‘Moore’s Law’s dead,’ Nvidia CEO Jensen Huang says in justifying gaming-card price hike

Nvidia Corp. Chief Executive Jensen Huang on Wednesday said he thinks it’s going to be “a pretty terrific Q4 for Ada,” the company’s next-generation chip architecture unveiled this week, even as critics balk of a price hike during a softening in consumer demand.

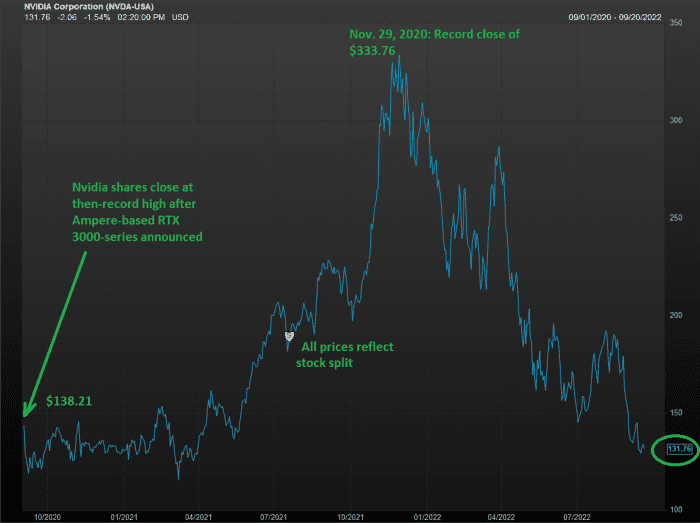

Nvidia NVDA,

A smattering of sales will hit the current quarter as Nvidia’s $1,599 flagship RTX 4090 goes on sale Oct. 12, with other cards like the $899 mid-tier 4080 to follow, and the “vast majority” of the launch occurring in the January-ending fiscal fourth quarter, Huang said.

Complaints circulated online about the unexpected price hike. For the respective class of chip, the 4090 is priced 7% above the 2020 launch price of the 3090 it’s meant to replace. (As for the 3090, an upgraded version of the original was going for $1,100 at Best Buy in an advertised $900 price drop.) Even more striking, the 4080 is priced 29% above the 2020 launch price of the 3080.

Lovelace succeeds Ampere, which was unveiled in May 2020, about two months into the COVID-19 pandemic, amid strong demand for gaming cards. Ampere-based gaming cards were introduced in September 2020.

Huang has certainly paid for that optimism in form of two quarters of “really harsh medicine” after the chip maker cut its outlook not just once, or twice, but three times and said $400 million in sales are now up in the air because of a U.S. ban on selling data-center products to China, and a $1.22 billion charge to clear Ampere-based inventory ahead of the Lovelace launch.

Read: Nvidia’s ‘China Syndrome’: Is the stock melting down?

“We are very, very specifically selling into the market a lot lower than is what’s selling out of the market, a significant amount lower than what’s selling out of the market,” Huang said. “And I’m hoping that by Q4 time frame, sometime in Q4, the channel would have normalized, and it would have made room for a great launch for Ada.”

To critics, Huang said he feels the higher price is justified, especially since the cutting-edge Lovelace architecture is necessary to support Nvidia’s expansion into the so-called metaverse.

“A 12-inch [silicon] wafer is a lot more expensive today than it was yesterday, and it’s not a little bit more expensive, it is a ton more expensive,” Huang said.

“Moore’s Law’s dead,” Huang said, referring to the standard that the number of transistors on a chip doubles every two years. “And the ability for Moore’s Law to deliver twice the performance at the same cost, or at the same performance, half the cost, every year and a half, is over. It’s completely over, and so the idea that a chip is going to go down in cost over time, unfortunately, is a story of the past.”

“Computing is a not a chip problem, it’s a software and chip problem,” Huang said.

“ “Moore’s Law’s dead…It’s completely over.””

Nvidia continues to grow software

That’s why, over the years, Nvidia has developed such an entrenched software ecosystem for its chips, that it has prompted some analysts to start looking at Nvidia as a quickly emerging software company.

This time around, Huang unveiled a big expansion of the company’s so-called metaverse platform with Nvidia Omniverse Cloud, the company’s first Software-as-a-Service and Infrastructure-as-a-Service product, to design, publish, operate and experience metaverse applications.

Another push into SaaS is Nvidia’s NeMo and BioNeMo large-language-model cloud AI services. LLMs are machine-learning algorithms that use massive text-based data sets to recognize, predict and generate human language. While NeMo is the general model service, BioNemo specializes in applying LLMs to biological and chemical research.

Seeing that Nvidia essentially offers an RTX 3080-gaming-chip-as-a-service with its GeForce NOW Priority service that dropped in November, charging subscribers $99.99 for six months of RTX 3080 gaming chip performance, MarketWatch asked Huang if he ever foresees the use of purchased, physical GPU hardware being replaced by cloud-based subscription services.

Read: Nvidia sales forecast falls about $1 billion short of expectations, stock falls

“I don’t think so,” Huang said. “There are customers who want to own, and there are customers who like to rent.”

“Some people would rather outsource the factory,” Huang said. “And remember, artificial intelligence is going to be a factory, it’s going to be the most important factory in the future.”

“A factory has raw materials come in, and something come out,” Huang said. “In the future, the factories are going to have data come in, and what comes out is going to be intelligence, models.”

As far as factories go, Nvidia has to be able to have options to serve all customers of scale. “Startups would rather have things in opex,” Huang said. “Large, established companies would rather have things in capex.”

Over the years, Nvidia has shown it isn’t resistant to transformation, going from that gaming-chip company to becoming the largest U.S. chip maker by market cap after data-center designers found Nvidia’s graphics-processing units, or GPUs, didn’t just make videogames prettier, their parallel processors were very useful in machine learning.

Several other tech hardware companies, like Cisco Systems Inc. CSCO,

Read: The end of one-chip wonders: Why Nvidia, Intel and AMD’s valuations have experienced massive upheaval

Of the 43 analysts who cover Nvidia, 31 have buy-grade ratings, 11 have hold ratings, and one has a sell rating. Of those, 13 lowered their price targets, resulting in an average target price of $202, down from a previous $202.51.

Shares closed Wednesday up 0.7% at $132.61, versus a 1.7% decline by the S&P 500 index SPX,

Over the year, Nvidia shares have fallen 55%, compared with a 36% drop by the PHLX Semiconductor Index SOX,

As for the Ampere run, Nvidia’s stock price has declined 4.7% since Sept. 1, 2020, when Nvidia unveiled its RTX 3000 series Ampere-based gaming chips, versus a 9.3% gain by the S&P 500 over that period.