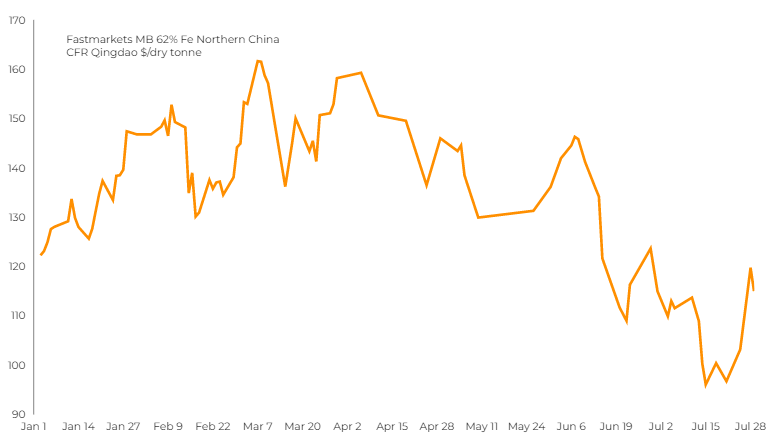

Iron ore price falls as property crisis threatens to drag down steel industry

Iron ore’s most-traded September contract on China’s Dalian Commodity Exchange ended volatile daytime trade 0.8% lower at 786.50 yuan ($116.44) a tonne.

Sentiment has turned shaky after iron ore’s solid gains last week. A private survey showed on Monday that China’s July new home prices and sales volume both fell from a month earlier.

China’s property market, which is already grappling with a debt crisis and weak demand, has been further rocked recently by a mortgage boycott.

Analysts said confidence is unlikely to be quickly restored despite government support for the industry.

“The recovery will be slow and gradual, with two major uncertainties ahead: the impact of recent mortgage boycotts on homebuyers’ confidence (and) revival of more lockdowns,” J.P.Morgan analysts said in a note.

China’s ailing property sector and its decarbonization goal, which entails cutting annual steel production for a second straight year in 2022, remain key concerns for iron ore traders, though rebounding steel margins offer support.

Almost a third of China’s steel mills could go into bankruptcy in a squeeze that’s likely to last five years, Li Ganpo, founder and chairman of Hebei Jingye Steel Group, warned at a private company meeting in June.

“The whole sector is losing money and I can’t see a turning point for now,” he said, according to a transcript of the gathering seen by Bloomberg News.

A total of 23 blast furnaces in China resumed production between July 21 and August 1, prompted by improved margins, according to metals information provider SMM, among dozens of such facilities idled for maintenance amid weak domestic steel demand.

(With files from Bloomberg and Reuters)