Live news: Historic immigration targets to level out in 2026, Ottawa says

The latest business news as it happens

Article content

Today’s top headlines

Advertisement 2

Story continues below

Article content

Article content

5:16 p.m.

Markets close: TSX, Wall Street jump as Fed holds on rates

Wall Street and Canada’s main stock index closed up after the United States Federal Reserve held interest rates for the second consecutive time.

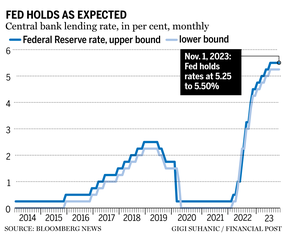

Members of the Federal Open Market Committee, the body that sets interests rates in the U.S., voted unanimously to maintain the Fed’s benchmark lending rate in the range of 5.25 per cent to 5.50 per cent.

Jerome Powell, chair of the Federal Reserve, indicated policymakers could raise rates when they meet next month. But, he also allowed that officials may be done with their tightening campaign. He said he wasn’t yet confident to judge whether monetary policy was restrictive enough to bring inflation back to the Fed’s two per cent target.

“It’s fair to say that’s the question we’re asking is ‘Should we hike more?’” Powell said, when asked whether a majority of policymakers still expected another rate increase would be necessary this year.

Markets liked what they heard.

On Wall Street, the S&P 500 was up 1.05 per cent to close at 4,237.86. The Dow Jones Industrial Average and the Nasdaq composite rose 0.67 per cent and 1.64 per cent, respectively, closing at 33,274.58 and 13,061.47.

Advertisement 3

Story continues below

Article content

In Toronto, the S&P/TSX composite index rose 1.09 per cent to 19,079.00 in a broad-based rally led by utilities, telecom and technology stocks.

The top three performers on the TSX were Brookfield Infrastructure Partners LP., up 10.8 per cent, Centerra Gold Inc., up 9.08 per cent, and Dye and Durham Ltd., up 7.66 per cent.

Brookfield rose after it reported higher funds from its operations in the third quarter.

The Canadian dollar traded for 72.19 cents U.S., down 0.21 per cent.

The December crude oil contract was down 0.15 per cent to US$80.90 per barrel on news that U.S. stockpiles rose nationwide and at the nation’s largest storage hub in Cushing, Okla.

The December gold contract was down US$3.00 at US$1,991.30 an ounce.

The Canadian Press, Financial Post, Bloomberg

4:06 p.m.

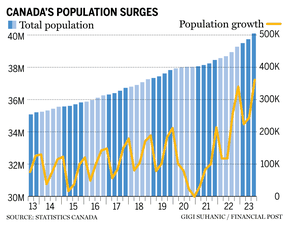

Canada’s immigration targets to level out at 500,000 in 2026

Prime Minister Justin Trudeau’s government is slowing down the increases in its key immigration targets amid growing concerns that record population gains are exacerbating housing shortages.

Canada aims to welcome 485,000 permanent residents next year and 500,000 in 2025, the same levels announced in last year’s plan, Immigration Minister Marc Miller announced Wednesday.

Article content

Advertisement 4

Story continues below

Article content

Starting in 2026, the government will stabilize the levels at a record half a million. That’s the first time in a decade that the government won’t raise its annual targets.

The climbdown from continued increases in immigration levels suggests the government is trying to placate criticisms that explosive population growth has overwhelmed housing and infrastructure. Yet keeping a record target of 500,000 shows it’s also sticking with its broader plan to rapidly add more workers to stave off economic decline from an aging populace.

“By stabilizing the number of newcomers, we recognize that housing, infrastructure planning, and sustainable population growth need to be properly taken into account,” Miller said in Ottawa. “We are striking the appropriate balance to grow Canada’s economy, while maintaining our humanitarian traditions, supporting Francophone immigration, and developing a more collaborative approach to levels planning with our partners.”

While permanent residents aren’t the only newcomers the country is receiving in record numbers, they’re the backbone of Canada’s immigration system. These arrivals, along with international students and temporary workers, helped bring the country’s population growth over a one-year period to July to a record 2.9 per cent, among the world’s fastest rates.

Advertisement 5

Story continues below

Article content

Since Trudeau came into power in 2015, his government was able to count on wide public support to constantly raise immigration targets. Thanks to the country’s relatively isolated geography sharing land borders with only the United States, Canada can better control the inflow compared with many of its peer countries, where large influxes of undocumented migrants have become a political issue.

For two decades, a majority of Canadians rejected the premise that the country accepted too many newcomers, and Canada stood out globally for its attitude and approach to immigration. But soaring housing prices have pushed support for immigration levels to their lowest point in two decades. That’s a fresh challenge for a government already facing an outcry over an affordability crisis.

Bloomberg

3:08 p.m.

Calgary home sales rise 17 per cent for October to near record for month

The Calgary Real Estate Board says 2,171 homes sold in October, marking a 17 per cent increase compared with the same month last year and among the highest levels it has ever reported for October.

Advertisement 6

Story continues below

Article content

New listings also rose compared with last year, reaching 2,684 units, which mark the most reported for October since 2015.

But inventory levels in October remained more than 40 per cent lower than what’s traditionally available for the month as relatively strong sales prevented any significant shift.

The unadjusted residential benchmark price rose to $571,600, nearly 10 per cent higher than October 2022.

CREB chief economist Ann-Marie Lurie says supply levels remain a challenge in the market and “it will take some time to see a shift toward more balanced conditions and ultimately more price stability.”

The board reported record high sales of apartment condominiums thanks to big gains in new listings, and noted that year-to-date price gains for the category have occurred across every district in the city.

The Canadian Press

2 p.m.

Fed keeps key interest rate on hold at 22-year high

The United States Federal Reserve kept its key short-term interest rate unchanged Wednesday for a second straight time but left the door open to further rate hikes if inflation pressures should accelerate in the months ahead.

Advertisement 7

Story continues below

Article content

The Fed said in a statement after its latest meeting that it would keep its benchmark rate at about 5.4 per cent, its highest level in 22 years. Since launching the most aggressive series of rate hikes in four decades in March 2022 to fight inflation, the Fed has pulled back and has now raised rates only once since May.

The statement noted that recent tumult in the financial markets has sent longer-term interest rates up to near 16-year highs and contributed to higher borrowing rates across the economy.

“Tighter financial and credit conditions for households and businesses,” it said, “are likely to weigh on economic activity.”

That reference echoed recent comments by Fed officials that higher yields — or interest rates — on the 10-year Treasury note could impose a dampening impact on the economy, cool inflation and substitute for an additional rate hike by the Fed.

Long-term Treasury yields have soared since July, the last time the Fed raised rates, swelling the costs of auto loans, credit card borrowing and many forms of business loans. Nationally, the average long-term fixed mortgage rate is nearing eight per cent, its highest level in 23 years.

Advertisement 8

Story continues below

Article content

Economists at Wall Street banks have estimated that sharp losses in the stock market and higher bond yields could have a depressive effect on the economy equal to the impact of three or four quarter-point rate hikes by the Fed.

Those tighter credit conditions, though, have yet to cool the economy or slow hiring as much as the Fed had expected. Growth soared at a 4.9 per cent annual pace in the July-September quarter, powered by robust consumer spending, and hiring in September was strong. On Wednesday, the government said employers posted a sizable 9.6 million job openings last month, well below the peak of early last year but still sharply above pre-pandemic levels.

The Associated Press

1:45 p.m.

Beer tax to rise ‘damaging’ 4.7% unless Freeland intervenes, industry group warns

Canadians may have to swallow higher beer prices if the industry doesn’t get some tax relief in the upcoming fall fiscal update, the association representing brewers says.

Federal beer excise duties will rise 4.7 per cent in April 2024 without intervention from Finance Minister Chrystia Freeland, Beer Canada said in a press release on Nov. 1.

Advertisement 9

Story continues below

Article content

The increase is the result of a “rigid inflation-indexing formula” added to Canada’s Excise Act in 2017, according to the organization, which advocates on behalf of its members who brew 90 per cent of all beer consumed by Canadians.

Under the Excise Act, the rates of excise duty on beer are adjusted annually every April 1, based on changes to the consumer price index.

“Freezing or capping beer tax hikes in this era of sticky high inflation is a practical, sensible policy lever that should be included in the upcoming Fall Economic Statement,” said CJ Hélie, president of Beer Canada.

Freeland is expected to announce a date for the fall fiscal update soon.

This isn’t the first time Beer Canada has sought relief from Ottawa for the excise tax. Last year’s federal budget capped the increase in the beer tax at two per cent instead of the expected 6.3 per cent.

“We had tremendous support from members of Parliament from all parties last year to ensure we avoided a catastrophic 6.3 per cent tax hike, but unfortunately persistent higher than expected inflation means a damaging 4.7 per cent beer tax increase next year unless Parliament takes appropriate action again,” Hélie said.

Advertisement 10

Story continues below

Article content

Gigi Suhanic, Financial Post

12:47 p.m.

Copper miner First Quantum has lost half its value this week

First Quantum Minerals Ltd. is plunging again today, bringing the total decline this week to more than 50 per cent as uncertainty deepens over the future of its flagship copper mine in Panama.

The Canadian metals producer tumbled as much as 15 per cent today in Toronto, extending the decline to about 51 per cent in the three trading sessions since Panama’s government said it planned to hold a referendum for voters to decide whether to extend or revoke First Quantum’s mining contract. Shares of the Vancouver-based company are trading at their lowest level in three years.

This week’s plunge has wiped out about $9.6 billion from First Quantum’s market value. The decline comes as investors assess the outlook for Cobre Panama, one of the world’s biggest and newest copper mines and First Quantum’s most important asset.

The future of the mine has been cast into doubt after weeks of civil unrest in the Central American nation over its new operating contract, which would extend the company’s mining licence by 20 years. Panama President Laurentino Cortizo said on Sunday that the government plans to hold a referendum on Dec. 17, though it’s still not clear if the vote can take place.

Advertisement 11

Story continues below

Article content

Doug Alexander, Bloomberg

12 p.m.

Midday markets: Stocks gain ahead of Fed decision

U.S. stocks are drifting higher at midday as Wall Street waits to hear what will come out of the United States Federal Reserve’s latest announcement on interest rates.

In New York, the Dow Jones industrial average was up 110.37 points at 33,163.24. The S&P 500 index was up 22.17 points at 4,215.97, while the Nasdaq composite was up 90.57 points at 12,941.81.

Strength in the utility stocks helped lead Canada’s main stock index higher. The S&P/TSX composite index was up 105.85 points at 18,979.32.

The Canadian dollar traded for 72.12 cents U.S. compared with 72.09 cents U.S. on Tuesday.

The Canadian Press

10:45 a.m.

WeWork to file for bankruptcy as soon as next week

WeWork Inc. is preparing to file for bankruptcy as soon as next week, according to people with knowledge of the matter.

The co-working company plans to seek Chapter 11 protection in New Jersey, said the people, who asked not to be identified because discussions are private. Talks are ongoing and plans could change, the people added.

Advertisement 12

Story continues below

Article content

Chapter 11 bankruptcy allows a company to keep operating while it works out a plan to repay its debts. It also opens up a basket of legal tools that can aid in a turnaround, like abandoning pricey leases.

A WeWork spokesperson declined to comment. The Wall Street Journal earlier reported on the timing of the filing.

WeWork skipped interest payments on some bonds at the beginning of the month and on Tuesday disclosed a seven-day forbearance agreement with noteholders after an earlier grace period expired. It also said it would not make a US$6.4-million payment due Wednesday on a separate bond.

The company and its backers, including SoftBank Group Corp. and bondholders including King Street Capital Management, have been locked in discussions over who will take the keys to the firm as part of its latest restructuring, Bloomberg previously reported.

WeWork’s potential bankruptcy caps a rapid downfall for the firm, which in March struck a deal to slash US$1.5 billion of debt in an out-of-court restructuring. As of June 30, the company had US$2.9 billion of long-term borrowings, along with more than US$13 billion of long-term lease obligations.

Advertisement 13

Story continues below

Article content

WeWork shares plunged more than 50 per cent Wednesday morning to trade as low as US$1.05. The stock has lost 98 per cent of its value this year.

Bloomberg

10:20 a.m.

Ontario scraps its portion of HST on purpose-built rentals

Ontario is scrapping its portion of the harmonized sales tax on eligible purpose-built rental housing in an effort to spur construction.

The province has been saying it would remove its eight per cent portion of the tax if the federal government dropped the five per cent goods and services tax on rental housing builds.

The federal government did that last month.

Ontario Finance Minister Peter Bethlenfalvy says the changes will apply to new rental housing units such as apartment buildings, student housing and senior residences built for long-term care rental accommodation.

The rebates apply to projects that began construction from this past September until Dec. 31, 2030.

To qualify, new residential units must be in buildings with a minimum four private apartment units or 10 private rooms, and be in a building where 90 per cent of units are long-term rentals.

Advertisement 14

Story continues below

Article content

The Canadian Press

10 a.m.

Stock markets are open

Stocks are drifting Wednesday as Wall Street waits to hear what will come out of the United States Federal Reserve’s latest announcement on interest rates.

The S&P 500 was 0.2 per cent higher in early trading, coming off its third straight losing month largely because of higher yields in the bond market. The Dow Jones Industrial Average was down 11 points, or less than 0.1 per cent, as of 9:40 a.m. Eastern time, and the Nasdaq composite was 0.3 per cent higher.

In Canada, the S&P/TSX composite index opened up 0.38 per cent.

The Associated Press

9 a.m.

Thomson Reuters to invest more than US$100 million a year in AI

Thomson Reuters Corp. announced plans to invest more than US$100 million a year in generative artificial intelligence.

The company said Wednesday it is building AI-powered capabilities for its products including a tool for its Westlaw Precision service that will launch Nov. 15 for customers in the United States.

“AI will revolutionize and transform the future of work for professionals across the globe,” Thomson Reuters chief executive Steve Hasker said in statement.

Advertisement 15

Story continues below

Article content

“Professionals have our unwavering commitment and support as they safely navigate the opportunities and challenges provided by the evolving AI landscape.”

Thomson Reuters bought Casetext, which uses advanced artificial intelligence and machine learning to build technology for lawyers, earlier this year.

It said it is looking to build AI capabilities, make acquisitions, find partners and train its staff to use AI across its business.

The plans to invest in AI came as the company reported a third-quarter profit of US$367 million, up from US$228 million in the same quarter last year.

The company, which keeps its books in U.S. dollars, says the profit amounted to 80 cents U.S. per diluted share for the quarter ended Sept. 30.

The result compared with a profit of 47 cents U.S. per diluted share a year earlier.

Revenue totalled US$1.59 billion compared with US$1.57 billion in the same quarter last year.

The company says the increase was helped by growth in recurring revenues, offset in part by net divestitures.

On an adjusted basis, Thomson Reuters says it earned 82 cents U.S. per share, up from an adjusted profit of 58 cents U.S. per share a year earlier.

Advertisement 16

Story continues below

Article content

The Canadian Press

8:30 a.m.

Canada Goose cuts full-year guidance, shares fall

Canada Goose Holdings Inc. shares fell after it cut its financial guidance for the full year as it reported a second-quarter profit attributable to shareholders of $3.9 million, up from $3.3 million a year earlier.

The luxury parka maker says it now expects total revenue for its 2024 financial year between $1.2 billion and $1.4 billion, compared with its earlier guidance for between $1.4 billion and $1.5 billion.

Shares fell as much as seven per cent in pre-market trading.

The company also says it expects adjusted net income per diluted share between 60 cents and $1.40 for its full year, compared with its earlier guidance for between $1.20 and $1.48.

The updated outlook came as Canada Goose said it earned four cents per share for the quarter ended Oct. 1 compared with three cents per share in the same quarter last year.

Revenue for the quarter totalled $281.1 million, up from $277.2 million a year earlier.

On an adjusted basis, the company says it earned 16 cents per share in its latest quarter compared with an adjusted profit of 19 cents per share for the same quarter last year.

Advertisement 17

Story continues below

Article content

The Canadian Press

8 a.m.

Oil and gas companies face era of credit downgrades: Fitch

Much of the fossil fuel industry may be facing an era of credit downgrades if producers prove too slow to adapt to a low-carbon future, according to Fitch Ratings.

Oil and gas companies stand out as the most vulnerable issuers in an analysis by Fitch, which sought to gauge how businesses will cope with climate risks such as increasingly stringent emissions regulations.

Fitch’s models show that more than a fifth of global corporates across regions and sectors face a material risk of a ratings downgrade due to an “elevated” level of climate vulnerability over the coming decade. Half of those issuers are in the oil and gas industry, while coal and utilities also stand out as being particularly exposed to the risk of downgrades, the analysis shows.

What’s more, over half the global issuers potentially facing downgrades due to climate risk are currently investment grade, according to Fitch, which based its report on a sample of 715 companies.

The International Energy Agency estimates that global demand for oil will peak this decade. But other researchers warn that the tide may turn even sooner. According to Inevitable Policy Response, a forecasting group whose data was used in the Fitch analysis, peak oil may come in 2025, after which demand will sink more than 60 per cent over the next two-and-a-half decades.

Advertisement 18

Story continues below

Article content

The scale of the demand slump ahead “is a very big number,” Sophie Coutaux, head of ESG for corporate ratings at Fitch, said. There’s now a “big question mark” as to whether producers will “be able to adapt,” she said.

The warning comes as much of the oil industry doubles down on its core business, after the war in Ukraine spurred an energy crisis that fanned fossil fuel prices. Oil majors have used cash flows inflated by temporarily higher prices to enrich shareholders with buybacks, and expand within their sectors through acquisitions.

Bloomberg

7:30 a.m.

Conservatives hold lead over Liberals as 57% of Canadians say they trust Bank of Canada: poll

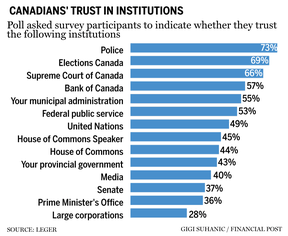

The Conservative party is maintaining a steady lead over Prime Minister Justin Trudeau’s Liberals, a new poll suggests, at a time when Canadians are reporting limited trust in their institutions.

Pierre Poilievre’s Tories are 14 percentage points ahead of the governing party, with 40 per cent of respondents in the survey saying they would vote Conservative, 26 per cent Liberal and 17 per cent NDP if an election were held that day. The poll was conducted by Leger.

Advertisement 19

Story continues below

Article content

The poll conducted from Friday to Sunday also suggested that people in Canada are generally more trusting of institutions than their neighbours to the south — especially when it comes to federal election administrators, the countries’ top courts and the police.

Nonetheless, majorities of Canadians said they don’t trust federal legislative bodies, provincial governments, the media and large corporations.

A total of 1,632 Canadian respondents participated in the web survey, along with 1,002 Americans. It cannot be assigned a margin of error because online polls are not considered truly random samples.

Nearly two-thirds of Canadian respondents, or 63 per cent, said they are dissatisfied with the federal government led by Trudeau.

That result was recorded in the days after the prime minister’s announcement that his government would institute a temporary pause in applying the carbon price to home heating oil — the Liberals’ first climbdown on their carbon-pricing policy and one that comes amid heavy Conservative emphasis on Poilievre’s “axe the tax” campaign.

Advertisement 20

Story continues below

Article content

Poilievre is in the lead when people are asked who they see as the best potential prime minister, with 29 per cent of Canadians choosing him, 19 per cent choosing Trudeau and 15 per cent choosing NDP Leader Jagmeet Singh. Another 13 per cent said no current federal leader would make a good prime minister.

Police services are the most trusted institution in Canada, with 73 per cent of respondents reporting they trust police.

At a time of high inflation when politicians, including Poilievre, have criticized the Bank of Canada for its macroeconomic policies, it still earns the trust of a little more than half of Canadians, or 57 per cent.

The Canadian Press

Before the opening bell: Stocks cautious ahead of Fed decision

World shares logged meagre gains as investors remained cautious ahead of a decision on interest rates Wednesday by the United States Federal Reserve.

Oil prices were higher as Israeli airstrikes levelled apartment buildings in Gaza and ground troops battled Hamas militants inside the besieged territory. In recent days, Israeli troops have advanced toward the outskirts of Gaza City from the north and east. Worries that fighting could escalate beyond the latest Israel-Hamas war, potentially disrupting supplies, have roiled oil markets in recent weeks.

Advertisement 21

Story continues below

Article content

U.S. benchmark crude oil advanced 86 cents U.S. early Wednesday to US$81.88 a barrel. It lost 29 cents U.S. on Tuesday to US$81.02. Brent crude, the international standard, picked up 85 cents U.S. to US$85.87 a barrel.

Germany’s DAX edged up less than four points to 14,813.13 and the CAC 40 in Paris gained less than 0.1 per cent to 6,891.38. Britain’s FTSE 100 was up less than one point at 7,322.05.

The futures for the S&P 500 and the Dow industrials were 0.4 per cent lower ahead of the decision later Wednesday by the Federal Reserve on interest rates. The overwhelming expectation is that the Fed will keep its overnight interest rate steady. The bigger question is how long it will keep that main rate high.

The Associated Press

What to watch today

The United States Federal Reserve will release its latest interest rate decision today at 2:30 p.m. A press conference from chair Jerome Powell will follow.

Bank of Canada governor Tiff Macklem and senior deputy governor Carolyn Rogers will appear before the Standing Senate Committee on Banking, Commerce and the Economy.

Data releases this morning include U.S. construction spending, ISM Manufacturing, job openings and light vehicle sales.

On the earnings front, we’ll get reports from companies including Canada Goose Holdings Inc., Spin Master Corp., Airbnb Inc. and Nutrien Inc., among others.

Related Stories

Need a refresher on yesterday’s top headlines? Get caught up here.

Additional reporting by The Canadian Press, Associated Press and Bloomberg

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.