Top headlines: EVs pile up at U.S. dealers as inventories hit record high

The latest business news as it happens

Article content

Today’s headlines

Advertisement 2

Story continues below

Article content

Article content

Top story

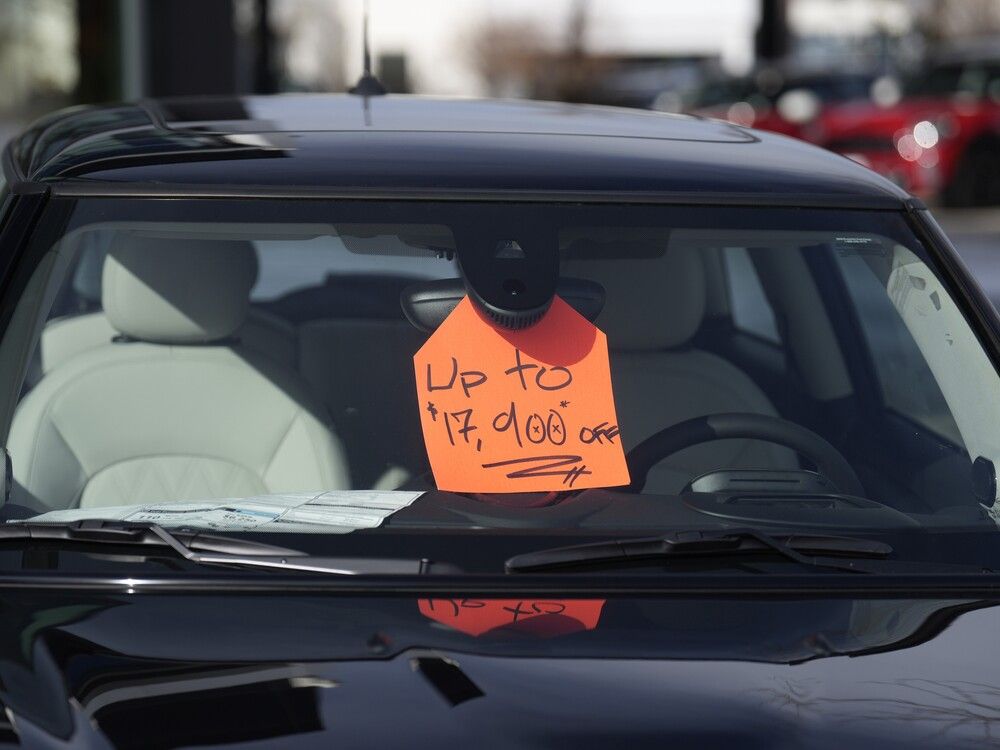

Electric vehicles are piling up at U.S. dealers as inventories hit record high

Electric vehicle inventories on United States dealer lots reached a new high in December, with a 114-day supply that was more than double what it was a year ago.

The nearly four-month inventory of EVs is up from a 53-day supply a year ago and compares to 71-days worth of inventory for the overall auto industry, researcher Cox Automotive wrote in a blog post.

U.S. consumers are growing increasingly wary of EVs, balking at high prices and the spotty charging infrastructure. Ford Motor Co. this week told suppliers it is cutting 2024 production in half for its F-150 Lightning plug-in pickup, its signature EV. General Motors Co. also is delaying production of some of its new EVs, including the Chevrolet Equinox SUV and Silverado pickup truck. It said it will cut 1,300 jobs at two plants in Michigan, one of which manufactures the Chevy Bolt electric car, which will cease production by year-end.

A coalition of U.S. auto dealers last month wrote to President Joe Biden asking that he “tap the brakes” on EV mandates because the cars are “stacking up on our lots.”

Advertisement 3

Story continues below

Article content

At the end of November, Ford’s electric Mustang Mach-E had among the highest inventory, at a 284-day supply, while the company’s F-150 Lightning had a 111-day supply, Cox reported. The Nissan Leaf had 183 days of supply, while the Kia EV6 had 145 days of supply, according to Cox.

Cox Automotive’s inventory numbers do not include Tesla Inc. or Rivian Automotive Inc. because those automakers sell directly to consumers, rather than through dealers.

Keith Naughton, Bloomberg

4:40 p.m.

Market close: TSX falls almost 250 points, while U.S. markets mixed

Canada’s main stock index fell almost 250 points, led by losses in energy and telecom stocks, while U.S. markets drifted to a mixed close.

The S&P/TSX composite index closed down 249.65 points at 20,529.15.

In New York, the Dow Jones industrial average was up 56.81 points at 37,305.16. The S&P 500 index was down 0.36 points at 4,719.19, while the Nasdaq composite was up 52.36 points at 14,813.92.

The Canadian dollar traded for 74.75 cents U.S. compared with 74.52 cents U.S. on Thursday.

The February crude oil contract was down 13 cents at US$71.78 per barrel and the January natural gas contract was up 10 cents at US$2.49 per mmBTU.

Article content

Advertisement 4

Story continues below

Article content

The February gold contract was up US$9.20 at US$2,035.70 an ounce and the March copper contract was down less than a penny at US$3.89 a pound.

The Canadian Press

2:30 p.m.

Bank of Canada governor says it’s too early to consider interest rate cuts

The Bank of Canada’s governor said policymakers will consider cutting interest rates when inflation is “clearly” on a path to the two per cent target, but added that it’s “too early.”

In a speech Friday, Tiff Macklem said that once officials are assured that price pressures are on a sustained downward track, they “will be considering whether and when we can lower our policy rate.”

“I know it is tempting to rush ahead to that discussion. But it’s still too early to consider cutting our policy rate,” Tiff Macklem said in prepared remarks from a speech in Toronto.

Still, the comments mark a shift in tone for the central bank. Macklem’s speech on Friday did not explicitly threaten that further hikes were on the table, although he did acknowledge that the bank must be “nimble” and adjust as needed.

While further declines in price pressures will likely be “gradual,” Macklem said that inflation will be “getting close to the two per cent target” by the end of next year, adding that “conditions increasingly appear to be in place to get us there” and that “underlying inflation pressures are easing in much of the economy.”

Advertisement 5

Story continues below

Article content

He sees policymakers continuing to debate “whether monetary policy is restrictive enough” and “how long it needs to remain restrictive to restore price stability.

Macklem also acknowledged that the central bank’s rate hikes are contributing to higher shelter inflation, which is currently one of the main upside contributors to headline inflation in Canada.

Erik Hertzberg, Bloomberg

More: Read the key take-aways from Macklem’s speech

1:17 p.m.

Auto dealers association demands more EV charging stations, improved affordability

The Canadian Automobile Dealers Association is raising concerns about electric vehicle affordability and charging infrastructure.

It says the regulated sales targets for zero-emission vehicles are not achievable without more government efforts to address vehicle affordability and the lack of charging infrastructure.

The federal government has set sales targets for the number of ZEVs among new light-duty vehicle purchases at 20 per cent by 2026, increasing to 100 per cent by 2035.

Association president Tim Reuss says high interest rates and inflation are severely impacting consumers’ ability to buy new cars, as evidenced by rising inventory levels on dealerships’ lots.

Advertisement 6

Story continues below

Article content

Reuss says the association wants the government to focus on creating the right set of circumstances to stimulate demand for EVs.

Brian Kingston, president of the Canadian Vehicle Manufacturers’ Association, says the federal government must provide stronger consumer purchase incentives, a widespread public charging network and enhancements to the electricity grid to prepare Canadians for more EVs on the road.

The Canadian Press

12:48 p.m.

Bell, Telus now offering equal wireless access to Rogers on TTC as key deadline looms

Telus Corp. and Bell Canada customers now have wireless service in all TTC subway stations and additional tunnel areas after Rogers Communications Inc. expanded access for its own customers nearly a month ago.

The move comes ahead of next Wednesday’s deadline for Canada’s four major wireless carriers to reach commercial agreements for subway service over the long term.

Industry Minister Francois-Philippe Champagne had ordered Rogers to grant its rivals access to its cellular network in Toronto’s subway earlier this fall while the companies continued to negotiate behind the scenes.

Advertisement 7

Story continues below

Article content

Rogers, Telus and Bell have been at loggerheads over the best technical approach, and financial terms, for the coverage since Rogers acquired the subway system’s cellular network from BAI Canada in April and pledged to build it out.

In September, Champagne handed down a decision that gave the carriers one month to reach a commercial agreement over wireless access on the TTC, or face a 70-day arbitration process to solve the matter.

Champagne’s office says all major wireless providers must offer full network access in every TTC station by June 2024.

Read more: Rogers reaches deal with other carriers on TTC wireless access

The Canadian Press

Noon

Midday markets: TSX down, Wall Street hovers near record highs

Wall Street is hanging around its record highs on Friday and remains on track to close out its longest weekly winning streak in six years, while Canadian stocks fell, led lower by losses in utility and energy stocks.

Stocks overall have bolted higher this week after the United States Federal Reserve seemingly gave a nod toward the hopes that have sent Wall Street screaming higher since autumn. Fed chair Jerome Powell at a press conference on Wednesday did not forcefully push back on traders’ expectations that inflation has cooled enough for the central bank to not only halt its market-hurting hikes to interest rates but to consider cutting rates.

Advertisement 8

Story continues below

Article content

The S&P 500 has jumped roughly 15 per cent since late October on rising hopes for just such a shift. Lower rates not only give a boost to prices for all kinds of investments, they also relax pressure on the economy and the financial system.

Hopes for several cuts to rates from the Fed in 2024 have sent Treasury yields tumbling in the bond market, which in turn releases pressure on the stock market.

The 10-year yield stabilized a bit on Friday and edged down to to 3.91 per cent from 3.92 per cent late Thursday. Yields were above five per cent in October and at its highest since 2007.

On Wall Street, the S&P 500 was up 0.01 per cent 4,719.85. The Dow Jones industrial average was up 0.07 per cent at 37,273.39, while the Nasdaq composite was up 0.37 per cent at 14,815.06.

In Toronto, the S&P/TSX composite index was down 0.73 per cent at 20,626.99. Energy stock were the main drag as the price of oil swung from gains to losses.

The Associated Press, The Canadian Press

11:10 a.m.

Trans Mountain warns regulator of potential ‘catastrophic’ two-year pipeline delay

The company building the Trans Mountain pipeline expansion is warning the project’s completion could be delayed by two years if the Canada Energy Regulator does not allow a previously rejected request for a pipeline variance.

Advertisement 9

Story continues below

Article content

Trans Mountain Corp. is nearly finished building the expansion, which will boost the pipeline’s capacity to 890,000 barrels per day from 300,000 bpd currently and improve access to export markets for Canadian oil companies.

But the Crown corporation has run into construction issues in British Columbia and has asked the regulator to allow it to use a different diameter, wall thickness and coating for a 2.3 kilometre section of pipeline.

The regulator denied that request earlier this month.

But Trans Mountain says it now has reason to believe that proceeding with the current construction plan through complex hard rock conditions could compromise a borehole and result in the failure of drilling equipment.

The company says if that happens, it would result in “catastrophic” delays to the project’s timeline and billions of dollars in losses for Trans Mountain.

The Canadian Press

Read the full story here.

10:53 a.m.

Rogers Sugar strike at impasse, company says as it pauses talks with union

Rogers Sugar Inc. says it is pausing negotiations after the union representing striking workers at its Vancouver refinery rejected the company’s latest offer.

Advertisement 10

Story continues below

Article content

Workers at the refinery have been on strike since Sept. 28 over issues including wages, benefits and the company’s proposal to increase refinery operations to 24 hours a day, 365 days per year.

The Rogers Sugar refinery in Vancouver is one of only three large sugar refineries in the country that processes imported cane sugar.

The strike has caused intermittent sugar shortages in Western Canada this fall.

But the company says there is currently ample supply of white sugar in the market, and it has restarted production of brown sugar at the Vancouver refinery.

Rogers Sugar has been operating the Vancouver refinery at reduced capacity, and says it has enough raw sugar on site to continue to do so until May 2024.

The Canadian Press

10:38 a.m.

Costco issues special $15-per-share dividend as earnings beat expectations

Costco Wholesale Corp. announced a special dividend of US$15 a share as the warehouse club chain beat profit expectations for the fourth consecutive quarter.

It’s the company’s first special dividend since late 2020, when investors got US$10 a share, according to data compiled by Bloomberg. Costco has shown resilience even as other big-box retailers voice caution on the consumer outlook. Walmart Inc., which operates the competing Sam’s Club chain, struck a far more cautious tone when it reported earnings last month.

Advertisement 11

Story continues below

Article content

The shares rose as much as 4.1 per cent as of 9:57 a.m. Friday in New York, setting a new all-time high. The stock has been trading near records, up 44 per cent this year and outpacing the S&P 500 Index’s 23 per cent gain.

Costco’s first-quarter earnings were US$3.58 a share, outpacing the average estimate compiled by Bloomberg. The closely watched measure of comparable-store sales rose 3.9 per cent excluding gas prices and currency movements, which also topped expectations.

The company’s “strong value offering, high renewal rates, and club expansion plans make Costco well-positioned,” Jefferies analysts wrote in a note Friday.

Bloomberg

10:15 a.m.

Markets open: Stock rally cools as March rate-cut euphoria fades

U.S. stocks slipped after a United States Federal Reserve official threw cold water on optimism for an interest rate cut early next year.

This week’s everything rally lost some of its heat on Friday after New York Fed president John Williams told CNBC it was “premature” to be thinking about a March rate cut. The S&P 500 and Nasdaq 100 are still poised for their seventh consecutive weekly gains after the Fed ignited a speculative frenzy this week when it affirmed it’s ready to shift to rate cuts.

Advertisement 12

Story continues below

Article content

On Wall Street, the S&P 500 was down 0.23 per cent at 4,715.73. The Dow Jones industrial average was down 0.22 per cent at 37,164.04, while the tech-heavy Nasdaq composite held onto gains rising 0.49 per cent to 14,832.57.

In Toronto, the S&P/TSX composite index was down 0.55 per cent at 20,663.69 on across-the-board declines with the energy sector falling the most.

A note of caution from Europe’s central bankers that they’re not ready to follow the Fed’s policy pivot damped some of the excitement. European Central Bank governing council member Madis Muller said Friday that markets are getting ahead of themselves in betting that the ECB will start cutting interest rates in the first half of next year.

Yesterday, ECB president Christine Lagarde said the bank had not discussed rate cuts at all.

“The contrast between the resilient U.S. economy adopting a dovish stance and faltering European economies holding on to a hawkish position gives the impression that something is amiss,” Ipek Ozkardeskaya, a senior analyst at Swissquote, wrote in a note to clients.

Bloomberg

Advertisement 13

Story continues below

Article content

9:30 a.m.

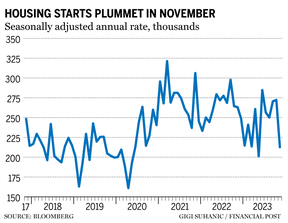

Annual pace of housing starts fell 22% in November: CMHC

The annual pace of housing starts fell 22 per cent in November, Canada Mortgage and Housing Corp. said Friday.

The monthly seasonally adjusted annual rate of housing starts in November came in at 212,624 units, down from 272,264 in October.

The drop came as the annual pace of urban starts fell 23 per cent to 195,363 units, with the rate of multi-unit urban starts down 27 per cent at 151,297. Single-detached urban starts fell seven per cent to 44,066 units.

The rate of starts in Montreal was down 30 per cent, while Toronto and Vancouver both saw a drop of 39 per cent, driven by significantly lower multi-unit starts.

The annual pace of rural starts for November was an estimated 17,261.

The six-month moving average of the monthly seasonally adjusted annual rate of housing starts in November was 257,777, up 0.7 per cent from 255,876 in October.

The Canadian Press

7:30 a.m.

Stock markets before the opening bell

Equities held gains after the United States Federal Reserve validated bets that it will soon move to easier policy and pushed stock market gauges toward all-time highs.

Advertisement 14

Story continues below

Article content

S&P 500 futures ticked up 0.3 per cent with the underlying gauge poised for its seven consecutive weekly advance. In Europe, the Stoxx 600 index hit its highest level since January 2022, on course for a fifth week of gains.

The S&P/TSX composite index closed up 149.35 points at 20,778.80 on Thursday.

Bloomberg

What to watch today

Bank of Canada governor Tiff Macklem will make an end-of-year speech around 12:40 p.m. at the Canadian Club Toronto. The webcast can be found here.

Finance Minister Chrystia Freeland hosts the annual meeting of provincial, and territorial finance ministers to discuss shared priorities such as housing, affordability and economic growth.

Canada Mortgage and Housing Corp. will release housing starts numbers for November this morning. Other data releases include October wholesale trade and international securities transactions.

Related Stories

Need a refresher on yesterday’s top headlines? Get caught up here.

Additional reporting by The Canadian Press, Associated Press and Bloomberg

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Comments