Top headlines: New BlackBerry CEO cutting costs in bid to return company to former glory

The latest business news as it happens

Article content

Today’s headlines

Advertisement 2

Story continues below

Article content

Article content

Top story

New BlackBerry CEO cutting costs as company reports $21-million loss

BlackBerry Ltd.’s new chief executive has his eye on lowering expenses as the company works to split its two main businesses and return the firm to some of its former glory.

“A key focus is to return BlackBerry to profitability and positive cash flow, and this requires us to make some tough decisions on our cost structure,” John Giamatteo told analysts on a call held Dec. 20, roughly a week into his tenure.

Cost-cutting efforts helped the Waterloo, Ont.-based software company — which has pivoted away from its smartphone roots in favour of pursuing cybersecurity and Internet of Things (IoT) software — almost halve its operating cash usage to $31 million in its third quarter, from $56 million a year prior.

Much of that was achieved by slashing expenses in the cybersecurity business and in the company’s back office.

Giamatteo warned that the company believes it can go further.

“BlackBerry’s business has significantly pivoted and made a number of acquisitions over the years and we see ways to streamline how our back office works,” Giamatteo said.

Advertisement 3

Story continues below

Article content

“For instance, despite recent cost reduction efforts, we still have 36 offices worldwide. We have some duplicative teams.”

Among Giamatteo’s other goals is tackling BlackBerry’s losses. The company revealed Wednesday that it lost US$21 million in its third quarter compared with a net loss of US$4 million a year earlier.

Tara Deschamps, The Canadian Press

Read the full story: New BlackBerry CEO John Giamatteo has his eye on expenses as he works to split firm

4:45 p.m.

Market close: TSX up more than 150 points, U.S. stock markets also higher

Strength in base metal and utilities stocks helped Canada’s main stock index rise more than 150 points, while U.S. stock markets also climbed higher.

The S&P/TSX composite index closed up 164.92 points at 20,765.73.

In New York, the Dow Jones industrial average was up 322.35 points at 37,404.35. The S&P 500 index was up 48.40 points at 4,746.75, while the Nasdaq composite was up 185.92 points at 14,963.87.

The Canadian dollar traded for 75.13 cents U.S. compared with 75.01 cents U.S. on Wednesday.

The February crude oil contract was down 33 cents at US$73.89 per barrel and the February natural gas contract was up 11 cents at US$2.46 per mmBTU.

Article content

Advertisement 4

Story continues below

Article content

The February gold contract was up US$3.60 at US$2,051.30 an ounce and the March copper contract was up a penny at US$3.92 a pound.

The Canadian Press

3:45 p.m.

Matthew Boswell reappointed as competition commissioner for another two years

The federal government is reappointing Matthew Boswell as the commissioner of competition for a two-year term.

Boswell, who was first appointed as commissioner in 2019, was slated to finish his term at the end of February.

A news release published Wednesday says his reappointment comes as the federal government looks to fulfill its promise of a comprehensive modernization of the country’s competition law.

The Liberals have made several amendments to the Competition Act over the last couple of years, but the changes still fall short of what the Competition Bureau has recommended to the government.

Boswell, who has been at the bureau since 2011, has been a vocal advocate for reforming the law and has called for a “whole-of-government” approach to unlock more competition across the economy.

During his tenure, the bureau notably tried to block the Rogers-Shaw merger from going ahead, but lost the case in court.

Advertisement 5

Story continues below

Article content

The Canadian Press

1:30 p.m.

Quebec introducing new rule to reduce bat deaths linked to wind farms

Quebec’s Environment Department says it is introducing a new measure to mitigate the impact of wind farms on bats native to the province.

The government will require all future wind farm projects to increase turbine cut-in speeds — when the blades start rotating and generating power — to 5.5 metres per second at night between June 1 and Oct. 15.

Those months coincide with the period of the year when bats are most active in North America — and when they are most often killed by turbines.

The department says the measure has proven effective elsewhere and should significantly reduce the risk of bats colliding with turbines in Quebec, the second-largest wind energy market in Canada, after Ontario.

In June, the province designated four of eight bat species in Quebec as threatened or vulnerable, and said that three of the four others are likely to meet the criteria in the future to be designated as threatened of vulnerable.

The province says the new rule is part of a series of protection measures to help save these species.

Advertisement 6

Story continues below

Article content

The Canadian Press

12:52 p.m.

Energy Fuels starts uranium production at three mines, shares rise

Shares of Energy Fuels Inc. were up after the company said it has started production at three of its uranium mines in the United States and was preparing to start production at two more.

The mining company says it made the move in response to strong uranium market conditions, with spot prices at a 16-year high.

Once production is fully ramped up at the three mines in Arizona and Utah by mid- to late-2024, the company says it expects to be producing uranium at a run-rate of 1.1 million to 1.4 million pounds per year.

The company is also preparing two mines in Colorado and Wyoming to start uranium production within one year.

Once in production, the company says they would increase its uranium production to over two million pounds per year starting in 2025, if market conditions continue as expected.

Energy Fuels shares were up 62 cents at $9.92 in late-morning trading on the Toronto Stock Exchange.

The Canadian Press

Noon

Midday markets: TSX up more than 150 points, U.S. stock markets also higher

Advertisement 7

Story continues below

Article content

Strength in the base metal and financial stocks helped Canada’s main stock index rise more than 150 points in late-morning trading, while U.S. stock markets also climbed higher.

The S&P/TSX composite index was up 178.41 points at 20,779.22.

In New York, the Dow Jones industrial average was up 241.93 points at 37,323.93. The S&P 500 index was up 34.95 points at 4,733.30, while the Nasdaq composite was up 121.60 points at 14,899.54.

The Canadian dollar traded for 75.19 cents U.S. compared with 75.01 cents U.S. on Wednesday.

The February crude oil contract was down 30 cents at US$73.92 per barrel and the February natural gas contract was up eight cents at US$2.43 per mmBTU.

The February gold contract was up US$5.80 at US$2,053.50 an ounce and the March copper contract was up a penny at US$3.91 a pound.

The Canadian Press

11:34 p.m.

Crescent Point closes deal to buy Hammerhead

Crescent Point Energy Corp. says it expects average production of 198,000 to 206,000 barrels of oil equivalent per day in 2024 now that it has closed its deal to buy Hammerhead Energy Inc.

The guidance includes development capital expenditures of $1.4 billion to $1.5 billion for the year.

Advertisement 8

Story continues below

Article content

The company says it plans to spend 45 per cent of its 2024 budget in Alberta’s Montney region where it expects average annual production of 97,000 boe/d.

Thirty-five per cent of the budget will go to the Kaybob Duvernay region where production is expected to average 50,000 boe/d.

Crescent Point says it plans to spend the remaining 20 per cent of its 2024 budget on its assets in Saskatchewan, which are expected to generate annual average production of 55,000 boe/d.

The company announced a deal in November to buy Hammerhead Energy and its assets in the Montney region of northwest Alberta for a total of $2.55 billion, including approximately $455 million of Hammerhead’s net debt.

The Canadian Press

10:33 a.m.

Markets open: Wall Street claws back some of Wednesday’s big loss

Wall Street on Thursday is clawing back much of its sharp loss from the prior day, which was its first significant step back since a rally began in late October.

The S&P 500 was 0.9 per cent higher in early trading, sitting 1.2 per cent below its record set nearly two years ago. The Dow Jones Industrial Average was up 0.62 per cent, a day after falling for the first time following five straight record-setting days. The Nasdaq composite was 0.89 per cent higher.

Advertisement 9

Story continues below

Article content

In the bond market, Treasury yields continued to ease following a mixed set of reports on the economy. Falling yields have been one of the main reasons the stock market has charged so high the last two months. They relax the pressure on the financial system, encourage borrowing and boost prices for investments.

The yield on the 10-year Treasury slipped to 3.82 per cent from 3.86 per cent late Wednesday. In October, it had been above five per cent and weighing heavily on markets.

In Toronto, the S&P/TSX composite index was up 0.85 per cent at 20,776.88.

The Associated Press

10:04 a.m.

Update: Ottawa to give Toronto $471 million in housing funding

The federal government says it will give Toronto nearly half a billion dollars in housing funding.

Prime Minister Justin Trudeau made the announcement in Toronto this morning, saying the city will receive $471 million from the federal Housing Accelerator Fund.

The $4-billion fund is a federal initiative to encourage municipalities to make changes to bylaws and regulations that would spur more housing construction, in exchange for more money.

Advertisement 10

Story continues below

Article content

Some of the changes Ottawa has pushed for include denser zoning and faster issuance of permits.

Housing Minister Sean Fraser, Toronto Mayor Olivia Chow and others were alongside Trudeau for the funding announcement.

Including the announcement today, Ottawa has reached deals with 16 municipalities across the country.

The Canadian Press

9:19 a.m.

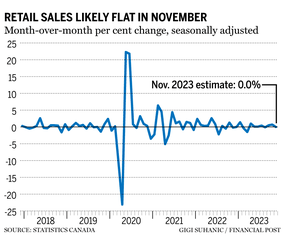

Canadians slow spending in November as interest rates bite

Canadian consumers likely slowed down their spending in November after splurging the previous month, as high interest rates restrict household budgets.

Receipts for retailers were flat last month, according to an advance estimate from Statistics Canada released Thursday. That followed a 0.7 per cent increase a month earlier, slightly below a median estimate of 0.8 per cent in a Bloomberg survey of economists.

Still, retailers had a strong month in October with sales up in seven of nine subsectors, led by a 1.1 per cent gain at car and parts dealers. Excluding autos, retail sales rose 0.6 per cent, versus expectations for an increase of 0.5 per cent. In volume terms, retail sales grew 1.4 per cent.

Advertisement 11

Story continues below

Article content

General merchandise retailers were the next-highest upside contributor to retail sales in October with a two per cent gain, while health and personal care sales were up 1.5 per cent and clothing sales rose 2.4 per cent. On the downside, sales at gasoline stations and fuel vendors decreased 3.1 per cent.

The Bank of Canada held its benchmark overnight rate at five per cent earlier this month. The Canadian economy has shown signs of stagnation, and in a separate release on Thursday, Statistics Canada said that payroll employment decreased by 44,600 in October, offsetting gains made in September and following little variation in July and August.

Governor Tiff Macklem told BNN Bloomberg Television that he expects to cut rates sometime next year, but he needs to see several months of sustained downward momentum in core inflation first.

The agency didn’t provide details on the November estimate, which was based on responses from 54.5 per cent of companies surveyed.

Bloomberg

Read more: Canadians splurged in October, but spending spree not expected to last

7:30 a.m.

Advertisement 12

Story continues below

Article content

Stock markets before the opening bell

World shares mostly fell Thursday after Wall Street hit the brakes on its big rally following disappointing corporate profit reports and warnings that the market had surged too far, too fast.

Germany’s DAX slipped 0.3 per cent to 16,676.00 and in Paris, the CAC40 fell 0.3 per cent to 7,559.33. Britain’s FTSE 100 edged 0.1 per cent lower, to 7,707.00.

The future for the S&P 500 rose 0.5 per cent. The future for the Dow Jones industrial average was 0.4 per cent higher.

The S&P/TSX composite index closed down 238.82 points at 20,600.81 on Wednesday.

The Associated Press

What to watch today

Canadian retail sales for October, along with the survey of employment, payrolls and hours, will be released this morning. Also on tap in the United States is real GDP, corporate profits and the Philadelphia Fed index.

Nike Inc. reports earnings.

Related Stories

Need a refresher on yesterday’s top headlines? Get caught up here.

Additional reporting by The Canadian Press, Associated Press and Bloomberg

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Comments