Missed Out on Nvidia Buy This Magnificent Artificial Intelligence (AI) Stock Before It Soars At Least 45% in 2024

Nvidia (NASDAQ: NVDA) has been one of the hottest stocks on the market in 2023, with eye-popping gains of 235%. That impressive surge is justified thanks to the astronomic acceleration in the chipmaker’s top and bottom lines on the back of booming demand for artificial intelligence (AI) chips.

However, the big pop in Nvidia stock this year inflated its valuation. It is now trading at 27 times sales, which is higher than its five-year average price-to-sales ratio of 20. The trailing earnings multiple stands at 65.

While Nvidia seems capable of justifying that valuation thanks to its dominant position in the market for AI chips, which is likely to translate into terrific growth in 2024, investors may be looking for a cheaper alternative to capitalize on the proliferation of AI.

Enter Micron Technology (NASDAQ: MU). Shares of the memory specialist have shot up 74% this year, and its latest earnings report tells us that more upside is in the cards in 2024 thanks to AI. What’s more, Micron stock is trading at a very attractive valuation despite its rally. Let’s look at the reasons why buying this chipmaker is a no-brainer right now.

Micron Technology is set to ride the AI wave

Micron Technology released its fiscal 2024 first-quarter results (for the three months ended Nov. 30) on Dec. 20. The company’s revenue jumped 16% year over year to $4.7 billion, exceeding its guidance of $4.4 billion and Wall Street’s expectation of $4.58 billion.

Micron reported a non-GAAP (generally accepted accounting principles) loss of $0.95 per share for the quarter. While that was higher than the year-ago period’s loss of $0.04 per share, the figure was smaller than Micron’s guidance of a loss of $1.07 per share. Analysts were expecting Micron to report a loss of $1.01 per share. However, the improving conditions in the memory market helped the chipmaker outperform expectations.

The memory market was in dire straits earlier thanks to oversupply. Demand for memory chips fell as sales of smartphones and personal computers (PCs) dropped off a cliff, leaving memory manufacturers with excess supply that weighed on pricing. The good news is that Micron is now witnessing an “improved supply demand environment in the current calendar quarter [that] gives us additional confidence in the trajectory of our business.”

CEO Sanjay Mehrotra added on the latest earnings conference call, “We have driven a strong inflection in industry pricing this calendar quarter, which will allow us to benefit from higher prices earlier in our fiscal year compared to prior plans.”

Micron expects memory prices to grow at a faster pace than it was anticipating earlier. One of the reasons why that’s the case is because the adoption of generative AI is driving stronger memory demand. Mehrotra says that Micron is “in the very early stages of a multiyear growth phase catalyzed and driven by generative AI,” and the company is “already seeing strong demand driven by early deployment of AI solutions, which will only accelerate over time.”

Micron sees AI creating the demand for more memory, not only in servers but also due to the deployment of this technology in smartphones and PCs. That’s not surprising, as PC manufacturers are already betting on AI to be the next big growth driver for this market, while tech giants are reportedly working to bring generative AI to smartphones.

All this explains why Micron is anticipating its key business segments to grow in the current fiscal year. In the data center business, for instance, Micron is forecasting server shipments to increase in the mid-single digits in 2024 following a double-digit decline in 2023. More importantly, the company’s high-bandwidth memory (HBM) chips are in the final stages of qualification for deployment in Nvidia’s H200 and Grace Hopper GH200 chip platforms, which are set to hit the market in 2024.

As a result, Micron management is confident of generating several hundred million in HBM revenue in fiscal 2024, followed by another year of growth in 2025. With the demand for HBM set to grow rapidly in the long run, Micron could win big by supplying its chips to Nvidia, considering that the latter is looking to substantially increase its production in 2024 thanks to the arrival of its new AI chip platforms.

Similarly, Micron is forecasting growth in both the PC and the smartphone markets in 2024 following sharp declines last year. Management also points out that the ramp-up of AI-enabled PCs in the second half of 2024 is likely to increase its addressable market to the tune of 4GB (gigabytes) to 8GB of dynamic random access memory (DRAM) per unit. Counterpoint Research estimates that shipments of AI-powered PCs could increase at an annual rate of 50% through 2030, and this should further contribute to strong memory demand in the long run.

So it’s not surprising to see why the memory market’s revenue is expected to jump a healthy 45% in 2024 to $130 billion, according to market research firm IDC. This robust end-market growth is the reason why Micron’s financial performance is anticipated to improve sharply next year.

The stock looks set for solid gains in 2024

Micron’s guidance for the current quarter suggests that its growth is set to accelerate. The company is forecasting $5.3 billion in revenue in the current quarter, which would translate into a year-over-year jump of 43%. Additionally, the chipmaker expects its adjusted net loss to drop to $0.28 per share from $1.91 per share in the prior-year period.

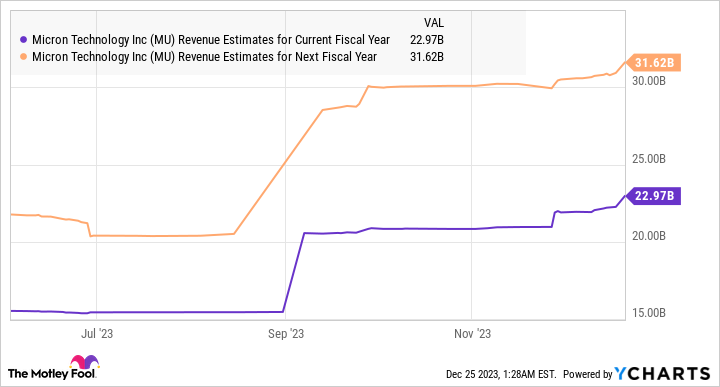

Though Micron hasn’t issued a full-year revenue forecast, analysts are expecting its top line to jump nearly 48% in fiscal 2024 to $23 billion, followed by another year of robust growth in fiscal 2025.

Assuming the company does hit $23 billion in revenue in the ongoing fiscal year, which it seems capable of doing, its market cap could jump to $138 billion based on its current sales multiple of 6. That would represent a 45% upside from current levels. And Micron’s price-to-sales ratio is much lower than Nvidia’s, so it won’t be surprising to see the market reward it with a higher multiple thanks to its AI-fueled growth.

That could lead to a stronger jump in Micron’s shares, which is why investors looking to buy a fast-growing AI stock at an affordable valuation should consider buying it hand over fist right now.

Should you invest $1,000 in Micron Technology right now?

Before you buy stock in Micron Technology, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Micron Technology wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Missed Out on Nvidia? Buy This Magnificent Artificial Intelligence (AI) Stock Before It Soars At Least 45% in 2024 was originally published by The Motley Fool