Posthaste: One of the last bastions of affordable housing in Canada is losing its edge

Property values in Calgary expected to keep climbing

Article content

Article content

Calgary’s booming housing market has been a bright spot in recent months, but there are signs the affordability edge that has been driving demand there is being eroded.

The latest version of Royal Bank of Canada’s long-running housing affordability index shows that Calgary, deemed “Canada’s housing hotspot in 2023,” is experiencing a deterioration in affordability, with the share of household income dedicated to home ownership rising three percentage points to 47.6 per cent in the third quarter, the third-largest increase among the markets RBC follows.

Advertisement 2

Story continues below

Article content

“Calgary’s affordability position compares well to other major markets but its advantage is diminishing,” said Robert Hogue, an economist with RBC and the author of the report. “And with inventories persistently low, this has kept property values on a steady incline. We expect this uptrend to continue, though more balanced demand-supply conditions are likely to slow the pace down,” he said.

While the bar is rising for homeownership in the western city, “the already-dire situation got worse for buyers last quarter” in the Vancouver area where the cost of owning a home reached an “astounding” 102.6 per cent. In Toronto, affordability deteriorated to its worst level on record at 84.1 per cent with Victoria rounding out the top three at 76.1 per cent after backtracking on improvement in the first and second quarters.

Numbers like these have left less than half of Canadian households able afford to own a home in 2023, a significant deterioration from 2019 when six in 10 had the means to become homeowners, the report said. When the index began in 1985 ownership costs as a percentage of income came in at 42.1 per cent, falling to a low of 33.9 per cent in October 2001.

Article content

Advertisement 3

Story continues below

Article content

Still, it may be that Canadians have passed through the worst of the housing affordability crucible, the report suggests.

The Canadian composite, which encompasses all types of housing, peaked at an all-time high of 62.5 per cent in July before falling ever so slightly to 62.4 per cent in October. RBC is forecasting for affordability to slowly improve in the coming year and into 2025 with ownership costs as a percentage of income dropping to 61 per cent in January 2024 and 56.3 per cent 12 months later.

“We see the situation improving from now on as home prices drift lower or stabilize in the majority of markets, and household income continues to grow at a solid pace,” said Hogue. “The trend will become even friendlier once the Bank of Canada starts cutting rates — around mid-year in our view.”

Hogue is one of many economists who are predicting that the Bank of Canada’s rate-hiking cycle is likely over and that it could start cutting as soon as the second quarter of this year as the Canadian economy weakens further under higher borrowing costs.

Housing seems to be capitulating to the additional costs being imposed by higher interest rates, recent data indicate.

Advertisement 4

Story continues below

Article content

National home prices are coming down month over month though they remain up from a year ago, according to the Canadian Real Estate Association. The actual average price of a home in Canada in November was $646,134, down 8.9 per cent from June when the Bank of Canada sprung an interest rate hike on unsuspecting markets after pausing earlier in the year.

While affordability looks set to improve “modestly,” Hogue acknowledges “there is still a lot of ground to make up.”

Sign up here to get Posthaste delivered to your inbox.

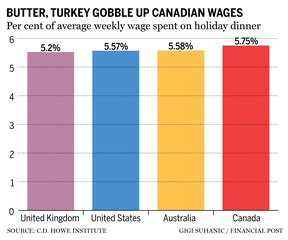

Canadians will have to spend more of their average weekly wage on this year’s holiday dinner than people in the United States, United Kingdom and Australia, says the C.D. Howe Institute.

The think-tank went shopping in the four countries for a “nearly identical basket of holiday fixings” — picking the lowest priced items in each category.

Butter, turkey and Canada’s supply management system were the biggest culprits for driving the Canadian bill higher, the analysis said.

“When shoppers are not able to buy these items on sale, the Canadian price stands out, particularly relative to shoppers in the U.K. and Australia. The pre-U.S. Thanksgiving sale prices for turkey allowed shoppers there to see considerably lower prices than most Canadian shoppers would likely ever see,” C.D. Howe said in the note.

Advertisement 5

Story continues below

Article content

Canadian butter prices are also proportionally higher than elsewhere.

“Australians have nearly identical average incomes to Canadians and see comparable prices in most goods except for, you guessed it, butter and turkey,” the institute said.

- The Department of Finance Canada publishes financial results for October 2023

- Today’s data: Canadian GDP for October; United States new home sales, various measures of the personal consumption expenditures deflator, durable goods orders

Get all of today’s top breaking stories as they happen with the Financial Post’s live news blog, highlighting the business headlines you need to know at a glance.

One tax refund each year is essentially an interest-free loan to the government for up to 16 months, writes tax expert Jaime Golombek. Instead of waiting until May 2025 to get your 2024 tax refund, Golombek explains how you can effectively begin receiving it on each paycheque and start investing it, for example, in some safe money market funds or high-interest savings account. Find out how here.

Related Stories

Today’s Posthaste was written by Gigi Suhanic, with additional reporting from The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at [email protected], or hit reply to send us a note.

Article content

Comments