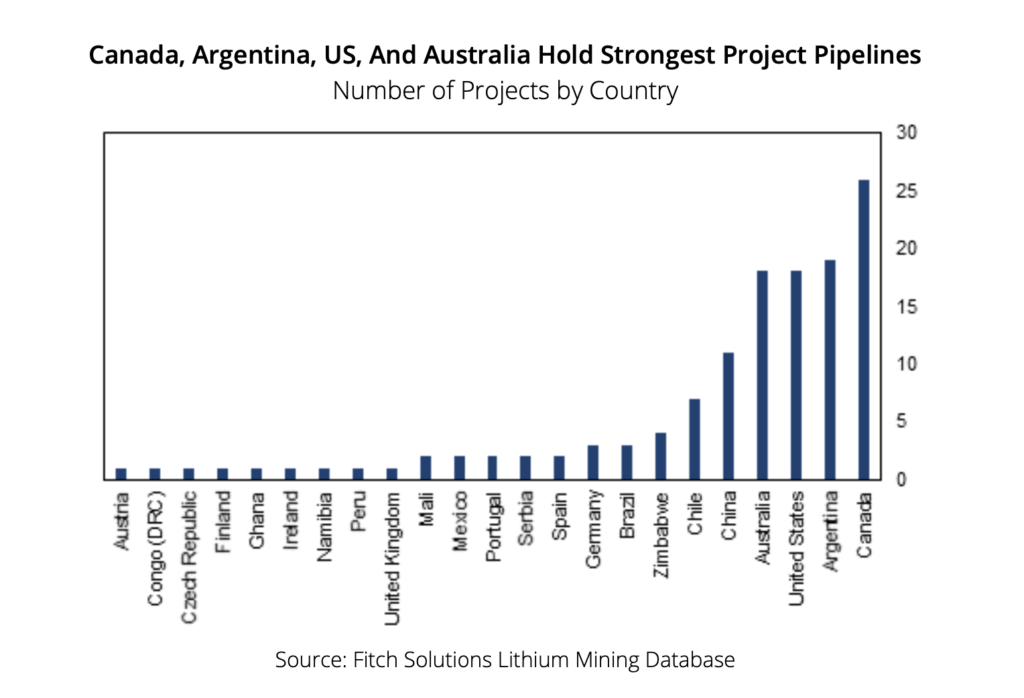

The study of the location of the lithium operations shows the clear current domination of the lithium upstream market by Latin America, specifically Chile and Argentina and Asia Pacific, specifically Australia and China.

While the US and Canada come on top in terms of total operations, all are new projects, and Fitch notes Northern America has plenty of potential in terms of future output.

Competitive landscape: Majors’ presence eclipsed by junior explorers

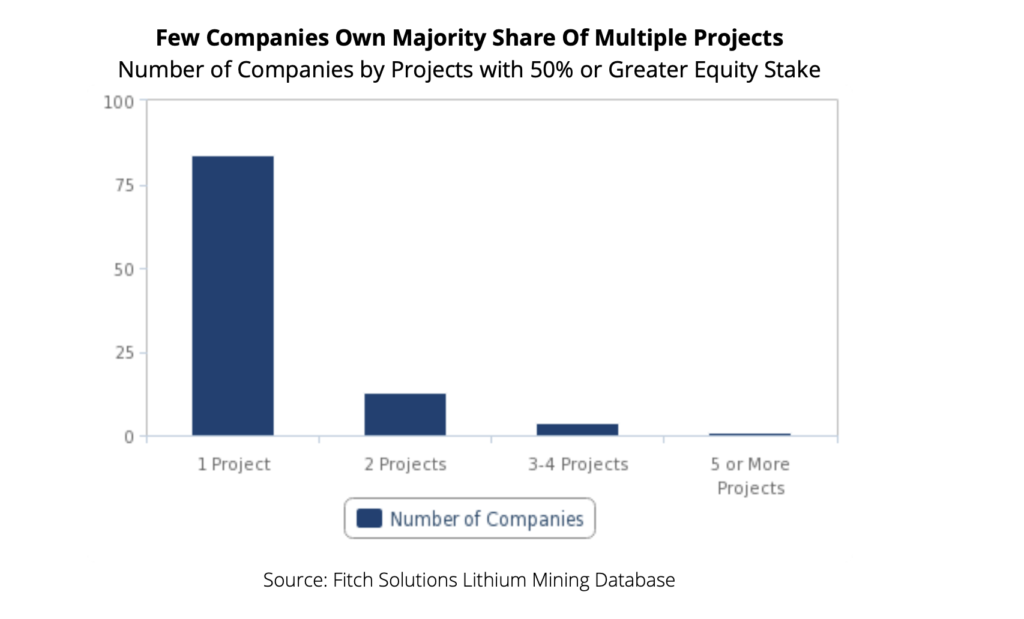

The lithium extraction sector is currently immature and not concentrated, Fitch asserts. Out of 129 total operations, whether active or new projects in its database, the analyst identified 105 individual companies owning these projects (owning 50% and above of the rights).

Out of those 105 companies, only 18 have more than one lithium operation/projects, while 87 companies only own one lithium operation/project.

Hence, Fitch notes, the lithium supply sector comprises a very large number of junior and exploration companies.

The largest lithium-producing mining companies include Sociedad Quimica y Minera de Chile (SQM), based in Chile. SQM also owns a 50% interest in Australia’s Mt Holland project with

Wesfarmers, which received final investment decision in Q121. Construction started in July 2021.

Albemarle, headquartered in the US, has a number of active lithium operations, in Chile (Salar de Atacama, La Negra), Australia (Greenbushes) and the US (Silver Peak); along with new projects (Antofalla in Argentina) and the Wodgina mine on care and maintenance in Australia.

Mineral Resources Ltd, based in Australia operates the Mt Marion mine in Australia along with Ganfeng Lithium and owns Wodgina with Albemarle. China’s Tianqi Lithium operates the world’s largest lithium mine, the Greenbushes mine in Australia along with Albemarle.

The only large diversified global miner developing lithium projects is Rio Tinto, which owns the now defunct Jadar project in Serbia, acquired the Rincon lithium project in Argentina for $825 million and is exploring the extraction of battery-grade lithium from waste rock at the Boron mine it controls in the US.

Chile’s state miner Codelco is another relatively large non lithium-specialist which is developing new lithium projects. The small presence of large mining players poses risks to the execution of the currently planned projects and raises question on the long-term project pipeline for lithium, Fitch argues.

Since the commodities crash of 2014-2015, major miners have preferred to acquire projects already developed by junior miners that are proven to be profitable rather than develop projects start to finish, Fitch points out, a dynamic that affects junior lithium miners frequently searching for financing and support for any final investment decision.

There is a large new project pipeline for lithium, which is likely to continue growing as interest in the sector rises and new production techniques are tested, the analyst notes.

Overall, Fitch is confident in the development of the majority of new lithium projects given the looming tighter market supply, but says a number of them will face delays and are even unlikely to be developed due to the characteristics of the competitive landscape and the location of a number of projects in markets facing significant economic, political, operational and mining risks.

Read the full report here.