Toronto home prices slip further as sales plunge 47% from last year

Review of mortgage stress test urged as rising rates puts more buyers on the sidelines

Article content

Home prices and sales in Canada’s most populous city continued to slide as economic uncertainty and rising rates put more would-be homebuyers on the sidelines.

Advertisement 2

Story continues below

Article content

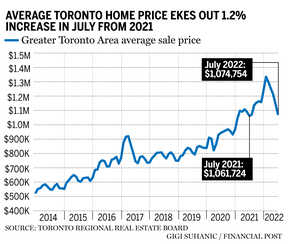

Toronto home prices fell just over six per cent in July from a month earlier, hitting an average of $1.074 million, according to data from the Toronto Regional Real Estate Board. Despite the month-over-month decline, the city’s home prices managed to eke out a one per cent increase from July 2021.

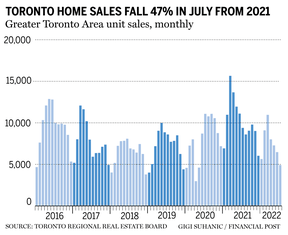

The number of homes exchanging hands tumbled 47 per cent year-over-year in July and 24 per cent from a month earlier, seeing 4,912 units sold.

Despite the slump in sales, TRREB chief executive officer John DiMichele said more households in the Greater Toronto Area will be planning to purchase a home in the future but are uncertain of where the market is headed. The board took aim at guidelines set by the Office of the Superintendent of Financial Institutions.

Advertisement 3

Story continues below

Article content

“Policymakers could help allay some of this uncertainty,” DiMichele said in a release accompanying the data. “As higher borrowing costs impact housing markets, TRREB maintains that the OSFI mortgage stress test should be reviewed in the current environment. Consumers looking to renew their existing mortgages with a different lender should not be subject to an additional stress test burden beyond what they would face with their existing lender.”

DiMichele further argued for a transparent process and more sound rationale surrounding the stress test rules.

TRREB chief market analyst Jason Mercer also warned that policymakers would have to take a growing population into account and drive more housing supply construction.

Advertisement 4

Story continues below

Article content

“The Greater Toronto Area (GTA) population continues to grow and tight labour market conditions will drive this growth moving forward,” Mercer said. “Despite more balanced market conditions resulting from rapidly increasing mortgage rates, policymakers must continue to take action to boost housing supply to account for long-term population growth …. With savings high and the unemployment rate still low, home buyers will eventually account for higher borrowing costs. When they do, we want to have an adequate pipeline of supply in place or market conditions will tighten up again.”

Toronto follows other markets like Vancouver and Calgary in seeing declines in July as the market loses steam amid the Bank of Canada’s aggressive rate hiking path, including a supersized full percentage point hike in July, and fears of a recession.

Advertisement 5

Story continues below

Article content

-

Vancouver home sales tumble, Calgary’s slide as rising rates and uncertainty take toll

-

Prices are falling but rents are rising in Canada’s paradoxical housing market

-

FP Answers: Where is the best value in Canada for real estate?

David Larock, mortgage broker and president of Toronto-based Integrated Mortgage Planners Inc., said markets like Toronto have a tendency to be hit harder than areas like Calgary, which saw sales slip three per cent year-over-year in July, because of the speculative fever the market attracts.

“…Toronto and Vancouver certainly seem to be more impacted than places like Calgary, for example,” Larock said in an interview before Toronto’s July data release on Thursday to describe the overall market slowdown. “Certainly, the most speculative markets have been most impacted psychologically by the one per cent increase by the (Bank of Canada) and probably exactly as they intended.”

• Email: [email protected] | Twitter: StephHughes95

Advertisement

Story continues below