Kevin Carmichael: Persistent labour shortages may prove a bittersweet victory for workers

Workers will reclaim a bigger piece of the pie, but will they be any better off than when wages were being suppressed?

Article content

Record job vacancies show labour is about to take its revenge. Victory might be bittersweet.

Advertisement 2

Story continues below

Article content

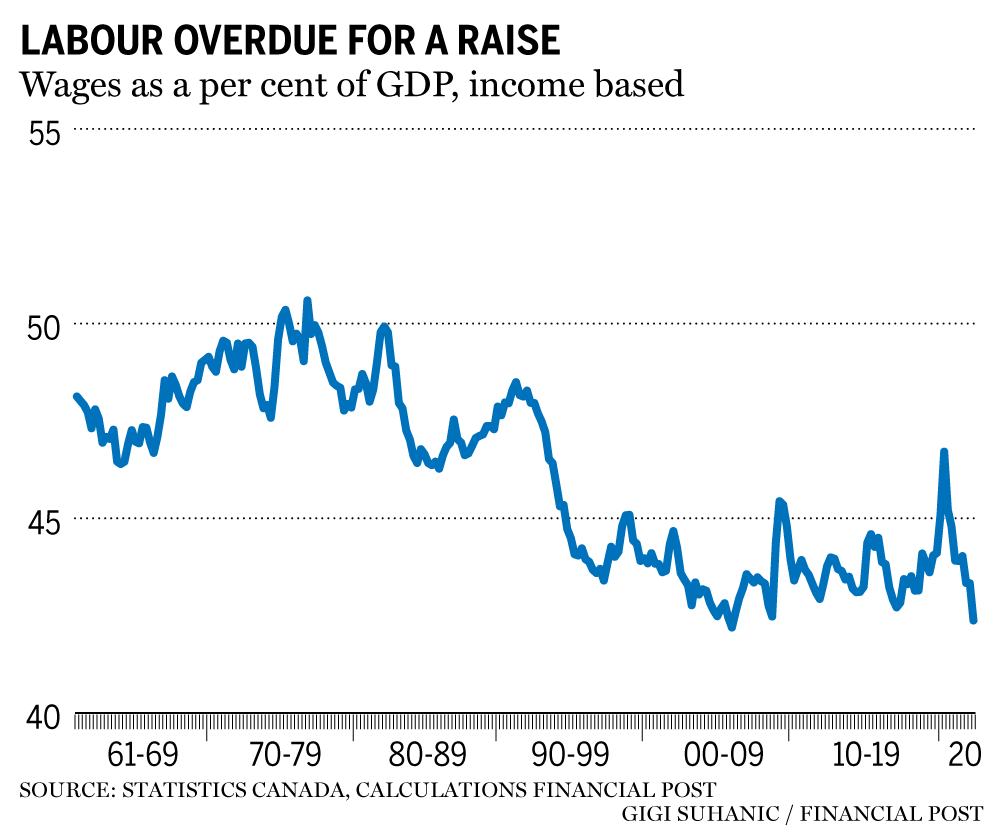

For three decades, owners and bosses mostly have had it their way. Wages and salaries peaked at about 50 per cent of Canada’s gross domestic product in the 1970s. They generally have declined ever since, dipping to 42.4 per cent in the second quarter, the lowest since 2005, according to Statistics Canada.

Article content

We know roughly why that happened. Union militancy ran into a political backlash fronted by Margaret Thatcher in the United Kingdom and Ronald Reagan in the United States in the 1980s, the participation rate of women in the economy accelerated dramatically and China joined the World Trade Organization in 2001, introducing North American, Japanese and European factory owners to an irresistible supply of cheap labour.

Advertisement 3

Story continues below

Article content

Those changes were good for profits, but they were also good for prices — after surging to double digits in the 1970s, inflation has been stable around two per cent since the early 1990s. We started buying more goods and services than ever. Household consumption consistently represented about 50 per cent of GDP until the mid-2000s, and then it broke higher. Household consumption expenditure was 57 per cent of GDP in the second quarter, the most on records that date to 1961, according to Statistics Canada.

Whether all of this was good for society is open for debate. Considerable evidence suggests the balance may have tilted too far in the favour of bosses, a group of digitally native entrepreneurs who found themselves in the right place at the right time, and anyone who happened to own property in big cities circa 2010. Income and wealth inequality widened as manufacturing employment declined, fuelling the resentment that characterizes contemporary politics; household debt surged, as many of us turned to credit to maintain a certain standard of living; and many North American communities are gripped by an opioid epidemic that is killing more than 20 Canadians per day, compared with eight per day in 2016, according to the Public Health Agency of Canada.

Advertisement 4

Story continues below

Article content

It’s too late for a generation of workers who had the misfortune of joining the labour force amid a perfect storm of wage-suppressing forces. But those headwinds are starting to recede, and labour is in the process of reclaiming its traditional share of the economic pie. The average offered wage was $24.05 in the second quarter, a 5.3 per cent increase from the same period a year earlier, a big increase by recent Canadian history. The average was held back by employers in the health and social assistance industry, where offered wages were only 3.6 per cent higher; offered wages in transportation and warehousing and mining and oil and gas increased by about eight per cent, while job postings for managers and technology jobs were offering salaries that were about 11 per cent higher than in the second quarter of 2021.

Advertisement 5

Story continues below

Article content

The average year-over-year increase for workers aged 15 years and over since the late 1990s has been about three per cent, according to Statistics Canada’s monthly Labour Force Survey. Wages have broken out of their decades-long rut because of one of the more remarkable macro-economic stories of the pandemic: the surge in the number of job vacancies. In the spring of 2020, everyone was talking about the price of lumber. The reopening brought tales of restaurants operating at reduced capacity because they couldn’t find enough servers, and renovations going undone because overworked contractors couldn’t be bothered with small jobs.

Much of what has occurred during the pandemic has proved ephemeral. Shares of Peloton Interactive Inc. now trade for about US$10 compared with about US$160 at the end of 2021 and Canada’s biggest lumber companies are cutting production amid falling prices. But the acute labour shortage has endured. There were one million job vacancies in the second quarter, the most since at least 2015, which is when Statistics Canada started keeping track.

Advertisement 6

Story continues below

Article content

Demand for workers has remained strong because the recovery from the COVID recession has been like no other. Central banks and governments in the world’s richest countries responded to the pandemic with monetary and fiscal stimulus that inspired shock and awe. They probably overdid it, as authorities are now struggling to get a burst of inflation under control. Bank of Canada governor Tiff Macklem, who has identified job vacancies as a symbol of excess demand, raised the benchmark interest rate by three percentage points between March and September and he probably isn’t finished. That’s more brake-pumping than occurred over the decade that separated the Great Recession and the start of the pandemic.

Economists at Royal Bank of Canada think the speed at which the Bank of Canada is raising interest rates will cause a recession. While acknowledging the possibility, Macklem argues there’s a chance the worst case will be avoided because companies might simply stop hiring instead of firing people. That would represent a soft landing from excess demand rather than the hard one that Royal Bank foresees.

Advertisement 7

Story continues below

Article content

But there are good reasons to think the high numbers of labour shortages are here to stay.

-

How Canada can ease its labour crunch by giving immigrants more support

-

‘Hey… It’s Jason’: Alberta ad campaign aims to woo young professionals from Toronto, Vancouver

Peloton’s fancy stationary bikes were part of a fad, and sawmills simply needed time to catch up with the demand for lumber. What’s happening in the labour market is different. Vacancy rates were rising before the pandemic because the postwar baby boom that created a glut of workers is now retiring at increasing rates. China’s population is also aging, and the productivity surge that came with its meteoric rise over the past few decades is slowing as it becomes a mature economy driven by consumption rather than exports and investment. There simply aren’t enough workers, even for a recessionary economy. That means shortages will persist, which will keep upward pressure on wages.

Advertisement 8

Story continues below

Article content

For the first time in a generation, workers will have bargaining power. Whether that translates into a stronger economy or a better quality of life remains to be seen. Employers that grew accustomed to cheap labour could balk at paying higher salaries, so the unemployment rate could rise.

Perhaps the bigger worry is inflation. If it persists, workers will seek bigger pay increases to offset a higher cost of living. Employers that are unable or unwilling to invest to become more productive will likely charge higher prices to offset bigger labour bills. That would keep upward pressure on interest rates as the Bank of Canada fights to keep inflation close to its two-per-cent target.

Workers will reclaim a bigger piece of the pie, but will they be any better off than they were when their wages were being suppressed?

• Email: [email protected] | Twitter: CarmichaelKevin

Advertisement

Story continues below