PayPal jumps as Elliott Management says it has a $2 billion holding in the financial services company

PayPal shares rose as much as 13% in extended trading on Tuesday after the financial services firm issued stronger-than-expected second-quarter results. During its earnings presentation, PayPal said it had entered into an information-sharing agreement on value creation with Elliott Management.

“As one of PayPal’s largest investors, with an approximately $2 billion investment, Elliott strongly believes in the value proposition at PayPal,” Elliott managing partner Jesse Cohn was quoted as saying in the presentation. “PayPal has an unmatched and industry-leading footprint across its payments businesses and a right to win over the near and long term.”

The news comes a day after Elliott said it had become the top investor in social network operator Pinterest.

Here’s how PayPal did in the second quarter:

- Earnings: 93 cents per share, adjusted, vs. 86 cents per share as expected by analysts, according to Refinitiv.

- Revenue: $6.81 billion, vs. $6.79 billion as expected by analysts, according to Refinitiv.

Revenue grew 9% year over year, but the company reported a $341 million net loss, compared with a $1.18 billion profit during the year-earlier period. At the end of the quarter, PayPal had 429 million active accounts, up 6% year over year but below the 432.8 million consensus among analysts polled by StreetAccount.

The company stressed the progress it has made on capital efficiency. It expects to reduce costs by $900 million this year, and it said annualized benefits from the cuts and other changes should save at least $1.3 billion in 2023.

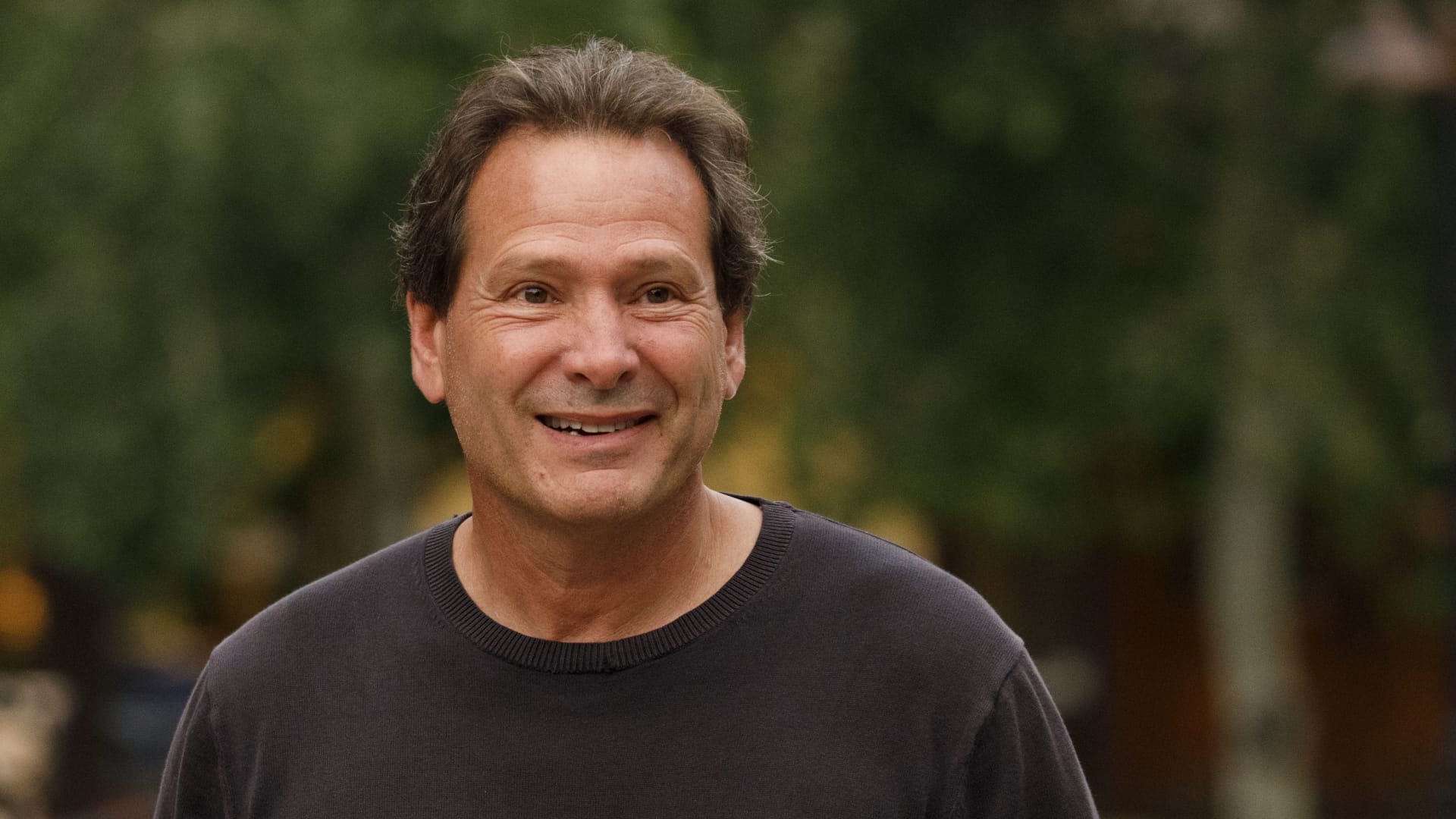

“We have plenty of heads. We can be more productive,” CEO Dan Schulman told analysts on a conference call.

PayPal announced a new $15 billion share buyback program, four years after kicking off a $10 billion program.

The company is pulling back in some areas, including stock trading, and it said it will focus on card in stores rather than exclusively on QR codes, Schulman said. The company is exploring interoperability between PayPal and its Venmo payment app, he said.

And the company said it has a “commitment to work with Elliott Investment Management L.P. on a comprehensive evaluation of capital return alternatives.” The Wall Street Journal reported in July that Elliott had taken a position in PayPal.

“Our discussions are focused on operational improvements, revenue generating investments and capital allocation, and they are consistent with our short and long-term objectives and plans,” Schulman said.

PayPal said it’s seeking a successor for Mark Britto, its chief product officer for the past two years. Britto will retire later this year.

For the full year, PayPal said it expects $3.87 to $3.97 in adjusted earnings per share, up from the range of $3.81 to $3.93 that it provided in April. Analysts polled by Refinitiv had expected $3.82 per share.

During the second quarter, mainly thanks to Venmo growth, PayPal added about 400,000 net new active accounts, or NNAs. In the first quarter, PayPal reported 2.4 million NNAs, for a total of about 2.8 million in the first half of 2022. It said it still intends to add 10 million NNAs for the full year.

“However, as with all of our forecasts, NNA growth could be affected by broader economic factors, given the channels that drive organic customer acquisition, may be negatively impacted by falling consumer sentiment and reduced demand for discretionary goods,” Schulman said.

PayPal shares have fallen more than 52% year to date.

WATCH: American Express or PayPal could be possible suitors for Affirm, says MoffettNathanson’s Lisa Ellis