Paul Volcker didn’t wait for inflation to get back to 2% before pivoting

Paul Volcker is back in the limelight after Federal Reserve Chair Jerome Powell approvingly cited his interest rate-hiking flurry to tame inflation back in the 1970s.

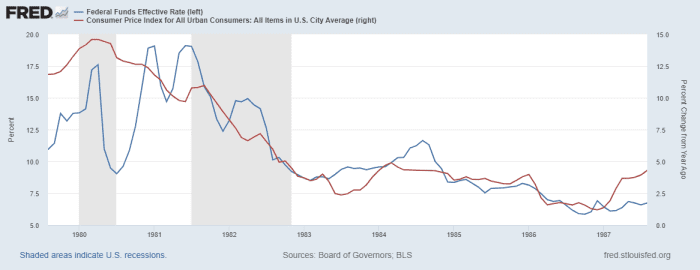

But what’s less talked about is that Volcker also cut interest rates. David Rosenberg, the founder and president of Rosenberg Research, points out the change in rate direction by Volcker started with inflation at 11.8%.

Granted, the rate path wasn’t a straight line down, but the chart shows he was willing to cut rates — or pivot, in today’s parlance — with inflation still at very high rates.

“In fact, through Volcker’s tenure, inflation only dipped below 2% at the very tail end — in April 1986. By the time that happened, the funds rate had plunged 1,200 basis points,” said Rosenberg.

Bringing the conversation back to the present situation, Rosenberg said the Fed may get rates up to 4% by early next year, and then pause.

“But interest rates by their nature are cyclical, and I sense a big reversal by this time next year,” he said. “Especially since we will be well on our way for the YoY trend in the core PCE deflator, based on the lags from the dollar and the commodity markets, to ease to and possibly through 3% by this time next year. And as Volcker showed, ‘keeping at it’ has a shelf life — and you don’t need to see 2% for this rates cycle to reverse course.

The 2-year yield TMUBMUSD02Y,