Lower rate of Canadians own homes despite increase in household incomes

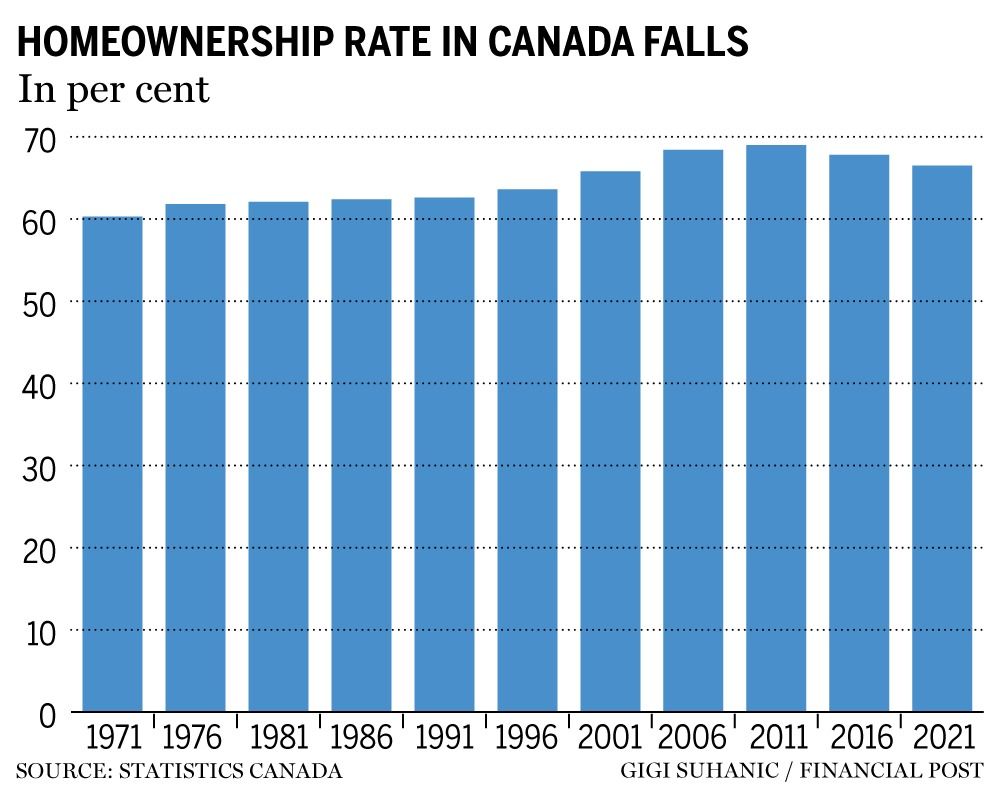

Canada’s homeownership rate has declined to 66.5% after peaking in 2011 at 69% as people struggle to get off sidelines

Article content

Canada’s homeownership rate has declined to 66.5 per cent after peaking in 2011 at 69 per cent, according to a Statistics Canada release Wednesday, with the agency acknowledging that people are having a hard time getting off the sidelines.

Advertisement 2

Story continues below

Article content

“Trying to figure out the right time to buy is a difficult decision that can leave Canadians wondering how long they want to hold out on entering the real estate market — or whether they even want to,” the agency said in its report.

Article content

While the slowdown in home starts and sales continues, home prices had previously increased to such levels that even a major correction may not be enough for most Canadians to enter the market given current interest rates.

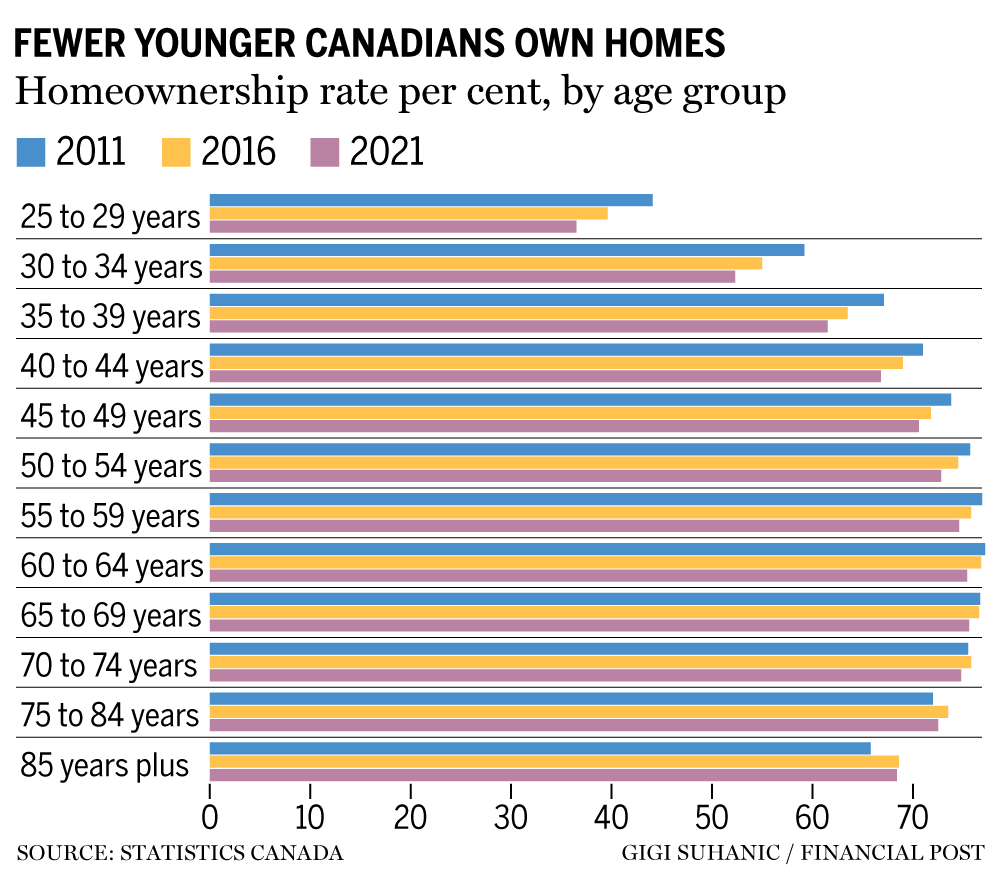

Adults under the age of 75, especially young millennials aged 25 to 29 years, were less likely to own their home in 2021 than a decade earlier, according to the Statistics Canada report, Portrait of Housing in Canada 2011-2021.

Meanwhile, the growth in renter households has more than doubled the growth of owner households. The agency said renter households grew 21 per cent between 2011 and 2021 compared to the homeownership growth rate of 8.4 per cent.

Advertisement 3

Story continues below

Article content

Housing is still at its most unaffordable level in 30 years — since the height of the housing bubble in the 1980s and the 1990s — according to recent reports by the National Bank of Canada and Royal Bank of Canada.

Nevertheless, Statistics Canada said the number of households that spent more than 30 per cent of their income on housing declined to 20.9 per cent in 2021 from 24 per cent in 2016.

The rate of unaffordable housing for renters fell to 33.2 per cent from 40 per cent during the same timeframe, with most of the decline occurring among renters earning below the median renter household income (68.4 per cent in 2016, compared with 56 per cent in 2021).

According to Statistics Canada, Canadians found housing more affordable in 2021 because they had higher incomes, in large part due to pandemic support programs.

Advertisement 4

Story continues below

Article content

Even with the broad-based increases in wages and salaries, income inequality increased in the first quarter of 2022 compared to the same quarter a year earlier, according to the latest Distributions of Household Economic Accounts estimates.

City dwellers faced the highest unaffordable housing rates. The percentage of renters spending more than 30 per cent of their income on shelter costs in 2021 was above the national average in 33 of 42 large urban downtowns.

“We’re seeing the results of people dropping out of the homeownership game, and they’re moving into rental and there’s just not enough affordable rentals being built,” Cherise Burda, executive director of City Building TMU at Toronto Metropolitan University, said of the current market.

Advertisement 5

Story continues below

Article content

“We’re doing something wrong. With all this effort and energy and resources from the national housing strategy, we’re not generating more affordable units. We need to have a really targeted focus for the next several years on building affordable rental because that’s where people are dropping down in the housing ladder, and that’s where we need effort and funding and resources the most.”

More than one-third of dwellings built from 2011 to 2021 were occupied and primarily maintained by millennial renters or owners in 2021, the largest share of any generation. Millennials also represented the largest share of condominium occupants (30.2 per cent).

-

Teranet home price index posts biggest drop in its history

-

Falling housing prices may not be leading to widespread buyers’ remorse the way you think

-

Housing inventory may reach crisis point in major Canadian centres, report finds

Advertisement 6

Story continues below

Article content

But Canadian housing starts have declined since Statistics Canada collected the data for its report. The decline in August was 2.8 per cent, to 267,443 units, on a seasonally adjusted annual basis, from 275,158 units in July, according to data released by Canada Mortgage and Housing Corp. The decline comes amid widespread concern about a shortage of housing supply in the country.

Residents of Atlantic Canada have historically been the most likely to be homeowners, and this remained true in 2021 even though rates declined. Indeed, the largest declines in the country were posted in Prince Edward Island, down to 68.8 per cent from 73.4 per cent, and Nova Scotia, down to 66.8 per cent from 70.8 per cent.

British Columbia had the third-largest decline in homeownership (66.8 per cent from 70 per cent), followed by Ontario, which was down to 68.4 per cent from 71.4 per cent.

Advertisement 7

Story continues below

Article content

Quebec had the smallest drop (to 59.9 per cent from 61.2 per cent), but still had the lowest homeownership rate in Canada, as has historically been the case. The Northwest Territories had the only increase.

Overall, the agency’s release indicates there is more pressure on the rental market regardless of increased household incomes, leaving the housing industry worried that both rental and homeowner prices are growing out of reach for many.

“We are going to push people out of our cities, out of our urban areas, even our suburban areas because people can’t afford to live there,” Burda said. “It’s really critical, if we want to maintain a workforce, to keep our cities functioning, to keep our cities welcoming. We need to focus on building more affordable housing.”

• Email: [email protected]

Advertisement

Story continues below