It’s a Tom Jones rally but it may be overbought, say analysts

The latest action in stocks may be a concern for the bulls. The S&P 500’s initial surge on Thursday to fresh three-month highs fizzled as the session wore on. The “peak inflation rally” faded.

Futures early on Friday are firmer again, but inevitably there are some observers still wary of the recent bounce.

“Obviously, a bear market rally, and a sustainable recovery are similar at the start. We must see consolidation to call the end of the year-to-date bear market,” says Ipek Ozkardeskaya, senior analyst at Swissquote Bank.

The good news for bulls is that this is a Tom Jones rally, as in his famous song: “It’s not unusual.”

Specifically, there is nothing superlative about the market’s, notably the Nasdaq’s, resurgence off its mid-June trough, suggests Bespoke Investment Group.

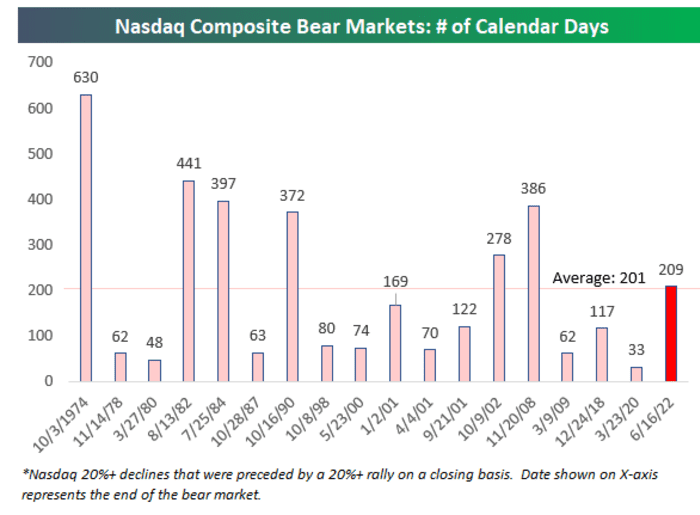

“The 20% rally/decline threshold is the most commonly used to define bull and bear markets….The Nasdaq Composite reached the 20% rally level on a closing basis [on Wednesday], which ended the bear market for the index that began on November 19th, 2021,” Bespoke writes in a note.

“What is most striking about the just-ended Nasdaq bear market is just how average it was. From peak to trough, the Nasdaq fell 33.7% over 209 calendar days from November 19th, 2021 to June 16th, 2022. The average bear market since 1970 has seen the index fall 35.5% over 201 calendar days,” Bespoke adds.

Technical factors, however, may be a red flag, at least in the short term. The 14-day relative strength index for S&P 500 futures on Friday morning was just above 75, according to CMC Markets, signaling the underlying market is in overbought territory. Similarly, the RSI for Apple AAPL,

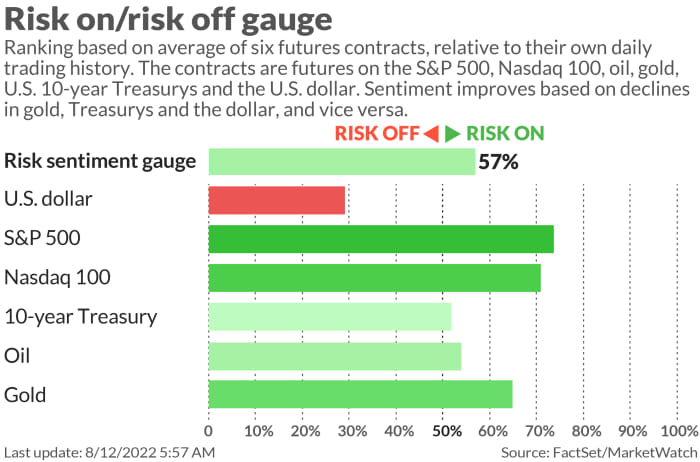

Meanwhile, Nicholas Colas, co-founder of DataTrek Research, notes that the recent move lower in the CBOE Vix VIX,

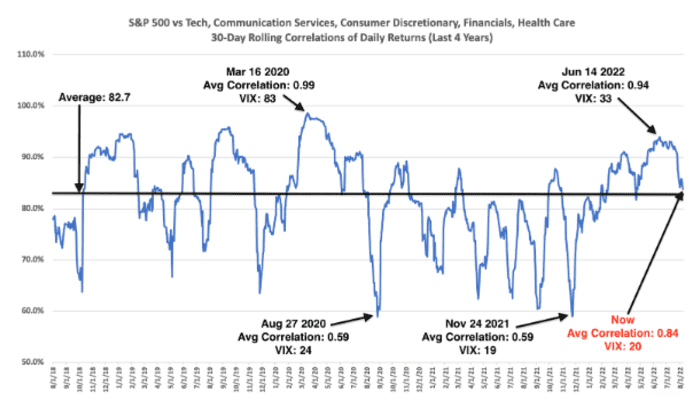

High correlations between sectors such as large cap tech, communication services, consumer discretionary, financials, and health care are usually a sign of a stressed market.

“The VIX close at 20 today is promising something stocks have not yet actually delivered, namely a healthy decoupling of sector price action from the overall market,” says Colas.

“We have had a standing recommendation all year to consider buying stocks when the VIX gets around 36 (2 standard deviations from the mean) and lighten up when it gets close to 20. We are at the latter point now. As much as we remain bullish, stocks look overextended here,” he concludes.

Markets

S&P 500 futures ES00,

The buzz

A wave of Chinese companies, including PetroChina PTR,

Shares in Illumina ILMN,

Fading inflation fears were highlighted by data from Bank of America, which showed the longest weekly streak of investor outflows from TIPS funds since April 2020.

The pound USDGBP,

The University of Michigan consumer sentiment survey is due for release at 10 a.m. Eastern.

The House of Representatives is due to vote on the Inflation Reduction Act, the legislation approved in the Senate that is focused on climate change and prescription drug prices and also raises corporate taxes.

President Donald Trump’s legal team will have until 3 p.m. Eastern to object to the Justice Department’s motion to release the search warrant.

Best of the web

China’s busting housing bubble

Walgreens is offering $75,000 to recruit pharmacists

The chart

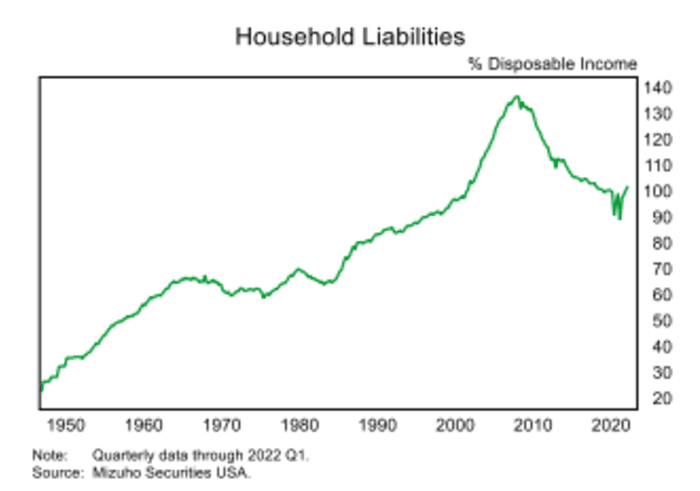

“The state of the consumer balance sheet is a key consideration in determining the severity of any economic slowdown,” says Mizuho Securities. On this, the news is pretty good. “The bullish case for the state of the consumer is based on a major deleveraging in the consumer sector, so liabilities relative to disposable income are at 20-year low.”

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

| AMC, |

AMC Entertainment |

| GME, |

GameStop |

| TSLA, |

Tesla |

| BBBY, |

Bed Bath & Beyond |

| NIO, |

Nio |

| AAPL, |

Apple |

| BABA, |

Alibaba |

| AMZN, |

Amazon |

| RIVN, |

Rivian |

| BNGO, |

Bionano Genomics |

Random reads

Pope runs Ireland after pint of Guinness

Want to stay fresh? Don’t think about it.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.