‘All but set in stone’: More economists join chorus predicting a Canadian recession

Housing, labour, consumption conditions all point to a looming slowdown

Article content

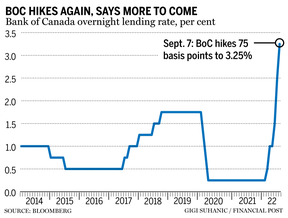

The signs of a recession becoming imminent in Canada are starting to pop up everywhere, and economists are not predicting a soft landing, but rather a bumpy one as the Bank of Canada continues its months-long fight against inflation by raising interest rates. The Bank of Canada has increased its key rate by 300 basis points since March to 3.25 per cent and on Sept. 7 it signalled that more hikes are coming, which will likely further dampen the housing market and the overall economy.

Advertisement 2

Story continues below

Article content

Housing slump

Article content

The decline in listings and a drop in sales volume could suggest Canada’s housing market remains a long way from pre-COVID-19 market dynamics. Desjardins Group economist Randall Bartlett said that more rate hikes are likely, which will continue to push residential investment to contract and weigh on the Canadian economy. “Our view is that we’re going to see a continued slowing of sales activity in Canada, and continued weakness on the price side going forward,” he said. This, he added will likely push the economy into recession in the first half of 2023.

Labour woes

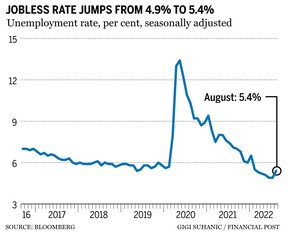

Labour markets remain strong and unemployment rates are still around the lowest levels in decades. But economists at Royal Bank of Canada said this strength will delay but not prevent a downturn. Canada’s unemployment rate jumped to 5.4 per cent in August, and RBC expects further increases in unemployment as the broader economic backdrop deteriorates. “We expect the year ahead to bring recessions for Canada, the United States, the Euro area, and the United Kingdom,” RBC’s team, including chief economist Craig Wright, said in a note. “That said, we expect the coming downturn in Canada will be ‘moderate’ by historical standards.”

Advertisement 3

Story continues below

Article content

Consumption wanes

RBC economists said that although households have accumulated excess savings during the pandemic, they will feel less wealthy as house prices drop and borrowing costs rise, and will be less likely to spend from this cash pile. Economist David Rosenberg predicts consumer consumption will tumble in the coming months as the government removes pandemic benefits. The drag on household income, he said in a column for the Financial Post, is set to be even greater after accounting for the downward pressure on organic income from stagnating job creation. “In addition, if we layer on the downside pressure to spending due to the negative wealth effect from falling home prices and reeling equity markets, the Canadian recession outcome is all but set in stone,” he said.

Advertisement 4

Story continues below

Article content

FedEx’s weaker outlook

FedEx Corp. on Friday withdrew its earnings forecast for 2023 and issued a profit warning, indicating that worsening trends have fuelled fears of a broad-based earnings decline. The package delivery giant joins other global logistics companies in signalling that consumers are saving their money for essentials as prices surge. Bartlett said FedEx is a “great proxy for what’s happening in terms of global commerce,” since a quick drop in the number of transactions is often a clear and up-to-date signal that the global economy is cooling very quickly.

-

Food inflation may have peaked, says head of Canadian grocery giant

-

U.S. inflation could push Bank of Canada to move policy rate higher than 4%

-

Canadian household wealth falls by nearly $1 trillion as real estate, financial markets pummelled

Advertisement 5

Story continues below

Article content

Potential global recession

The World Bank in a report released Thursday noted the global economy is in the midst of one of the most internationally synchronous episodes of monetary and fiscal policy tightening during the past five decades. With several countries withdrawing monetary and fiscal support to curb the risk of high inflation — which has risen to multi-decade highs in many countries — the World Bank said this could produce larger impacts than intended, both in tightening financial conditions and in steepening the growth slowdown. To minimize those impacts, it said central banks should coordinate their actions and “communicate their policy decisions clearly” to reduce “the degree of policy tightening needed to achieve the desired disinflation.”

• Email: [email protected] | Twitter: denisepglnwn

Advertisement

Story continues below