5 Beaten-Down Stocks That Could Soar in 2024

Now is a great time to make a list and check it twice — but unlike Santa Claus, I’m not talking about a gift list. Instead, this list is all about stocks to buy in order to set yourself up for an exciting investment future. You should first prioritize buying shares of companies that have proven themselves by delivering earnings growth over time and that still offer solid long-term prospects.

Once you position these stocks as the backbone of your portfolio, you then may want to look for a few beaten-down stocks that might be ready for a rebound. But not just any beaten-down stocks. I’m talking about ones that have what it takes to grow earnings down the road. They may offer your portfolio an extra boost in 2024 as well as lasting growth. Let’s check out five promising stocks that could soar as early as next year.

1. Ginkgo Bioworks

Ginkgo Bioworks (NYSE: DNA) specializes in the engineering of organisms that helps players in various industries — from pharma to materials — develop their products. Using Ginkgo’s optimized organisms, these customers can make gains in efficiency and quality.

This has helped Ginkgo land deals with some of the world’s biggest companies, such as Pfizer. The pharma giant recently signed a deal — worth as much as $331 million for Ginkgo — to use Ginkgo’s platform for the development of RNA medicines. And Ginkgo has seen growth in its active programs across sectors, with an increase of 36% in the most recent quarter year over year. The company also aims to grow its biosecurity business into a recurring revenue one.

Ginkgo isn’t yet profitable but has more than $1 billion in cash to help sustain it along the path. Today, it’s worth opening up a position in this organism specialist, trading at less than $2 a share.

2. Etsy

Etsy (NASDAQ: ETSY) offers sellers a platform to sell their handmade goods, which appealed to shoppers during the pandemic when they favored e-commerce. The good news is Etsy has kept those gains. For example, in the most recent quarter, it reported a double-digit four-year compound annual growth rate in revenue, gross merchandise sales, and adjusted EBITDA.

Of course, Etsy has faced some weakness in the past year as a tough economy weighed on demand for discretionary items. But the company has managed through this rough patch, and in the recent quarter reported a profit as well as a cash level of more than $1 billion. The company also said active buyers reached a record high of 92 million, showing shoppers are still flocking to Etsy. So, there’s reason to be confident about the business moving forward.

As Etsy returns to its path of growth, the stock, which has fallen 30% this year, could take off — and that makes it a great buy today, for only 17 times forward earnings estimates.

3. Teladoc Health

Teladoc Health (NYSE: TDOC) has become a giant in the world of telemedicine, serving more than half of Fortune 500 companies. But the company fell out of favor over the past couple of years as investors worried about whether it would reach profitability.

Teladoc took action, this year implementing a plan to balance revenue growth with efforts to become profitable. Things are moving in the right direction, with the company reporting results that met or beat expectations in the most recent quarter. The telemedicine player’s focus on chronic care has driven revenue gains, showing that its investment in this area could pay off over time.

Most recently, Teladoc launched an operational review of its business to ensure it’s keeping the focus on core products and to evaluate cost structure. This should help Teladoc further boost earnings and win the trust of shareholders.

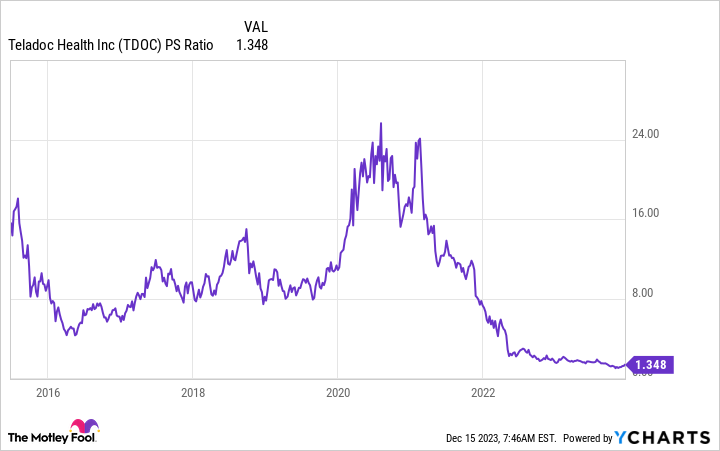

Today, trading close to its lowest ever in relation to sales, Teladoc is a top stock to bet on for a rebound.

TDOC PS Ratio data by YCharts

4. Chewy

As investors fled stocks linked to consumer spending, they turned their backs on Chewy (NYSE: CHWY). But this e-commerce pet supplies shop deserves a second look. Here’s why. Even in a difficult economic environment, Chewy has managed to grow net sales and the spend of its active customers.

And speaking of active customers, they have grown Chewy’s Autoship — a service that automatically reorders and send your favorite products to you — into a key part of the company’s business. Autoship sales climbed 13% in the most recent quarter and make up more than 76% of total sales.

Autoship’s strength proves customers return to Chewy, and that’s a positive sign for future revenue. Another reason to like Chewy today is its recent expansion into Canada, a market that could become just as significant as the U.S. for the company.

Finally, the e-commerce player reached a huge milestone last year when it became profitable. All of this makes Chewy an excellent growth stock to pick up now.

5. Intellia Therapeutics

Intellia Therapeutics (NASDAQ: NTLA) works in the hot area of gene editing, developing potential treatments that fix faulty genes responsible for disease.

The company’s candidates remain in the clinical trial stage right now, but recent approvals of other companies’ gene-editing therapies could offer Intellia a lift moving forward. That’s because we now see regulators are willing to offer a nod to treatments based on this newish technology. CRISPR Therapeutics recently won the world’s first authorization of a CRISPR-based gene editing treatment.

Intellia doesn’t have to worry about competition from CRISPR Therapeutics, though, as the companies’ programs address different diseases. And in more good news, Intellia’s lead candidate, for transthyretin amyloidosis with cardiomyopathy, is beginning phase 3 studies before the end of this year.

Finally, Intellia looks financially solid, with more than $900 million in cash that should help support the company as it works to bring a first product to market.

So, in the new year, any good news from other gene-editing companies and/or progress in Intellia’s own clinical trials could send the shares soaring.

Should you invest $1,000 in Ginkgo Bioworks right now?

Before you buy stock in Ginkgo Bioworks, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Ginkgo Bioworks wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 11, 2023

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends CRISPR Therapeutics, Chewy, Etsy, Intellia Therapeutics, Pfizer, and Teladoc Health. The Motley Fool has a disclosure policy.

5 Beaten-Down Stocks That Could Soar in 2024 was originally published by The Motley Fool