Top headlines: Court rulings force rethink of oil and gas emissions cap

The latest business news as it happens

Article content

Top headlines

Article content

4:34 p.m.

Market close: TSX gains more than 200 points as U.S. stock markets also rise

Advertisement 2

Story continues below

Article content

Canada’s main stock index gained more than 200 points on broad-based strength led by base metals, industrials and telecom stocks, while U.S. markets also rose.

The S&P/TSX composite index closed up 216.58 points at 20,452.87.

In New York, the Dow Jones industrial average was up 294.61 points at 36,245.50.The S&P 500 index was up 26.83 points at 4,594.63, while the Nasdaq composite was up 78.81 points at 14,305.03.

The Canadian dollar traded for 74.04 cents U.S. compared with 73.63 cents U.S. on Thursday.

The January crude oil contract was down US$1.89 at US$74.07 per barrel and the January natural gas contract was up one cent at US$2.81 per mmBTU.

The February gold contract was up US$32.50 at US$2,089.70 an ounce and the March copper contract was up eight cents at US$3.93 a pound.

The Canadian Press

3:47 p.m.

Enbridge wins commission sign off on Great Lakes Line 5 tunnel

Enbridge Inc.‘s proposed pipeline tunnel under Michigan’s Straits of Mackinac was approved by a key commission, a win for the company amid a long-running dispute with the state’s governor over the conduit’s future.

Advertisement 3

Story continues below

Article content

The Michigan Public Service Commission approved the company’s application to build a tunnel under the channel that connects Lakes Michigan and Huron. The tunnel would house the company’s Line 5 oil pipeline, which currently rests on the lakebed. Enbridge argues the tunnel will reduce risks of an oil spill but Governor Gretchen Whitmer issued an order to shut the line.

Enbridge and Whitmer have been enmeshed in a court battle for years and the dispute has roiled relations between the United States and Canada, which relies on Line 5 to supply refineries in Quebec and Ontario.

“We are ready to begin work on this project,” Enbridge said in a release. “The only thing standing in the way of locating a replacement section of Line 5 into the tunnel is a decision on our permit application by the U.S. Army Corps of Engineers.”

Bloomberg

2 p.m.

Telecoms defy forecasts by spending billions less in spectrum auction

Canadian wireless companies spent about $2.2 billion in a sale of wireless-spectrum licences, significantly less than analysts had forecast, as the sector grapples with high levels of debt.

Article content

Advertisement 4

Story continues below

Article content

Most of the spending was done by the three companies that dominate the industry. Telus Corp. spent the most at $620 million, followed by BCE Inc. at $518 million and Rogers Communications Inc. at $475 million.

The big wireless companies stunned investors two years ago by collectively spending $8.9 billion in a sale of wireless licences to build out 5G services. This time, there was more spectrum available and a different set of auction rules, which “allowed for far more discipline and subdued bidding” during the three-week auction, National Bank of Canada analyst Adam Shine said in a note.

Shine had estimated the industry would spend at least $3.1 billion in the auction of 3800 megahertz spectrum. BMO Capital Markets analyst Tim Casey had forecast spending of $4 billion to $4.5 billion, and some other analysts were even higher.

Rogers, Canada’s largest wireless provider by number of subscribers, has taken on higher leverage with the acquisition of rival Shaw Communications Inc. earlier this year. BCE, the country’s biggest telecommunications provider, has piled on significant amounts of new debt in recent years to spend heavily on building faster fibre-optic networks for home and business services. The company’s interest expense was up 30 per cent in the first nine months of the year, to $1.08 billion.

Advertisement 5

Story continues below

Article content

Rogers shares rose 2.3 per cent, while Telus was up 2.4 per cent and BCE gained 0.9 per cent as of 11:06 a.m. in Toronto. An index of Canadian telecom shares is down about seven per cent so far this year.

Bloomberg

12:24 p.m.

Midday markets: Investors greet December with gains on Wall Street, Toronto

United States Treasuries and stocks pushed higher, with the market boosting bets on rate cuts next year after Jerome Powell signalled the Federal Reserve will possibly stay put this month — even as he retained the option to hike further.

Two-year yields dropped nine basis points to below 4.6 per cent. The S&P 500 traded near session highs. “Having come so far so quickly, the FOMC is moving forward carefully, as the risks of under- and over-tightening are becoming more balanced,” Powell said at Spelman College in Atlanta. The U.S. dollar retreated. Fed swaps priced in additional easing by the end of 2024. Traders expect the effective Fed funds rate will fall to about 4.07 per cent from 5.33 per cent currently.

“Powell tried to push back, but that lasted only ‘a few seconds’ in Treasuries,” said Peter Boockvar, author of the Boock Report. “Whereas the market thinks it’s as easy as the Fed is done and cuts are coming next year, the speech he’s giving today is purposely meant, I believe, to try to keep the markets offside. I say ‘somewhat’ because it wasn’t forceful and the markets aren’t being swayed.”

Advertisement 6

Story continues below

Article content

On Wall Street, the S&P 500 was up 0.51 per cent at 4,591.04. The Dow Jones Industrial Average was up 0.68 per cent at 36,197.87 while the Nasdaq composite was up 0.39 per cent at 14,281.95.

In Toronto, the S&P/TSX composite index rose 0.66 per cent to 20,369.83, buoyed by strength in base metal, energy and industrial stocks.

The Canadian Press, Bloomberg

11:54 a.m.

Court rulings force rethink of oil, gas emissions cap, minister says

Environment Minister Steven Guilbeault says two recent court decisions striking down some federal environment policies delayed plans to implement a cap on emissions from oil and gas production.

Guilbeault is in Dubai for the annual global climate pact talks taking place over the next two weeks.

Guilbeault said earlier this week that the framework outlining the Liberals’ long-promised oil and gas cap is likely to be published during COP28.

Alberta Premier Danielle Smith, who will meet with Guilbeault in Dubai during the event, has promised to fight any emissions cap on oil and gas as an intrusion on provincial jurisdiction over natural resources.

Advertisement 7

Story continues below

Article content

Guilbeault says two recent court decisions that touched on federal and provincial jurisdiction did force him to go back and make sure the proposed cap won’t intrude on that jurisdiction.

One decision overturned parts of the federal environmental review process and another struck down the designation of manufactured plastic items as being toxic.

The Canadian Press

11:15 a.m.

First Quantum starts arbitration process to protect rights at Cobre Panama mine

First Quantum Minerals Ltd. says it has started arbitration proceedings to protect its rights at its Cobre Panama mine which has been the subject of environmental protests.

The Canadian miner says its Minera Panama SA subsidiary has started the action before the International Court of Arbitration to protect its rights under a concession agreement with the government in Panama agreed to earlier this year.

First Quantum suspended operations at its Cobre Panama mine earlier this week after Panama’s Supreme Court ruled unanimously Tuesday that a 20-year concession agreement covering the copper mine was unconstitutional.

Advertisement 8

Story continues below

Article content

The company says it is seeking additional details in respect of the ruling and its implications.

The mine was temporarily closed last year when talks between the company and government broke down over payments the government wanted, but the two sides reached a deal in March.

The agreement, which was given final approval Oct. 20, has faced widespread protests including a blockade of small boats that prevented supplies from reaching the mine.

The Canadian Press

9:45 a.m.

Stock markets take a breather after November rally

North American stock markets were mixed in early trading Friday after closing out the best month of the year.

The S&P 500 was down 0.15 per cent, while the Dow Jones industrial average was up 0.09 per cent just after the open.

The S&P/TSX composite index was in the red, down 0.1 per cent.

Financial Post, The Associated Press

8:30 a.m.

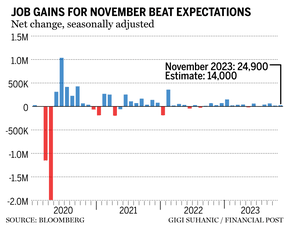

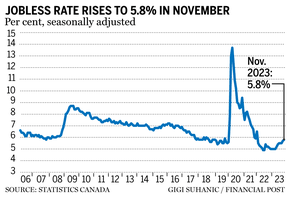

Canada adds 25,000 jobs in November, unemployment rate rises to 5.8%

The Canadian economy added 25,000 jobs in November, while the unemployment rate rose to 5.8 per cent, Statistics Canada said Friday.

The unemployment rate was 5.7 per cent in October.

Advertisement 9

Story continues below

Article content

Manufacturing and construction had the largest gains in employment, while the most jobs were shed in wholesale and retail trade as well as finance, insurance, real estate, rental and leasing.

As labour market conditions weaken, unemployed people last month were more likely to have been laid off compared with a year ago, Statistics Canada said.

The softer job market conditions come as high interest rates weigh on economic growth and a ballooning population adds to the number of people looking for work.

Despite those trends, however, average hourly wages continued to grow quickly — rising 4.8 per cent from a year ago — as workers seek compensation for high inflation.

Financial Post, The Canadian Press

More: Canada gains 25,000 jobs but unemployment rate ticks up

7:45 a.m.

BMO, National Bank raise dividend payments

Bank of Montreal and National Bank of Canada both raised their quarterly dividend payments in mixed earnings reports on Friday.

BMO will pay a quarterly dividend of $1.51 a share, up from $1.47 per share. Profit fell at the bank, with net income amounting to nearly $1.62 billion or $2.06 per diluted share for the quarter ended Oct. 31, down from $4.48 billion or $6.51 per diluted share a year earlier.

Advertisement 10

Story continues below

Article content

National Bank is also raising its dividend, as it reported a rise in profits from a year ago. Its quarterly dividend to shareholders rises to $1.06 per share, up from $1.02. The bank said it earned $768 million or $2.14 per diluted share for the quarter ended Oct. 31, up from $738 million or $2.08 per diluted share a year earlier.

The banks join Royal Bank of Canada, Toronto-Dominion Bank and Canadian Imperial Bank of Commerce in raising dividend payments this week.

The Canadian Press

More: Are Canada’s big banks just playing it safe or is there more trouble ahead?

7:30 a.m.

First Quantum risks covenant breach, cost cuts if Panama shuts key copper mine

First Quantum Minerals Ltd. could be forced to slow spending next year and face a potential breach of debt covenants if Panama follows through on plans to close a copper mine that generated roughly US$1 billion in profit last year.

The Cobre Panama mine has been the Canadian company’s top money maker since its 2019 opening and was expected to account for almost half of worldwide sales next year. Now, after the government announced plans to shutter the US$10-billion operation, First Quantum may have to trim spending elsewhere or sell assets in order to remain in compliance with lender agreements.

Advertisement 11

Story continues below

Article content

The company is facing an estimated US$625 million in debt maturities next year and another US$1.8 billion in 2025, according to Citigroup Inc. Without Cobre Panama’s revenue, the company’s debt covenants would be tested in 2024, First Quantum chief financial officer Ryan MacWilliam told a conference hosted by Bank of Nova Scotia on Nov. 29. The bank said in a research note that at current copper prices and without the mine, it expected a covenant breach in the fourth quarter of next year. First Quantum shares dropped 10 per cent to a three-year low.

It’s as-yet unclear how serious the risk is of a permanent closure of Cobre Panama. That said, First Quantum would post negative free cash flow of about US$300 million a quarter without it — at least initially, Citigroup analysts wrote in a note to clients.

Jacob Lorinc and James Attwood, Bloomberg

Stock markets before the opening bell

World shares were mixed on Friday after Wall Street closed out its best month of the year with big gains in November.

Germany’s DAX rose 0.6 per cent to 16,309.89 and the CAC 40 in Paris added 0.5 per cent to $7,348.88. Britain’s FTSE 100 was up 0.8 per cent at 7,512.94.

Advertisement 12

Story continues below

Article content

The future for the S&P 500 edged 0.1 per cent lower while that for the Dow Jones industrial average gained 0.1 per cent.

The S&P/TSX composite index closed up 120.09 points at 20,236.29 on Thursday.

The Associated Press

What to watch today

Statistics Canada will release the employment report for November this morning. The S&P Global Manufacturing PMI is also set for release.

Bank of Montreal and National Bank of Canada will report earnings today.

Trades will be watching for interest rate clues from United States Federal Reserve chair Jerome Powell, who is set to participate in a fireside chat at a college in Atlanta.

Environment and Climate Change Canada will release its forecast for the upcoming winter season.

Related Stories

Need a refresher on yesterday’s top headlines? Get caught up here.

Additional reporting by The Canadian Press, Associated Press and Bloomberg

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Comments