A second leg down for the bear market in stocks would expose 3 ‘naked swimmers.’ That won’t be pretty.

Following a hat trick for all three major indexes last week, both optimism and trepidation are in the air as a new trading stretch begins.

Stocks up amid hopes that the week’s big data — CPI due Tuesday — will show nosebleed inflation easing up a little. Some optimism over the war in Ukraine might be helping too.

But some, like the Kobeissi Letter’s editor in chief and founder Adam Kobeissi, who nailed the June top, remain cautious. “Until we have evidence that inflation has peaked and that the Fed is toning back their hawkish rhetoric, we believe that rallies in stocks will be sold,” he tells clients.

Echoing that sentiment is Miller Tabak + Co.’s chief market strategist Matt Maley who sees a “huge bounce in economic growth” needed for stocks to significantly rally from current levels, let alone hit a new all-time high.

Maley also provides our call of the day, where he warns of a potentially rough September/October period ahead, with chances that a second leg of a bear market could develop, exposing “naked swimmers.”

He’s borrowing from a famed quote by Berkshire Hathaway’s Warren Buffett in 1992 when Hurricane Andrew revealed under-reserved insurers. “Only when the tide goes out do you discover who’s been swimming naked,” said the legendary investor.

As for those “swimmers,” Maley thinks investors need to be wary of the cryptocurrency market, following recent news that bitcoin mining-pooling service Poolin had suspended withdrawals. The strategist recalls the summer rout for cryptos that coincided with a withdrawal halt by crypto lender Celsius, eventually forced to declare bankruptcy.

“That, in turn caused some serious selling in the stock market,” because some leveraged investors had to sell big-cap tech stocks to raise money to meet their crypto margin calls, said Maley. So, if bitcoin BTCUSD,

Another potential “swimmer” issue that worries him is a big jump in corporate debt over the last 2.5 years — U.S. companies currently hold nearly $11 trillion in outstanding debt securities. Total U.S. corporate debt stands at over $22.5 trillion, nearly twice it was during 2007-2008, the strategist said.

The Fed’s monthly quantitative tightening program is due to double this month, meaning the central bank will not be scooping up Treasurys, which may drive down prices. And as corporate debt is priced off Treasury debt, the yields of both could keep rising, and a potential blow-up in credit markets could be out there, said Maley.

Stock-market wild card: What investors need to know as Fed shrinks balance sheet at faster pace

Finally, he says they’ve been worried by some press reports saying European energy markets could halt, unless governments extend liquidity to cover some $1.5 trillion in margin calls.

“What if a serious problem with counterparty risk were to develop…and people stop trading with one or more entities? That could create problems in the physical delivery market as well………As we learned during the GFC, whenever the problem of ‘counterparty risk’ raises its ugly head, it’s always bad for risk assets,” he said. (Regulators including the Bank of England already are taking action in an effort to prevent those problems.)

Maley says while none of these issues may be coming to a head soon, “if the cracks in these markets begin to widen, it would send up a major warning flag for investors in many different risk asset markets.”

The markets

Stocks DJIA,

The buzz

Bristol-Myers Squibb BMY,

Twitter TWTR,

European energy prices hit the lowest in a month on hopes Russian President Vladimir Putin’s energy war is faltering. Meanwhile, after Ukraine forces recent retaking of eastern territory, Russian TV pundits have started questioning the war.

Data highlights for the week include August CPI, followed by retail sales and the University of Michigan consumer sentiment survey.

Activist investor Dan Loeb has hinted that he will no longer push Disney DIS,

Best of the web

Another sign of a looming recession? Americans’ ‘financial health’

Russian soldiers fled Kharkiv ‘like Olympic sprinters’

5-mile wait to see the late Queen

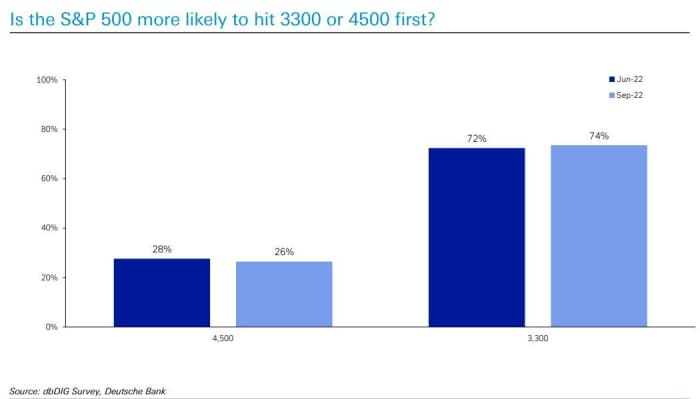

The chart

Investors responding to Deutsche Bank’s September survey are fairly clear about where they think the S&P 500 is headed next:

The tickers

Here are the top-searched tickers on MarketWatch as of 6 a.m. Eastern Time:

| Ticker | Security name |

| GME, |

GameStop |

| TSLA, |

Tesla |

| AMC, |

AMC Entertainment |

| BBBY, |

Bed Bath & Beyond |

| APE, |

AMC Entertainment preferred shares |

| NIO, |

NIO |

| AAPL, |

Apple |

| AVCT, |

American Virtual Cloud Technologies |

| AMZN, |

Amazon |

| MULN, |

Mullen Automotive |

Random reads

Thousands of the Queen’s bees have been told of her death.

Early lights out for the Eiffel Tower?

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.